In a move that signals a major leap forward in generative AI, OpenAI has quietly rolled out ChatGPT-5, its most advanced model to date….

The silent Naspers coup: how Koos Bekker gave away the family jewels [Opinion]

This article needs to be written before it’s too late (it might be). It needs to be written and attention drawn to the below before we lose everything Naspers got from and created for South Africa.

Appointing Bob van Dijk as CEO of Naspers was the biggest mistake Koos Bekker could have made for SA and for his legacy (not according to former Nasper manager Johann van Tonder — in his response to this piece, here — Ed).

But before we talk about the present, let’s revisit history and how things developed, how Naspers came to pass and why I make this point.

Naspers was started more than a 100 years ago, by a bunch of Afrikaners in Stellenbosch.

According to Wikipedia (see article here), the company was founded in 1915 under the name De Nasionale Pers Beperkt (National Press Ltd) as a publisher and printer of newspapers and magazines. A group of prominent Cape Afrikaners decided in December 1914 at a meeting in Stellenbosch to form a publishing company that would support Afrikaner nationalism.

Appointing Bob van Dijk as CEO of Naspers is the biggest mistake Koos Bekker could have made for SA and for his legacy

So, contrary to a lot of belief out there, Naspers wasn’t founded by Koos Bekker.

Bekker has only been CEO of Naspers since 1997. He was however instrumental in launching M-Net, Multichoice, DSTV, MTN etc. And obviously the investment into TenCent. I don’t take any of this away from him and he’s been well rewarded and at the same time become fabulously wealthy through this.

By South Africans for South Africans

However, the point of this article is that Naspers was started by South Africans for South Africans.

The money used to grow and invest in all these companies came out of Naspers, out of the fruits of the labour of thousands of South Africans.

Keep all of that in mind as we continue to unpack where we are.

By a sad twist of events, in 2012 unfortunately Antonie Roux passed away. He was to be the natural successor to Bekker as CEO, being a key player in the investments into Mail.ru, Tencent and others.

That kept Bekker in the position for a year or two longer and the search was out for a new CEO.

At this point Naspers was investing in and growing the business across the globe, with many South Africans part of the senior management teams disrupting industries and truly being a company of pioneers.

I won’t delve too deep, but it was also a time when weirdly a lot of foreign managers were appointed in the SA businesses of Naspers, with, at times disastrous results.

Most of MIH’s e-commerce businesses shut down, Kalahari was swallowed up by Takealot after being managed very badly – all these businesses managed by foreigners that had no real idea of local markets, bringing in incorrect European thinking.

Enter Bob van Dijk

Around this time Van Dijk steps into the ring. A senior manager at eBay with a background in management consultancies such as McKinsey and others. And for some reason Bekker thought he’s the best man for the job (a senior manager or VP?).

Van Dijk is not someone that’s ever created something or run a large corporate. Furthermore, he’s a really boring speaker and uninspiring leader.

But this is where one needs to take note of the Naspers history and see where this story is heading. Let’s remind you again that Naspers was started for South Africans by South Africans and that it was the work that we did in Naspers that allowed Koos and his team to invest in the Tencent’s of the world and get fabulously wealthy.

Since he took over, Van Dijk has removed every single senior South African heading up any part of the company around the world, he has appointed all his mates and fellow eBay managers in positions of power around him. In the corridors of the Naspers buildings in the Cape they are calling the Naspers senior team the “eBay B-team”.

I’m not sure if anyone has noticed, but he’s been busy splitting Naspers up so that the international business is removed from the SA business – it’s not a secret that Van Dijk would prefer not to have anything to do with SA (or most emerging markets for that matter).

He doesn’t like them and frankly doesn’t understand them (what he doesn’t understand being the exact reason why Naspers got so big, by focusing on the non-traditional and challenging).

He’s already split Multichoice out of the group, the next move is to take the TenCent stake out of South Africa into a listing in the Netherlands and leave South Africa with the scraps.

Recently there was a big fanfare about Naspers investing R3-billion in South Africa with the ask by President Cyril Ramaphosa for investment (see this statement). So, let’s dissect it a little – that’s only $250-million of which most will be going into the investments they already have here eg: Takealot and OLX (both unprofitable).

It might sound like a lot but (as an example) compare it to the speculative investment into LetGo of $500-million (second or third round) to take on Craigslist in one of the most competitive markets in the world, the US.

