We all have them. Those apps we open without thinking. Not because we need anything in particular, but because they feel… safe, in some…

SA tech startups still out of touch when getting angel, VC funding – survey

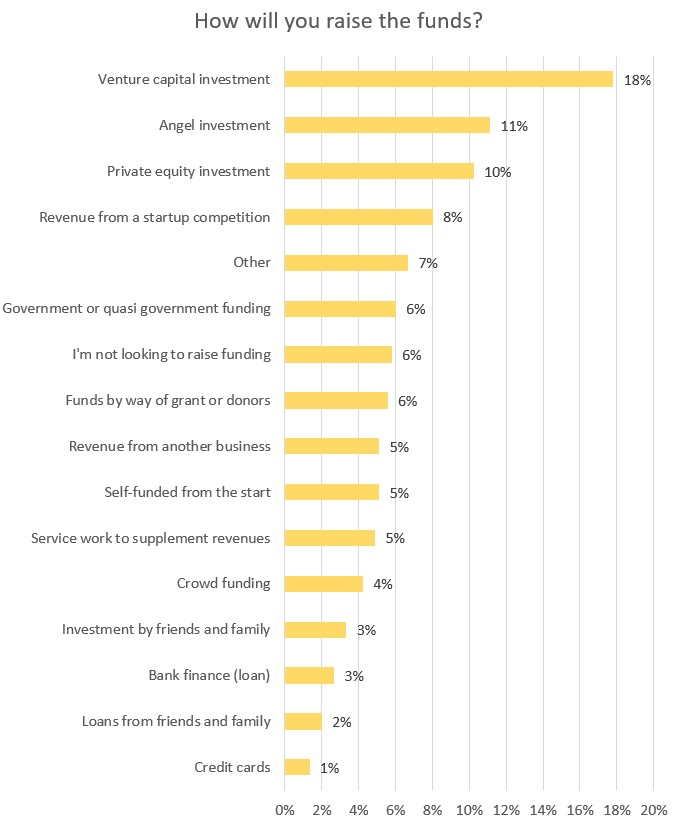

Over a quarter of founders or 29% of SA tech startups believe that they will grow their business by securing venture capital (VC) or funding from angel investors – yet the reality is that only about 11% report having been able to secure such funding, a new survey reveals.

Are startup founders then out of touch with reality?

The figures are revealed in the 2018 Ventureburn Tech Startup Survey powered by Telkom Futuremakers which was released today. The survey sampled 153 SA tech startup founders.

The finding is similar to that of a 2017 survey Ventureburn conducted last year of 260 startup founders. In this survey over a quarter of founders said they expect to grow their business by tapping VC or angel funding, while only about eight percent reported having been able to secure such funding.

Read more: Startups hold unrealistic view on securing VC, angel funding suggests new survey

South Africa has seen an explosion in venture capital (VC) deals of late – with a Southern African Venture Capital Association (Savca) report finding that funds invested over R1-billion in startups and early-stage companies last year. Angel investors invested approximately R73-million, compared to R44-million invested in 2016.

Yet such funding still remains beyond the reach of most local tech startups. Ventureburn’s survey confirms this (see the below graphs).

