AI chat is no longer just about faster answers or conversational tone. Search.com, a division of Public Good, has launched a generative AI search…

Are these the four biggest SA tech acquisitions of 2018?

As 2018 comes to an end SA tech entrepreneurs can look back on a year of four big acquisitions. As usual, no one is willing to say (at least for now) how much the companies — Uber, Hewlett Packard, Pam Golding or Crossfin — paid to acquire these four local tech companies.

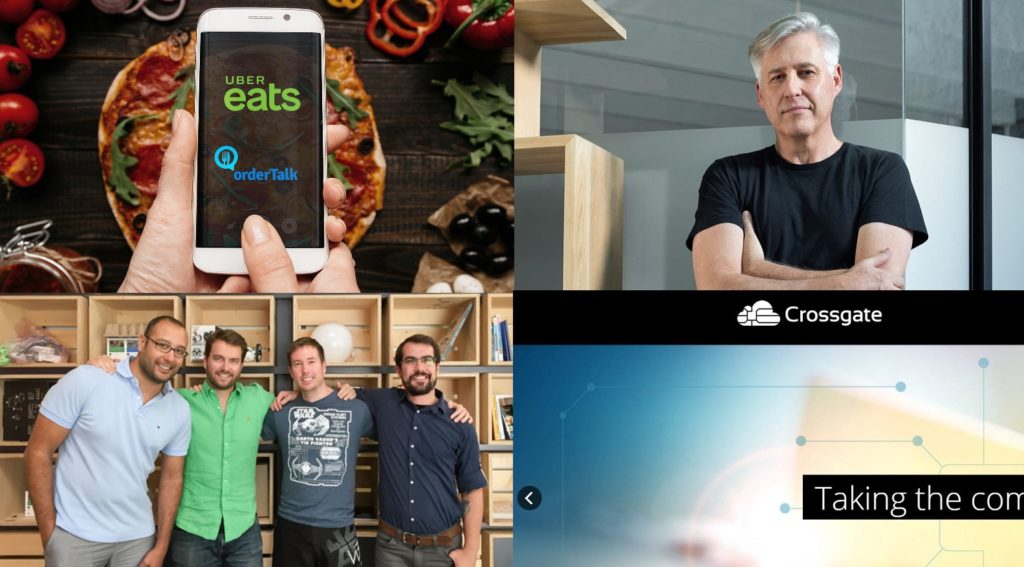

The Uber Eats deal — in which the company bought SA-founded orderTalk — is perhaps this year’s biggest acquisition deal.

Local venture capital (VC) company Knife Capital invested R9-million in the company back in 2008 (the company was founded in 1998) for a significant minority stake (probably 20% or more). Going on this, the sale could have easily gone into the hundreds of millions of rands.

Here then are the four big tech acquisition of 2018:

Uber Eats buys orderTalk

In May Uber’s food delivery business Uber Eats announced that it had acquired SA tech company orderTalk, in part by buying out Cape Town based venture capital (VC) firm Knife Capital’s share and that of the founder Hilton Keats.

While the terms of the deal were not been disclosed, Knife Capital invested R9-million in the company –which provides online ordering software to restaurants that integrates with a restaurant’s point-of-sale system — in 2008 and took a “significant minority” stake in the business.

Uber Eats said the acquisition will allow it to “streamline workflows by directly integrating with leading point-of-sale systems”. At the time Uber said the majority of the company’s employees will stay on for now — most of whom will relocate to Uber’s New York office.

However Uber Eats plans to wind down other orderTalk features, namely, supporting the ability for restaurants to accept online orders, over the next year.

The startup was founded by Keats in 1998 on the back of an online ordering software development partnership with a US restaurant chain.

In 2004 lawyer Patrick Eldon joined as CEO and opened the Cape Town head office in 2005. After initial angel investor backing, HBD Venture Capital (owned by internet billionaire Mark Shuttleworth and subsequently managed by Knife Capital) invested R9-million ($700,000) in 2008 to scale the business internationally.

While orderTalk initially expanded its technical capabilities in Cape Town, the main client base started growing aggressively in the US and UK. Over the years the core business was relocated to Dallas, Texas.

OrderTalk was the final investee company to exit from the R150-million HBD Venture Capital Fund that Knife Capital managed.

