In a move that signals a major leap forward in generative AI, OpenAI has quietly rolled out ChatGPT-5, its most advanced model to date….

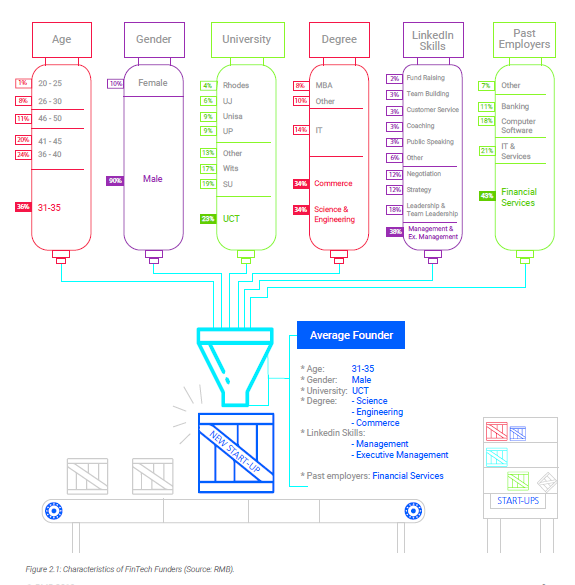

What does the average SA fintech founder look like?

What does the typical SA fintech founder look like?

Most likely they’re male, aged over 30, have studied at UCT, Stellenbosch or Wits and have worked previously in the financial services sector.

This is revealed in a new report “The SA Fintech in Motion Report” by Rand Merchant Bank, whose authors gathered data from LinkedIn profiles of 90 SA fintech company founders.

A new report by Rand Merchant Bank provides a picture of the typical SA fintech founder

The report doesn’t however provide a breakdown of the race of each founder, likely because this is not always that easy to discern from someone’s LinkedIn profile.

Among other things the report reveals that the average fintech founder:

- Is older than expected. In all, 60% of founders are aged between 31 and 40, with a further 33% aged over 41. In all, 90% are male.

- Likely attended one of three top SA universities. When it comes to universities, 23% attended the University of Cape Town (UCT), 19% Stellenbosch University and 17% Wits university. The remainder are from other universities.

- Most likely has a commerce, engineering or IT qualification. When it comes to qualifications, most founders have a commerce (34%) or engineering degree (34%). A further 14% have IT qualifications, eight percent had an MBA and 10% had another type of qualification.

- Listed their past employers as being from the financial services sector (54%), while a further 39% were from the IT sector. The remainder (seven percent) worked for employers from other sectors.

In addition, the report’s authors — Malanee Hutton, Trushall Bhana, Stuart Allen and Ubaid Nursoo — found that while venture capital (VC) spend in South Africa has grown, fintech-specific ventures make up a very small part of deals concluded.

The number of VC deals concluded from 2015 to 2017 grew 70% (see this story), but investment in fintech-specific ventures only equates to 7.3% of the 159 deals concluded in 2017 with the figure dropping to less than five percent if split by value of deals.

Furthermore, funding, say the authors, seems to be accessible only to established players or to those who have a network influential enough to be directly referred to VCs and angel investors.

“Bootstrapped fintechs, rather than jumping through hoops for funding, focus their energy on growing their businesses (either diversifying or pivoting) so they can further bootstrap or search for funding abroad,” say the authors.

The report’s authors conclude that while some SA fintechs have been successful both locally and internationally, many continue to struggle to establish themselves.

Say the authors: “This is due to a variety of contributing factors, part of which is an unsupportive funding ecosystem and the complexity of navigating our financial regulatory system”.

Featured image (from top left, clockwise): Yoco’s Katlego Maphai, Pineapple’s Matthew Elan Smith, JUMO’s Andrew Watkins-Ball and WiGroup Bevan Ducasse