We all have them. Those apps we open without thinking. Not because we need anything in particular, but because they feel… safe, in some…

Over a year on, when will big companies’ SA SME Fund get going? [Opinion]

South Africa’s private sector loves to lament how poor the government’s support has been for small business — but it seems, business owners shouldn’t expect much either from big companies.

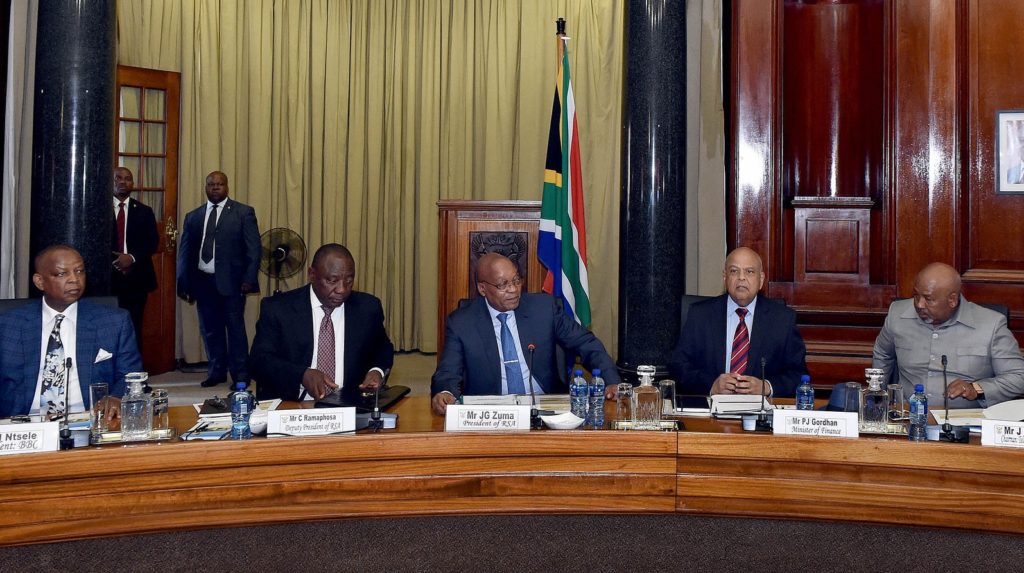

The idea to get big companies to fund small businesses emerged in 2015 following discussions that President Jacob Zuma held with large listed companies through the CEO Initiative (with Zuma pictured above at one such meeting with CEOs).

Yet over 15 months since the CEO Initiative, led by Discovery CEO Adrian Gore and former Bidvest chair Brian Joffe, announced the establishment of a R1.5-billion fund of funds to support high-growth small businesses, not a single investment has been made. The fund will co-invest with funds it accredits.

SA SME Fund CEO Quinton Dicks confirmed to Ventureburn earlier this week that though the first two funds have been signed up last year, none have yet began investing. He adds that his small team is looking at accrediting one additional fund. A fourth fund that his team assessed didn’t meet the grade and won’t be accredited, he said.

Over 15 months since the CEO Initiative announced the establishment of theR1.5-billion SA SME Fund to support high-growth small businesses, not a single investment has been made

While many in the sector (including venture capitalist and former FNB head Michael Jordaan in an interview last year) hoped that the fund would hit the ground running, Dicks’ argument is that due diligence work needed to accredit funds, takes between five and nine months.

Contributions to the SA SME Fund are being drawn from 48 listed companies. An original pledge by Deputy President Cyril Ramaphosa that the government would match the private sector’s R1.5-billion contribution in funding won’t be honoured, after then Treasury director-general Lungisa Fuzile confirmed in April last year that the state would not be taking part in the fund.

But this won’t necessarily mean that the fund will be short on cash. Dicks this week told Ventureburn that each of the funds that the SA SME Fund co-invests with are expected to raise about R400-million of their own money, with the SA SME Fund looking to put in R100-million in each accredited fund.

Going on this, it means the fund could mobilise a significant amount of money, perhaps around R7.5-billion. This could do away with criticism by some that the figure of R1.5-billion is insignificant.

But importantly, when the money is finally deployed, what kinds of small businesses will get it?

In other countries — such as Malaysia, Brazil, India and Chile (and most recently Argentina) — the state is actively involved in co-investing with venture capital (VC) funds to help build a local VC sector and help promote innovative and fast growing companies (see this story). The state often takes the first losses and enables co-investment funds to invest in more risky deals.

As the private sector is more concerned with making a good return, without the backing by the government the fund runs the risk of opting to invest in more cushy private-equity type deals.

Dicks — who has long worked in the private equity sector — has repeatedly said that the fund will not necessarily invest in startups. In September he said the fund is not aimed at boosting the country’s nascent VC sector, but rather at helping already profitable mid-sized companies to grow and create jobs.

This after Gore in 2016 in an interview with The Financial Mail, said the fund would aim to support the creation of a VC sector in South Africa, in effect performing a similar role to how the Small Business Administration in the US used the Small Business Investment Company (SBIC) to help grow the VC sector.

It should be remembered that in South Africa big capital only came up with the idea for a co-investment fund when several CEOs were summoned by Zuma to help spur economic growth again.

In a strange way it bears similarities to Russian President Vladimir Putin’s announcement last year, also during similar economic difficulties, that big companies would have to set up venture funds to fund small businesses.

Is the fund then just a nice way for big companies to show in some way that they care about small business, all while making an easy buck off private equity or will it live up to CEOs’ claims of supporting high impact firms that might create thousands of jobs the country needs?

Until the fund gets under way it’s difficult to know.

*Editor’s note (11/01/2018): SA SME Fund CEO Quinton Dicks subsequently contacted Ventureburn to point out that the two funds which Ventureburn made reference to have not been signed up. “The two funds have been approved by the investment committee, but (this is) still subject to certain conditions and consequent upon these being met we will sign the required deeds of adherence,” he said.

In addition he said the fourth fund was not approved because it didn’t fall in line with the SA SME Fund’s investment mandate which is to invest in late-stage VC or midcap firms.

“The SA SME Fund will invest in funds that cover the investment spectrum form late stage and mature venture capital through small and medium to small mid cap businesses,” he said.

“I have consistently said that the fund is not a complete solution to the challenges facing the VC investment space but clearly we are able to and will support venture capital funds as set out above. I do not recall ever saying we will not invest in VC,” said Dicks.

Dicks pointed out that the SA SME Fund expects to sign up between seven and 10 funds in total. He said the total commitment from the SA SME Fund would be about R1.4-billion and not R1.5-billion. The fund — through those funds it signs up — aims to invest in 51 firms.

“The fund will target high growth businesses that have an enterprise value of between R20-million and R500-million — ie the investment cheque size could be as low as R5-million — ie a minority equity stake in a R20-million enterprise value business,” he said.

Featured image: GovernmentZA via Flickr (CC BY-ND 2.0)