In a move that signals a major leap forward in generative AI, OpenAI has quietly rolled out ChatGPT-5, its most advanced model to date….

Southern African VC sector invested over R1bn in 2017 reveals Savca report [Updated]

Southern African venture capital (VC) funds invested over R1-billion in startups and early-stage companies last year.

This, while the number of reported South African VC deals rose from 114 deals in 2016 to 159 last year — the latest Southern African Venture Capital and Private Equity Association’s (Savca) Venture Capital Industry Survey has revealed.

The report which was released yesterday (12 September) at the SA Innovation Summit in Cape Town, was carried out in collaboration with research partner Venture Solutions. The survey features data gathered from 57 fund managers as well as other industry investors.

The Savca Venture Capital Industry Survey shows that the average deal size increased from R7.6-million in 2016 to R8.3-million in 2017

The survey found that last year, the Southern African VC sector invested a total of R1.16-billion in startups and early-stage companies — exceeding the R1-billion mark for the first time. This, while the average deal size increased from R7.6-million in 2016 to R8.3-million last year.

It’s the first year in which countries bordering South Africa — Namibia, Botswana, Lesotho, Swaziland, Mozambique and Zimbabwe — were included in the survey.

Savca said South Africa accounted for 99.6% of deal value and 98.6% of the number of deals concluded in 2017. Namibia and Botswana accounted for most of the remaining figure in deal value and number of deals, said Savca.