Read more: Uber Eats acquires SA founded tech firm orderTalk for undisclosed amount

Read more: Three reasons why Uber acquisition of SA grown orderTalk is so big a deal [Updated]

Pam Golding buys Eazi.com

Real estate company Pam Golding Property Group announced in August that it had acquired property marketplace Eazi.com for an undisclosed sum (see this story).

The Cape Town startup was founded by Shaun Minnie (pictured above) and Grant Leigh in 2016.

Minnie, who has since moved to the US to pursue business interests there, said he and Leigh and 12 other employees of the startup will be staying on. Minnie would remain “actively involved” with the company until about February next year and then on a consultancy basis for a further six months.

Eazi.com enables consumers to buy and sell residential property for a fixed fee of R29 500 plus VAT which is only payable on sale of the property.

Pam Golding’s group’s chief executive Andrew Golding said the deal would broaden the group’s access to the SA and African residential property sector — by enabling the agency to take an interest in the high-volume segment of the market.

Eazi.com had at the time of the deal focused only on the Cape Town Metropole and Golding said it will continue to be managed and branded separately from Pam Golding Properties.

He told Ventureburn in September that it is “too early” to tell with any real accuracy what the long-term effect of technology platforms will be on the sector. He doesn’t believe estate agents are going to be totally replaced by tech platforms (see this story).

The deal was follow up in September by an announcement by online estate agency PropertyFox that it had acquired fellow Cape Town based property platform Steeple.

PropertyFox did not disclose the amount it had bought the company for. The two agencies will effectively be consolidated, with PropertyFox taking on all Steeple’s clients.

Steeple, which has been in operation since 2012, is a “low commission” estate agent platform, where sellers get to show potential buyers around their home and where Steeple takes commission of “only 1.9%” (plus Valued-Added Tax).

Read more: Will growth of property tech signal the death of the estate agent?

Read more: SA startup PropertyFox acquires local platform Steeple for undisclosed amount

Read more: Eazi.com co-founder plans to relocate to US following Pam Golding deal [Updated]

Cape Networks acquired by Hewlett Packard

In March Cape Networks (the founding team is pictured above), a software as a service and hardware startup based in Cape Town and San Francisco, revealed that it was set to be acquired by IT giant Hewlett Packard Enterprise (HPE) for a yet-to-be-disclosed price.

Cape Networks uses Internet of Things (IoT) sensors to monitor and optimise Wi-Fi networks. The acquisition involved Cape Networks merging with Aruba, an HPE subsidiary which specialises in data networking solutions.

Cape Networks was founded in 2013 by David Wilson under the name Asimmetric. He was later joined by Ross Douglas, Fouad Zreik, and Michael Champanis the following year. In 2016 the company underwent a name change to Cape.

Cape Networks’ previous investors include Silicon Valley venture capital firms Highway1, Autonomous Ventures, Haystack, Bolt and Root Ventures. Last year the startup was crowned the best Wi-Fi Startup of 2017 at Wi-Fi Now Europe in the Hague.

Wilson said at the time of the deal that the company was planning on hiring a “significant” number of software engineers. Following the deal, he said, Cape Network’s solutions will help to expand Aruba’s artificial intelligence powered network capabilities. He said the four founders would be staying on when the acquisition is concluded.

Read more: SA startup Cape Networks to be acquired by Hewlett Packard Enterprise

Read more: 10 South African startups leading innovation in IoT [Digital All Stars]

Crossfin acquires majority stake in Crossgate

In October Cape Town based fintech holding company Crossfin announced that it had acquired a majority stake in SA payment solutions company Crossgate for an undisclosed amount.

The deal followed Crossfin’s partnership with SA bank and asset management group Investec to identify and invest in early-stage fintech businesses.

Crossfin bought media technology company Tritech Media’s stake as well as two other US-based investors (Tritech Media said at the time that it had disposed its 45% holding in the company).

Crossgate CEO David de Coning (pictured above) said at the time that the deal gives the payment solutions firm access to Crossfin’s “well-established and strong position” in the African payments market.

Based on information on De Coning’s LinkedIn profile, Crossgate was — in 2014 — spun out of the products and advanced payments business unit of Opengate, a company that De Coning co-founded in 2006.

Read more: Crossfin acquires majority stake in payment solutions company Crossgate [Updated]