We all have them. Those apps we open without thinking. Not because we need anything in particular, but because they feel… safe, in some…

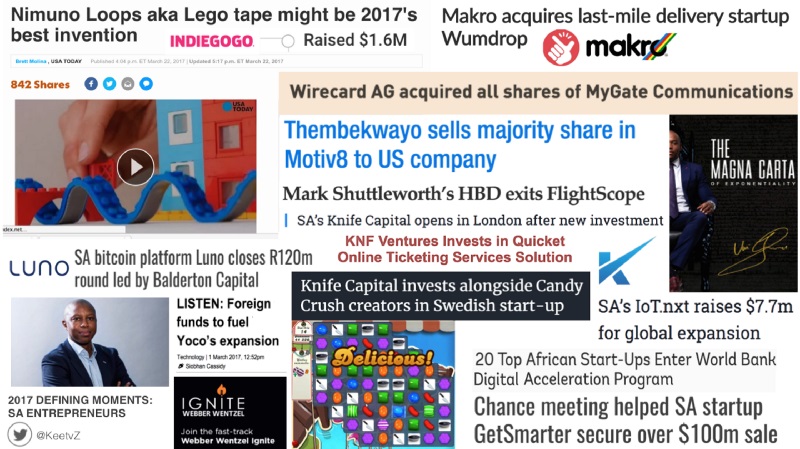

10 Defining moments that shaped the 2017 South African startup ecosystem

2017 in South Africa is a very hard year to define… Most people are limping into 2018 battle-scar ridden and trying to figure out what the hell just happened?!

Bitcoin highs and Steinhoff lows, neighbouring coup-non-coups, Rugby World Cup hosting woes and Western Cape dam levels scraping the bottom of the barrel along with GuptaBots, while Cyril is rising to the top.

‘In 2017 South African entrepreneurs had a bumper year — leading the charge with innovation, job creation and growth’

But adversity is the mother of invention… South African entrepreneurs had a bumper year — leading the charge with innovation, job creation and growth.

It was a real challenge cutting it down to 10, but these are some of the defining moments that shaped the South African entrepreneurship ecosystem in 2017 that stood out for me:

Yoco: Series A Funding Fuelling Expansion — March 2017

Yoco closed a funding round with US-based Quona Capital and Velocity Capital of the Netherlands to expand the footprint and services offered by this fast-growing fintech Startup that processes more than R1 billion in transactions per year. Subsequently Mastercard announced that it will be collaborating with Yoco to roll out 15 000 mobile Point of Sale (mPOS) devices to SMEs by the end of 2017.

Nimuno Loops: $1.6m Crowdfunding Raised — March 2017

Nimuno — the SA designed “LEGO tape” by Chrome Cherry Design Studios — quickly overshot its modest crowdfunding goal of $8,000 on Indiegogo, and ended up raising $1,647,948 in one of 2017’s best inventions! In May New Zealand based Zuru Toys signed an exclusive, worldwide licensing agreement to manufacture, distribute and market Nimuno Loops. The success of this simplistic design is now featured in the London Design Museum.

MyGate: €23m Wirecard AG acquisition — March 2017

Wirecard AG supplemented its existing regional product portfolio with the acquisition of leading Cape-based payment service provider: MyGate for a purchase price of EUR23.1 million. MyGate enables merchants across Africa to accept a wide range of different e-commerce payment options.

IoT.nxt: R100m Raised for Global Expansion and R&D — April 2017

Centurion-based Internet of things startup IoT.nxt secured a further R100-million from funding partner Talent Holdings to expand globally and invest in research and development. IoT.nxt’s core product is Raptor, a data-clearing platform that takes data from multi-vendor systems and integrates it into a platform that is independent from the legacy technology.

Motiv8: Vusi Thembekwayo Sells Majority Share to US Partners — April 2017

Vusi Thembekwayo, an entrepreneur and prominent global business speaker, sold a majority stake in his management advisory and growth consultancy business: Motiv8 Advisory to US based Watermark Advisory LLP. He then set up MyGrowthFund to find and nurture high-growth entrepreneurs through funding, incubation and enterprise development platforms. And through it all launched a leadership and management book: The Magna Carta of Exponentiality.

GetSmarter: US$103m Acquisition by EdTech Giant 2U — May 2017

In one of the most exciting deals of 2017 for SA Startups, Nasdaq-listed 2U acquired GetSmarter — a local EdTech Startup that hat delivers short-term online certification courses to distance-learning students in partnership with many of the world’s top-tier universities — for $103-million (plus an earn-out provision of as much as $20-million). CEO and co-founder Sam Paddock noted that they weren’t necessarily looking to be acquired, but hey!

Luno: R120m Series B Round — September 2017

Luno allows users to buy and sell digital currencies — Clearly something traders have been doing a lot of this year with the rise of the Bitcoin price. Luno’s R60-million Series A funding round in 2015 was led by Naspers. Its recent R120-million Series B round for expansion into 35 new markets across Europe was led by London-based venture capital firm Balderton Capital. Rand Merchant Investments, through its fintech investment arm, AlphaCode, and existing investors Digital Currency Group also participated in the round.

Knife Capital: UK Expansion and Swedish Investment — September 2017

Sure I am biased 😉 but it has been a big year for SA venture capital firm Knife Capital! Knife successfully exited its investment in sports radar-tracking business: FlightScope and invested in local ticketing services solution: Quicketand Swedish IoT specialist: MOST (alongside the creators of Candy Crush). The Knife-managed South African Revenue Service (Sars) Section 12J VCC: KNF Ventures keeps on gaining credible investors and in September Knife expanded into the UK with the opening of a London office after introducing UK-based Draper-Gain Investments as a strategic investor. And with a few due diligences running — Knife is well teed up for an even better 2018.

XL Africa: World Bank Digital Acceleration Programme — November 2017

20 of the most promising African digital Startups were chosen for the XL Africa residency, the flagship initiative of a business accelerator by the World Bank Group’s infoDev programme. While there is an accelerator frenzy in Africa at the moment, it is great to see that some are adding some real market access value for their cohort companies. Other exciting developments in this space include: Webber Wentzel Ignite — a legal incubation programme for entrepreneurs (Hurry — Applications close 15 Jan 2018); StartupbootcampCape Town; MEST Cape Town Incubator for South African entrepreneurs looking to launch into the rest of the continent and Knife Capital’s GrindstoneAccelerator (Applications for Grindstone 4 now open!).

WumDrop: Makro Acquisition — November 2017

Big retailer Makro acquired a majority stake in last-mile delivery startup: Wumdrop, to enable it to shrink its delivery window in getting products to its customers. WumDrop is now busy integrating with Builder’s Warehouse and Mass Discounters, and deliveries from those companies will start in 2018.

In cutting it down to 10 — I am definitely missing some other defining SA startup moments, but these lists or posts capture most of them:

VentureBurn: A look at 2017: the year that was for South Africa’s tech startup ecosystem

Disrupt Africa: Top 5 South African startup developments in 2017

SME South Africa: SA Tech Startups That Took The World By Storm In 2017

Well done to all SA entrepreneurs and ecosystem participants! Let’s build on the momentum created in 2017, collaborate, learn, innovate, fail, iterate, invest, bootstrap, accelerate, exit, have fun, make money and create an impact through conscious capitalism!

*This post originally appeared on Medium on 28 December 2017. See the post here.