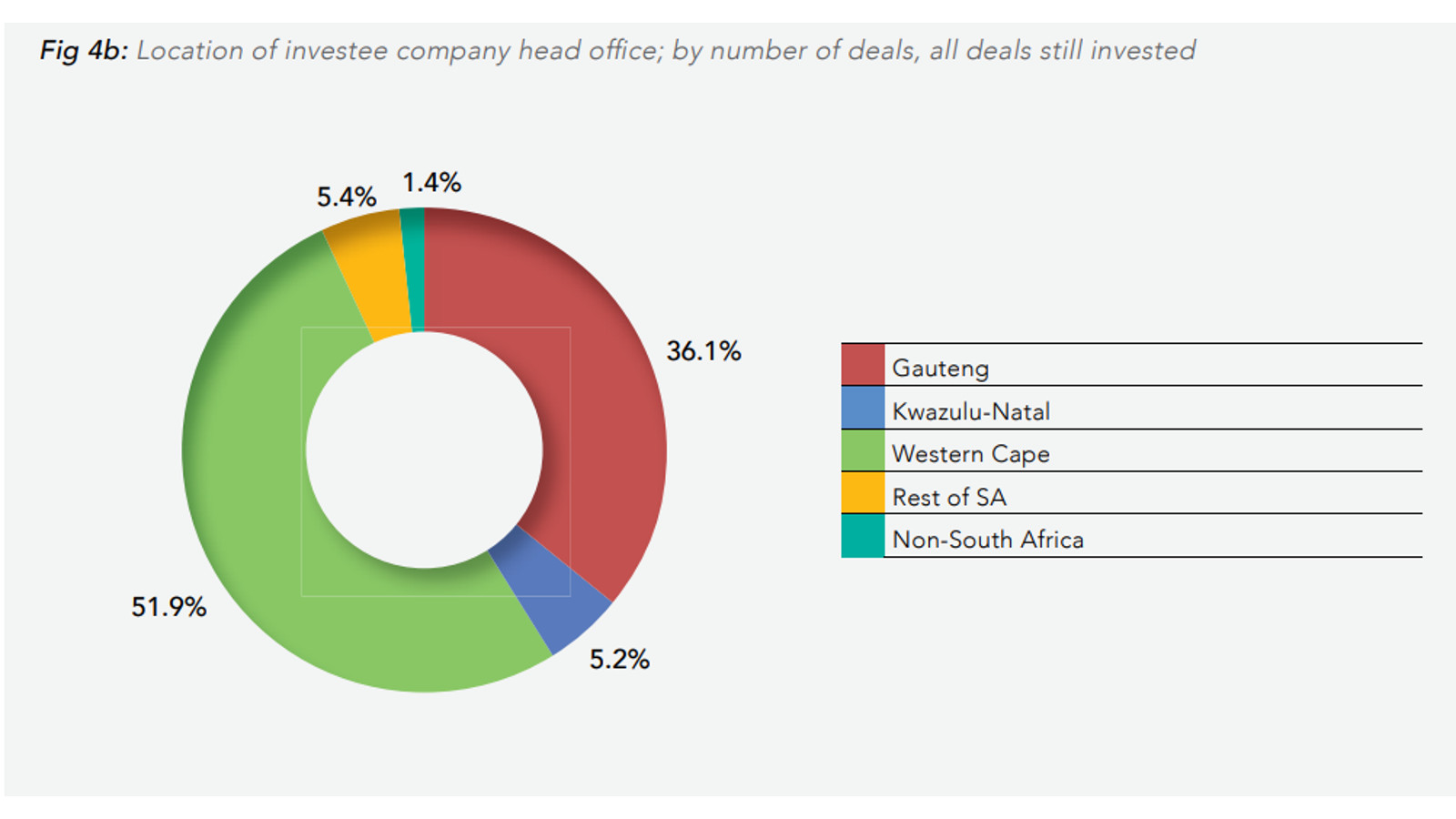

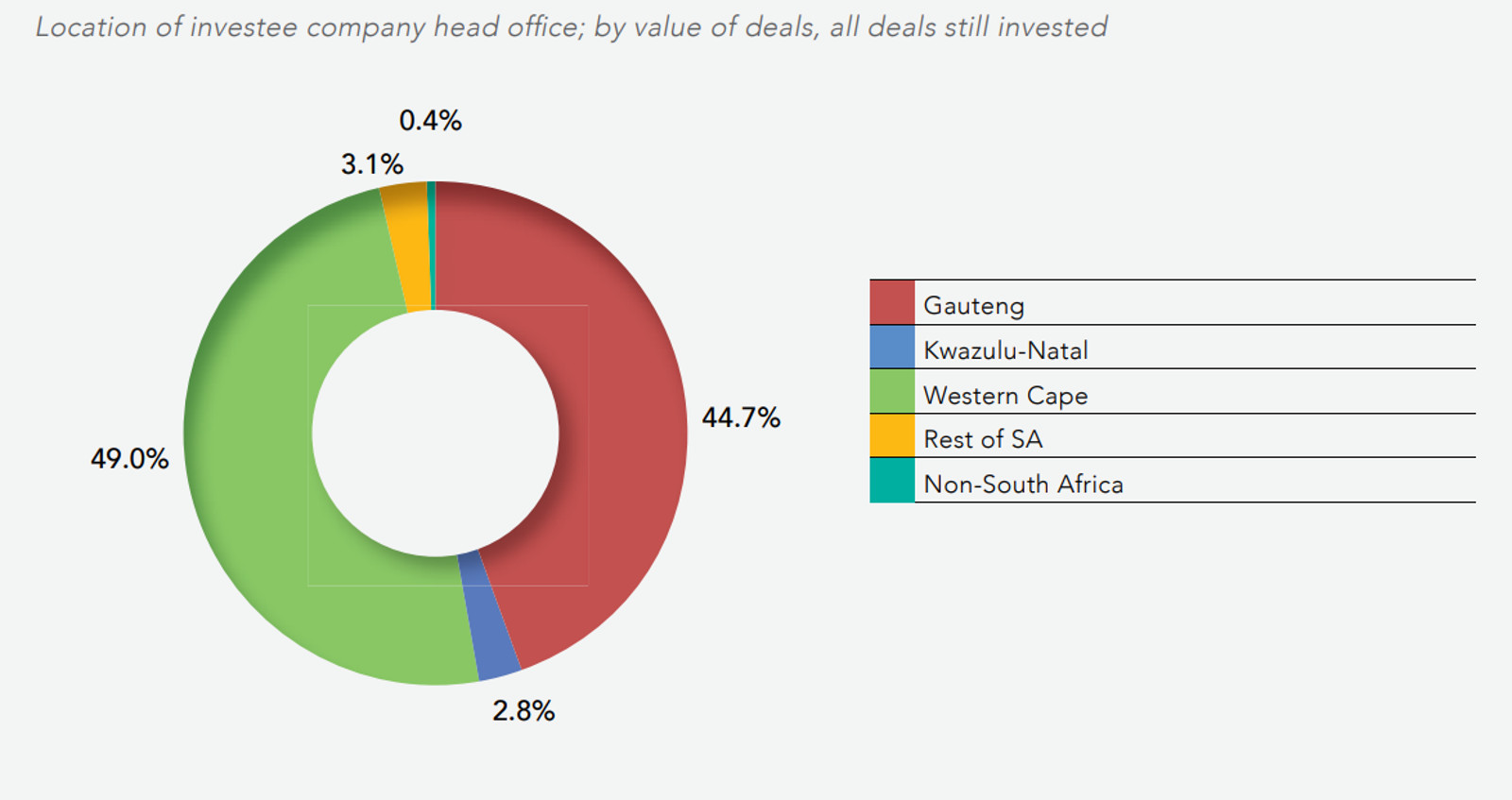

In addition, when it came to location the Western Cape is still the number one province for the number of deals and deal size in the VC sector.

In all, 51.9% of deals were with companies based in the province (see below graphs — Figure 4b and drawn from the report ).

This, while the province accounted for 49% of the total deal value — only slightly higher than Gauteng which accounted for 44.7% of deal value, but jusrt 36.1% of the number of such deals.