That’s nearly double the total investment into SA, going on a “maybe” (Side note: there’s been a big noise about LetGo having hit 100 million app downloads – compare that to Craigslist that has 450 million unique visitors a month. Hardly a number to be excited about. This, before Facebook fully even switches on its marketplace).

And this investment is into the team that sold OLX to Naspers – so very happily double dipping into the pot of money supplied by us South Africans.

The list continues – nearly a billion dollars into Delivery Hero an already listed entity, to help the Rockets Internet brothers get their money out of that company. As an emerging market company, why would one invest in an EU-listed company?

No investment in SA startup scene

This, while hardly any money is being put back into the SA entrepreneurial startup or growth scene (In October last year Naspers announced that it plans to next year launch a R1.4-billion startup fund in 2019, see here. It’s not certain when the fund will launch — Ed). The startup scene was once a budding e-commerce and fintech ecosystem, has all but died.

Between 2010 and 2014 the startup environment was alive and well, entrepreneurs were building new fun groundbreaking tech businesses. Now it’s like a ghost town.

One of the reasons Silicon Valley works is that the businesses grown there have all come back and invested heavily back into the ecosystem. Didn’t we learn anything?

Across the world South Africans have proven to be pioneers (we do that well), Elon Musk (Tesla, SpaceX), Roelof Botha (Sequoia), Pieter de Villiers (Clickatell), to name but a very few, the list carries on, yet not one is left in Naspers any more. A company that was known for its groundbreaking and pioneering spirit will be all that in name only soon.

I’m getting to the end of the point I’m trying to make – there are many more examples of how Naspers is being used by Van Dijk and friends as theirs. It’s not.

Us South Africans that helped build this business are being taken for a ride and Bekker has given it all away (to an ex-senior manager from eBay). This is someone (and now a team of people) with no allegiance to the country and no desire to give back. No South Africans are left in the company to stand up and make this point.

On one side, no South Africans are being given a future in Naspers, while at the same time a massive (truly massive) investment is being taken away from us and we’re not saying a thing – we seem to be happy to complain about the state of business in South Africa, but when it’s a silent coup like this one, no-one says a word.

Enough is enough

Isn’t it time someone stood up and raised the flag on this?

As shareholders (and perhaps the board too), we still have the power to stop the listing in the Netherlands, or at least raise our voices around this issue – we’ve truly lost the war about appointing South Africans and using SA skills in the company, let’s at least make a last-ditch attempt at this part.

It’s time South Africans had a senior voice in the company that calls them out on their bullshit.

We’re quick to complain about mining wealth and state capture taking billions out of the country, but when it happens quietly and is painted in a pretty colour, no-one says a thing.

If we say nothing, not our kids nor their kids (black and white), will ever work for or benefit out of the work we and our parents built for them. This was not why Naspers was created.

Isn’t it time to show the emperors’ choice of dress (both emperors for that matter)?

There is an old proverb that says if you make it to the top floor, it’s your responsibility to send the lift back down.

Koos, if you’re reading this, it’s time to step up and do the right thing.

Andre de Wet is the former CEO of SA e-commerce platform Pricecheck, which was bought by Naspers in 2010, before in 2015 its founder Kevin Tucker with the help of investors Silvertree bought the company back (see this story).

Read more: Do you want to treat Naspers like a small family business? [Opinion]

Read more: How Naspers could help find SA’s next great tech startups [Opinion]

Read more: Naspers to launch R1.4bn fund to back SA tech startups

Editor’s note (7 June 2019): The opinion piece was updated to include a link to a reference the author used from Wikipedia (see article here) for Naspers.

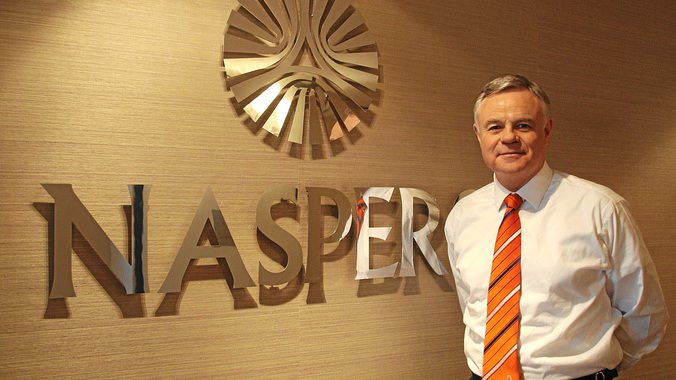

Featured image: Naspers chairman Koos Bekker (Facebook)