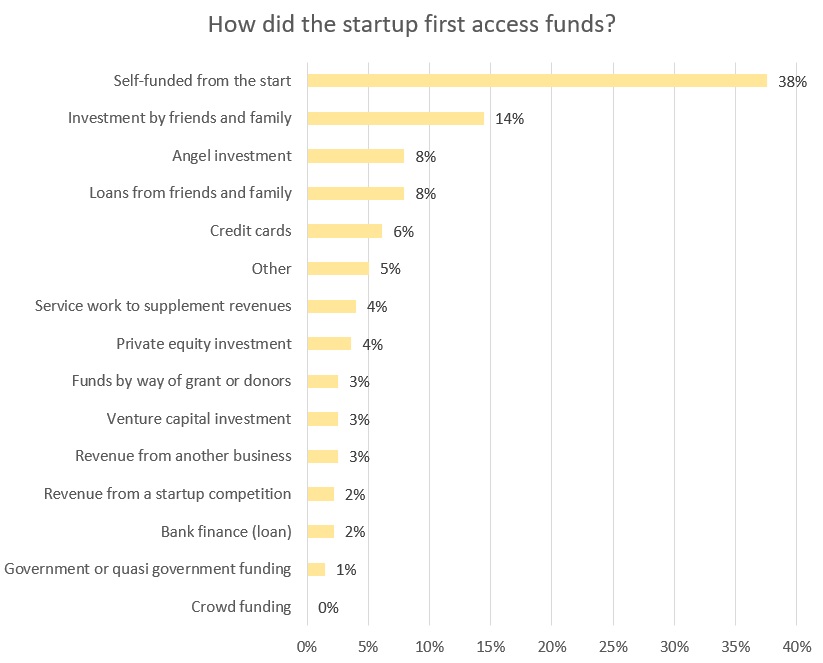

The majority of SA tech startup founders or 38%, said they used their own cash to fund their business (2017: 40%), followed by loans and grants from friends and family at 22% (2017: 23%).

Perhaps a sign of how tough it is to raise funding, is that eight percent of startups aim to raise funding by signing up to competitions (2017: six percent). In all two percent of startups reported that they had already received funding from such competitions.

Only three percent said they expect to get the money they need from a bank (a mere two percent said their business was first funded by a bank) — which may be telling at how hard it is to get a bank loan if you’re a startup.

Tech startups will likely not have much luck turning to the government — which often claims that it is helping small business. Only two percent of founders said they got funding for their startup from a government programme or agency.

42% will run out of cash within three months

Yet the financial situation for many tech startups is critical.

Of those startups surveyed 42% (2017: 51%) said they would run out of funds in less than three months, while a further 36% (2017: 31%) said they would run out of funds within a year. Only about 9% (2017: 7%) said they had funding to last over a year, while 13% (2017: 11%) said they were profitable.

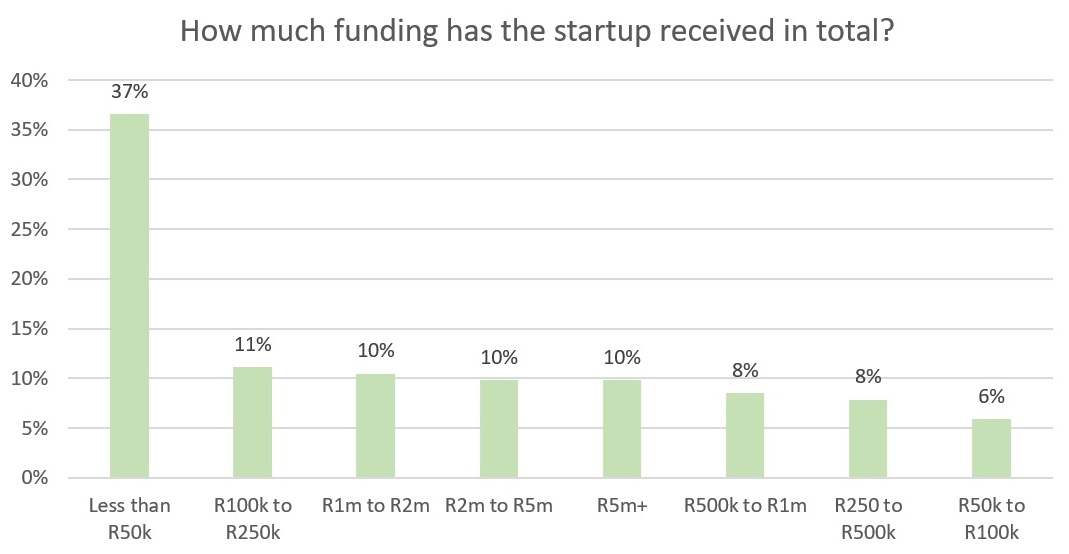

When they are able to get funding, most startups tap very little. Only 20% (2017: 16%) received R1-million or more in funding (the value at which angel investors and VC funding usually starts at).