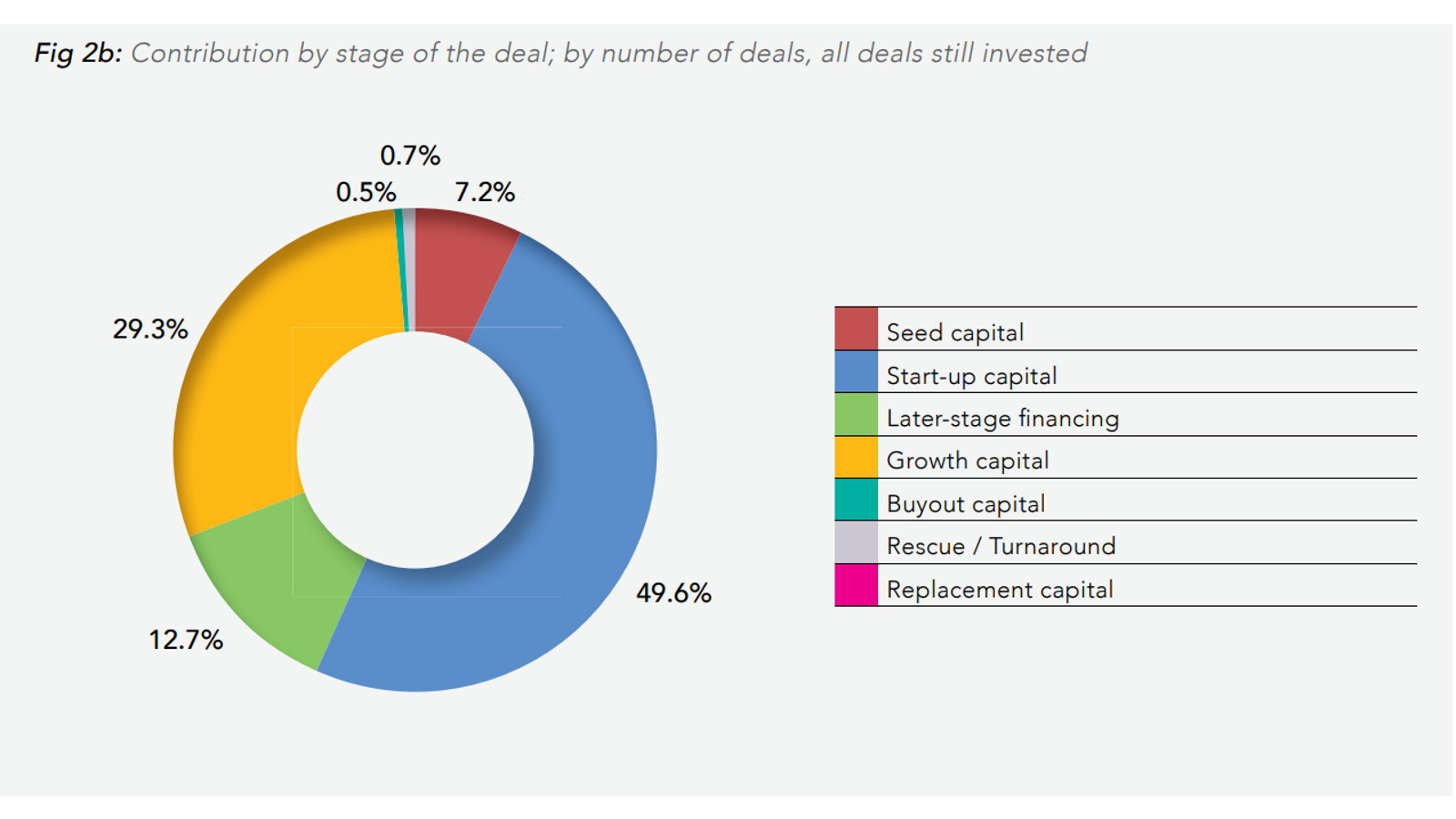

The survey also found that a total of 57% of the reported number of VC deals were categorised as seed funding and startup capital (see Figure 2b drawn from the report, below). In contrast, in 2016 the two categories accounted for only a combined 49% of reported deals.

Commenting in a statement today (13 September) Savca CEO Tanya van Lill said the association is “very encouraged” with the continued growth of the asset class.

Van Lill added that while there were only 15 reported exits during the period, her association is confident that as the VC sector matures an increase in exits will follow suit.

“What’s more, we’re particularly excited about the role and future impact that the increased capital flowing to the sector is expected to have on the economy.

“In line with this, our focus over the next few months will be on conducting research aiming to identify and quantify the overall economic impact of the venture capital and private equity asset classes,” she said.

The survey also features a brief socio-economic impact assessment based on the responses of 38 VC-backed SA companies.

The study found that 77% of the respondents acknowledge the advantage that VC investments have on their ability to enhance employment opportunities within their respective enterprises and creating jobs.

Editor’s note (18 September 2018): This story was updated to include a clarification from Savca that the survey was opened in 2017 for the the first time to fund managers from countries bordering South Africa and will continue to do so.

Savca said South Africa accounted for 99.6% of deal value and 98.6% of the number of deals concluded in 2017. Namibia and Botswana accounted for most of the remaining figure in deal value and number of deals, said Savca.