We all have them. Those apps we open without thinking. Not because we need anything in particular, but because they feel… safe, in some…

Fintech accelerator DFS Lab to invest $200k in four African startups

US-based fintech accelerator Digital Financial Services Lab (DFS Lab) yesterday (11 April) announced that it will invest $200 000 in four African fintech startups, including Nobuntu, Cherehani Africa and NALA.

In addition to the $50 000 investment per startup, the selected companies will also receive six months intensive mentorship and integration into a global network of experts who will be working with the four startups.

The accelerator, which is funded by the Bill and Melinda Gates Foundation, made the announcement in a press release to Ventureburn. The four investments bring the total DFS LAb portfolio to 12 startups.

In addition to the zero-equity funding, the four fintech startups will also receive six months of intensive mentorship and access to DFS Lab’s global network of experts

In the statement, DFS Lab director Jake Kendall said the accelerator is excited to have the opportunity to invest in companies that will improve, simplify and enrich people’s lives.

“Our current set of portfolio companies are using technology to create solutions for low-income and unbanked populations, providing high-impact advancement. We look forward to seeing these companies grow and encourage others to look at Africa and Asia for investment opportunities,” said Kendall.

In an email in January, DFS Lab communications officer Alina Kaiser told Ventureburn that startups selected to receive funding from the accelerator would work closely with a DFS Lab entrepreneur in residence as well as a dedicated team of mentors to scale their businesses for future funding and investment.

Kaiser added that the startups, which are selected by a DFS Lab investor committee, would also not be asked to give up equity.

The early-stage accelerator aims to identify, accelerate and invest in fintech startups focusing on consumers in consumers in sub-Saharan Africa and Asia.

Last year, nine startups from Kenya, Tanzania, South Africa, Indonesia, Cameroon, France and the United States participated in a one-week DFS Lab bootcamp.

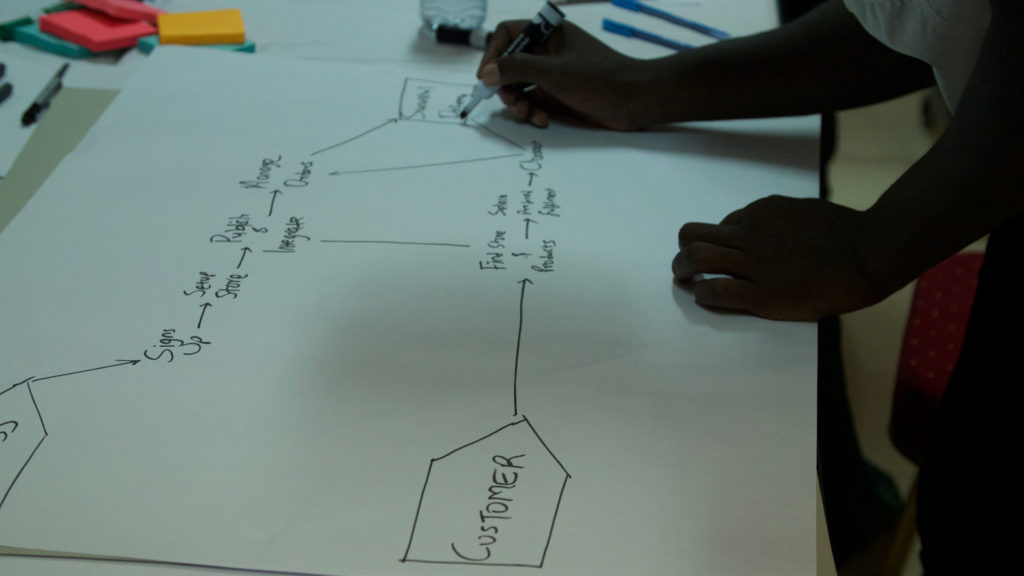

During the bootcamp, with the assistance of DFS Lab experts and invited mentors, participants mapped out challenges and solutions as well as created prototypes to solve the specific issues their businesses were facing.

Who are the recipients?

The selected startups are from Kenya, South Africa and include one US startup currently operating in Tanzania.

The fourth startup, a Kenyan digital lender is still in “stealth mode” and its identity was not disclosed in the statement.

Cherehani Africa (Kenya): Uses mobile-based technology to provide credit and distribute financial literacy content to women owned micro-enterprises.

NALA (Tanzania, US): Through its unified wallet, this fintech is aiming to offer Tanzanians digital financial services.

Nobuntu (South Africa): Community-minded savings solution which aims to help South Africans prepare for old age.

In an earlier interview in January — shortly after the company’s participation in the DFS Lab Dar es Salaam bootcamp in December 2017 — Nobuntu founder and CEO Tyrone Fouche told Ventureburn that if selected for funding by the accelerator, the startup would use it to support continued development of its platform.

“Specifically the multi-channel, multi-lingual on-boarding bot [Interavtive voice response, USSD, SMS] and a multi-factor proof of life verification system using biometrics and third party integrations (both with voice and other means),” Fouche said in an email.

“This is ground-breaking in the lower-income market, and is highly innovate as it would reduce time to pay-out (beneficial to customers) and reduce fraud,” he added.