In all, 37% (2017: 42%) of startups reported getting less than R50 000. The remaining 43% (2017: 42%) received between R50 000 and R1-million.

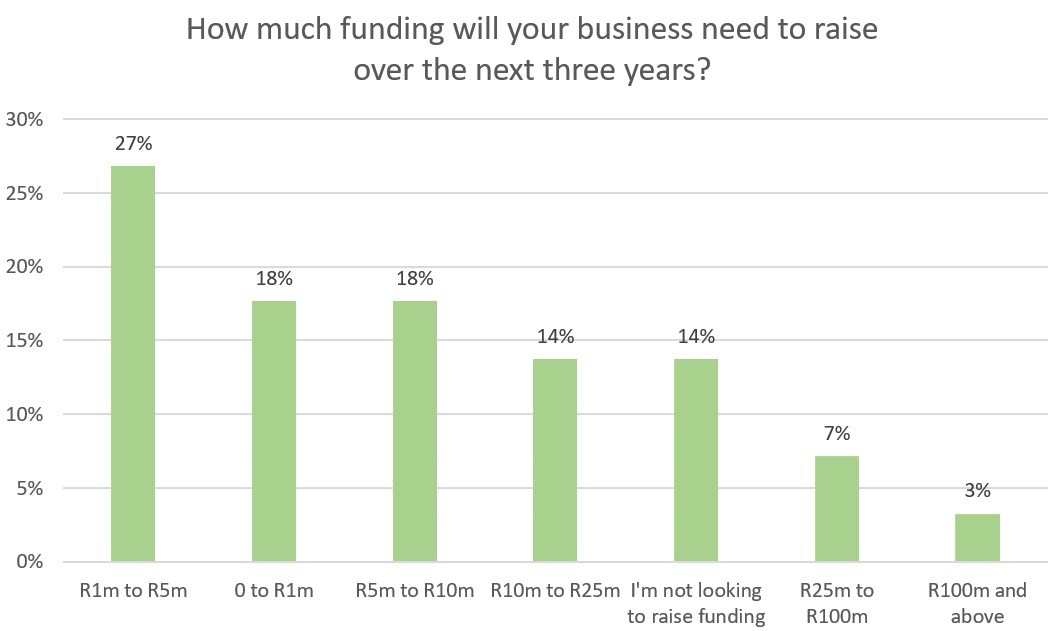

Over a quarter or 27% of founders want to raise between R1-million and R5-million over the next three years (2017: 30%). A further 42% (2017: 31%) want to raise over R5-million and 18% want less than R1-million (2017: 21%). A further 14% (2017: 17%) are not looking to raise any funding.

While perhaps the findings suggest more needs to be done to make it easier for tech startups to access equity funding, it could also suggest that more could be done to popularise other forms of funding — such as bank loans, government and private-sector grants or crowdfunding.

*Note on the methodology the survey used: In all there were 169 respondents to the survey which was conducted using an online questionnaire, by data analytics firm Qurio. Of this number, 16 respondents were found to be employees of startups (rather than founders) and were excluded. The survey therefore sampled 153 startup founders.

To ensure the integrity of the data, PwC will be involved to perform specified procedures, the results of which will be included in a report that will be available for inspection upon request.

More information on the Ventureburn Startup Survey:

Gauteng home to most tech startups, but Cape firms still more successful – survey

SA startups with combination of male-female founders most successful – survey

Black tech startups in SA still struggling finds new Ventureburn survey

Infographic: the 2018 Ventureburn Tech Startup Survey

View the full 2018 Ventureburn Tech Startup Survey presentation

Featured image: stevepb via Pixabay