Johannesburg-based fintech company MFS Africa has closed a Series-B funding round led by China-based VC firm LUN Partners Group.

The raise is an extension round to a $4.5-million round the company closed earlier this year, and brings the total round of funding to $14-million (see this earlier story).

No ad to show here.

The mobile payments services provider’s current shareholder Goodwell Investments — an Amsterdam-based investment firm — also participated in the extension round, as did ShoreCap III, an LP managed by US-based Equator Capital Partners and UK-based FSD Africa.

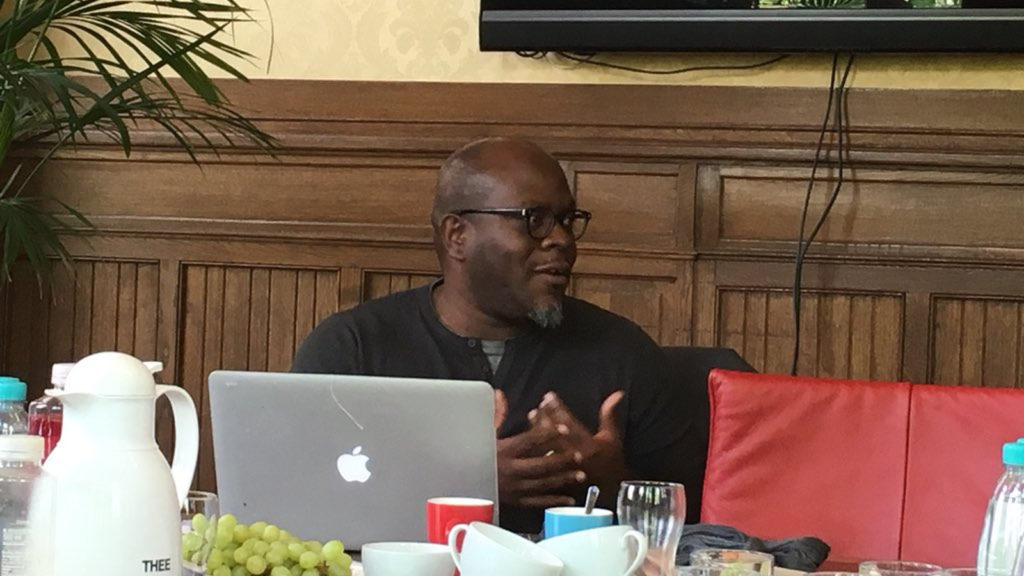

MFS Africa was founded in 2009 by Dare Okoudjou (pictured above). In April Okoudjou declined to disclose to Ventureburn the equity stake that was offered up in return for the funding

In a statement yesterday (30 October) MFS Africa said the investment from LUN Partners Group will help better connect MFS Africa with opportunities and financial services players in Asia.

MFS Africa’s latest raise is an extension to its Series-B round and brings the total round of funding to $14 million

In addition, the fintech company said the partnership with Equator Capital Partners and FSD Africa will offer MFS Africa deeper links to global and regional financial institutions as well as strong experience in regulator and policymaker engagement.

Founder and Chairman of LUN Partners Group Peilung Li said the partnership with MFS Africa will enable a boost in cross-border trade, and open new opportunities for Chinese firms and other partners globally to connect to the African continent.

Goodwell Investments managing partner Wim van der Beek said the MFS Africa investment is in line with the funder’s investment strategy for its uMunthu fund, namely to invest in companies that are building the infrastructure through which large numbers of underserved customers can access more affordable and better financial services.

Okoudjou said the growth of the MFS Africa network has positioned the company as a full-range provider for digital payments in Africa – effectively opening financial services to those who were previously excluded from traditional banking spaces.

Said Okoudjou: “This network growth means that we will continue to increase our impact and drive our mission of financial inclusion across the continent”.

Read more: How MFS Africa made history for African fintechs with $4.5m Chinese-led deal

Featured image: MFS Africa founder Dare Okoudjou (Els Boerhof via Twitter)