Mental health in Africa faces deep-rooted challenges—limited resources, widespread stigma, and a severe shortage of professionals. But Cape Town-based tech company Metasapien is looking…

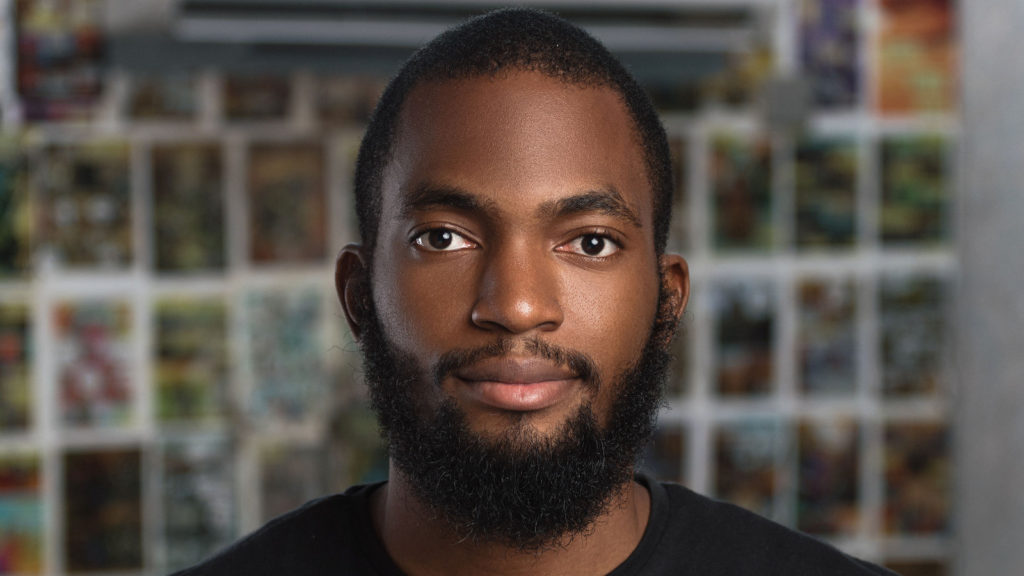

Microtraction looking to invest outside Nigeria says partner Dayo Koleowo

Lagos-based early-stage investment platform Microtraction is looking to do “some non-Nigerian” deals this year, its former principal investment officer and newly appointed partner Dayo Koleowo has revealed.

Last year Microtraction — which was founded in 2017 by Yele Bademosi (who was last month appointed as a director at Binance Labs) — has so far invested in only Nigerian startups. It’s made eight investments to date.

The platform ordinarily invests $65 000 in two stages. The first investment is usually about $15 000 in exchange for a 7.5% equity stake. This is followed by an additional $50 000 convertible note at a $1-million valuation cap for companies that Microtraction says have shown “significant progress” after the platform’s initial investment.

Microtraction partner Dayo Koleowo says the investment platform aims to expand its reach

Koleowo said the early-stage investor has no target for the number of investments the platform will make in 2019, adding that the platform is “looking to do some non-Nigerian deals” as well as more follow-on investments.

“We have focused primarily on Nigerian in the past 18 months. We are looking to expand our geographical reach to other countries with growing tech ecosystems.

“Our goal is to accelerate Africa’s transition to a sustainable developed economy and to do that we need to identify these potentials not just in Nigeria, but in other countries on the continent,” he explained in an email last Friday (15 February).

He added that Microtraction is “presently working on some initiatives” that will help the platform expand its reach.

Stack DX investment

Microtraction’s latest investment is last month’s deal with Nigerian healthtech Stack Diagnostics (Stack DX). The Lagos-based startup provides molecular diagnostic services to doctors and hospitals.

Koleowo said Stack DX’s team and the problem they are solving were “a big motivation” for the investment.

“We knew the magnitude of the problem being solved, we saw the progress they had made in such little time, and we were confident that the team had the right background and experience to execute and capture the market opportunity,” he added.

‘Startup’s first investor’

Microtraction’s goal, Koleowo explained, is to be the “most accessible and preferred source” of pre-seed funding for high quality African tech entrepreneurs. He said the early-stage investor aims to be “the first cheque” in most of the companies it funds.

In addition to the initial investment of $15 000, Microtraction also works closely with its investees, he added.

The platform does this by providing them with professional and advisory services. The hope is that this will get investees to a point where they are able to raise more funding — either through the platform’s second cheque of $50 000, or through follow-on funding from other investors.

Up to 45% of Microtactions investments have come from outreach by Microtraction’s investment committee, with 55% of the platform’s investee having applied for funding.

Microtraction’s investment committee is comprised of founding partner Bademosi, Koleowo, PAVE Investments managing partner Kwamena Afful, and PAVE Investments chairman Tunde Folawiyo. Koleowo said the platform also gets advice on investment decisions from industry experts.

Sector agnostic

Koleowo emphasised that Microtraction is “100% sector agnostic”, drawing attention to the fact that its portfolio includes startups across fintech, edtech, healthtech and one startup in the logistics space which is yet to be announced.

“I believe some verticals are more difficult to crack than others. However, we are happy to support relentless and innovative entrepreneurs ready to crack the most difficult market they are passionate about,” he added.

Million-dollar fund

Microtraction, Koleowo revealed, started out as a hypothesis. He said the investor wanted to “raise the minimum” amount of capital to test its key assumptions and deploy capital rapidly. Microtraction, Koleowo said, closed a “small” angel fund of about $1-million.

“We were able to secure funding from an African institutional investor called Pave Investments, alongside other angel investors like Y Combinator CEO Michael Seibel, Google head of ecosystem Andy Volk and Launchpad co-founder Chris Shultz,” he said.

‘Investees doing well’

Koleowo said Microtraction’s porfolio companies are “doing well” and have all raised follow-on funding. Two of the startups — cryptocurrency trading platform BuyCoins and fintech Cowrywise — he added, were accepted into US seed accelerator Y Combinator’s (YC) Summer 2018 Batch.

He said the platform had even more exciting portfolio news soon, but that he can’t reveal what this was as the startups themselves haven’t publicly announced anything yet.

Featured image: Microtraction partner Dayo Koleowo (Supplied)

Read more: Nigeria’s Microtraction announces its sixth deal, with cloud accounting startup

Read more: Nigerian rewards platform Thank U Cash secures funding from Ventures Platform

Read more: Nigeria’s Microtraction announces investment into Lagos-based fintech Riby

Editor’s note (22 February 2018): Subsequent to the publication of the article Koleowo told Ventureburn that he had been appointed partner at Microtraction. The article has thus been updated to reflect that. Microtraction founder Yele Bademosi’s announcement yesterday (21 February) of the appointment is available here.