Have you ever wondered how much easier travel has become, thanks to the digital innovations shaping our world? Exploring new destinations used to mean…

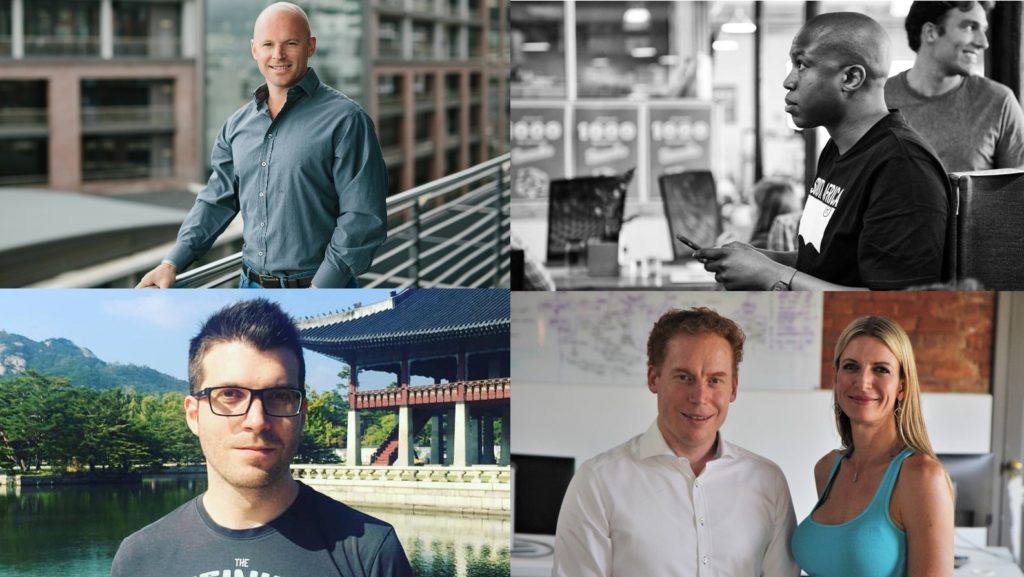

Are these the biggest disclosed VC deals in 2018 involving SA tech startups?

SA tech startups raised over a R1-billion or over $89.3-million in 2018. This is the figure available to Ventureburn through the 15 venture capital (VC) deals in which startups disclosed how much they raised (JUMO’s $52-million and $12.5-million deals and Yoco’s $16-million deal accounted for the bulk of this).

Not every startup wants to disclose how much they raised. Usually to avoid giving future potential investors the inside edge, startups often withhold the amount and equity stake involved in a funding raise — which is why a further 13 tech startups elected to withhold this figure from the public when announcing they had closed a deal.

Going on the figures that are then available, SA startups accounted for nearly half of the over $178-million raised from 48 disclosed VC deals reported by Ventureburn in 2018 (see this story).

The true figure, if undisclosed deals were also to be included, could run into hundreds of millions of rands. In October the organisers of annual tech startup conference AfricArena said the amount of VC raised by African startups could for the first time exceed $1-billion (see this story).

The bulk of the disclosed deals involving SA startups were made in fintechs (six deals worth $83.7-million) and went to Cape Town startups (13 of the 15 deals originated in startups based there, with the remaining two disclosed deals for Johannesburg based startups).

SA tech startups raised over $89.3-million or R1-billion from 15 deals in 2018, in which amounts were disclosed

While local investors participated in 11 of the 14 disclosed deals, international investors contributed perhaps 90% of the $76.8-million injected into startups in these deals.

The local investors that participated in disclosed deals included Yellowwoods, 4Di Capital, Sanari Capital, Kalon Venture Partners, Cape Town-based investment fund Getihu, HAVAÍC and The Asisa ESD Fund which is managed by Edge Growth.

Here is a ranking of the top 10 disclosed SA deals that Ventureburn reported in 2018 (with the origin of startup and date it was founded)

1. JUMO (Cape Town, 2014): $52-million

2. Yoco (Mauritius/Cape Town, 2015): $16-million

3. JUMO (Cape Town, 2014): $12.5-million

4. Snapt (Cape Town, 2012): $3-million

5. Naked (Cape Town, 2017): $2.2m

6. Sensor Networks (Cape Town, 2015): $950 000

7. FinChatBot (Cape Town, 2016): $510 000

8. SnapnSave (Cape Town, 2015) $510 000

9. The Sun Exchange (Cape Town, 2015) $500 000

10. Hi5 (Cape Town, 2015) $180 000)

The four other disclosed deals were Hashtag Our Stories ($150,000), Jumpin Rides ($130,000), Vula Mobile ($70,000) and Zelda Learning ($35,000).

Those SA deals in which the amount raised was not disclosed were: PharmaScout, Simply, HouseMe, Click2Sure, Instant Property, Crossgate, Atura, CoGrammar, Aerobotics, Yalu, Skillup, Giraffe and DataProphet.

Read more: AfricArena predicts funding raised by African startups in 2018 will crack $1bn

Read more: Southern African VC sector invested over R1bn in 2017 reveals Savca report [Updated]

Read more: Are these the 10 biggest disclosed African tech startup deals of 2018? [Updated]

Earlier updates (on 18 and 23 December 2018, respectively) were made to this article, to include HouseMe’s announcement (also last week) of an undisclosed amount it received in investment and JUMO’s $12.5-million deal with Odey Asset Management (see here).

Featured image: (from top left to bottom right) JUMO founder Andrew Watkin-Balls, Yoco co-founder Katlego Maphai, Snapt founder Dave Blakey and Naked Alex Thomson and Sumarié Greybe (Supplied, via Facebook and via Yoco)