We all have them. Those apps we open without thinking. Not because we need anything in particular, but because they feel… safe, in some…

10 steps to setting up an office for your startup in the US [Opinion]

There are many reasons for incorporating your business in the US.

The reason why I incorporated my business Feastfox (an eating out app that allows diners to book with restaurants, see this story — Ed), in the US, was to take advantage of raising venture capital (VC) in Silicon Valley.

For SA entrepreneurs, the process of setting up a business in the US can be complex and frustrating. So, here’s a list of the 10 most important steps to follow when doing so:

Disclaimer: This article does not constitute legal advice.

1) Make sure you don’t have a loop structure

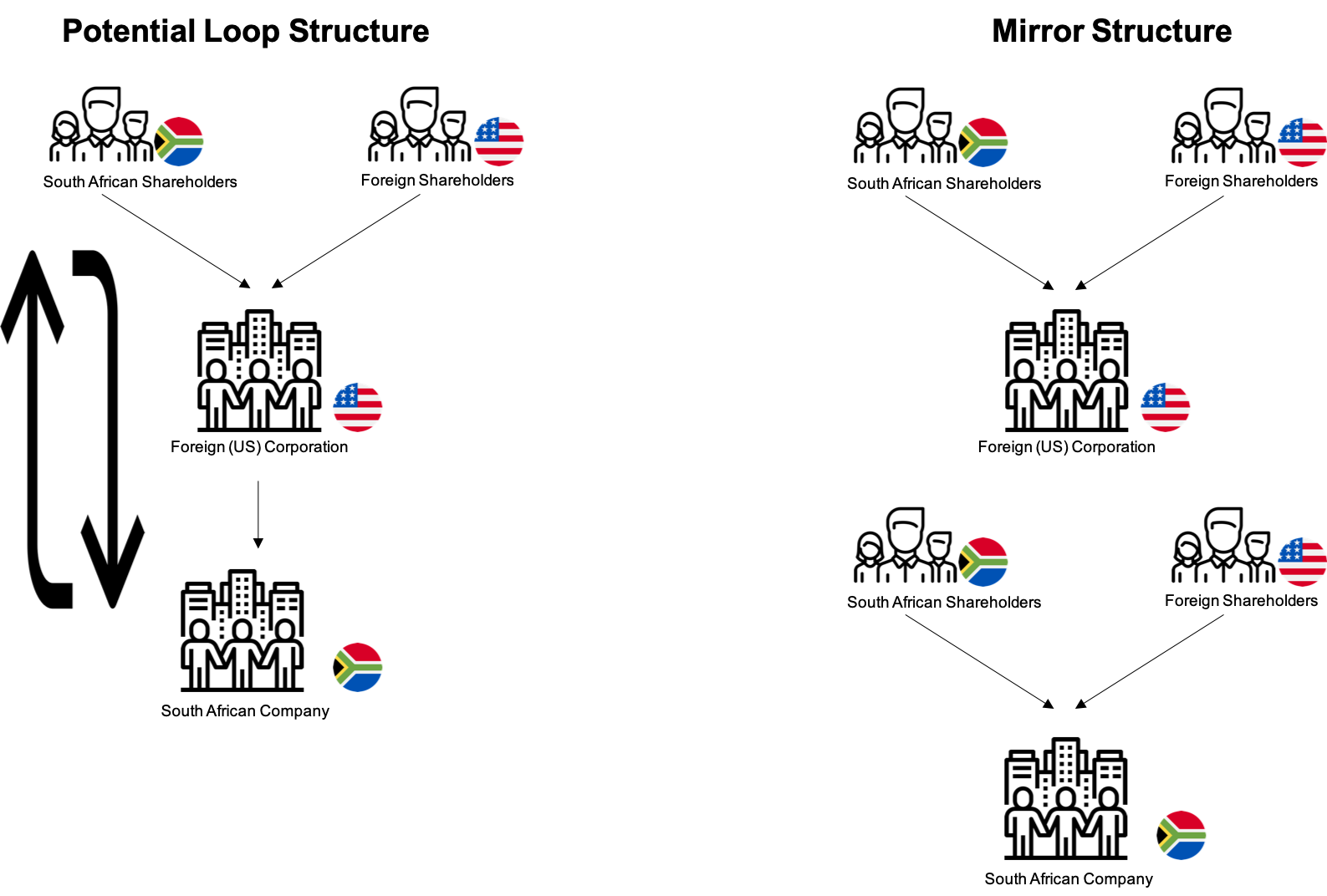

If you intend to set up a US holding company with a SA subsidiary you will likely encounter issues with the SA Reserve Bank’s regulations around loop structures.

Simply put, SA residents are prohibited from investing in a foreign company, which in turn invests back into a SA company. This type of legal structure risks being unwound by the Reserve Bank.

A potential solution is to create a mirror structure which replaces the foreign company’s shareholding in the subsidiary with a structure such that all shareholders have a direct shareholding in both the foreign and the SA entities, in the same proportion (see the below graphic).

2) Decide where and what to register

Unlike South Africa, which has a national registration authority (CIPC), each US state has its own registration authority with varying requirements.

I decided to register the US holding company of Feastfox in the state of Delaware because:

- It is the market standard for VC-funded startups in the US.

- The state has some of the most flexible business laws in the US.

- If you don’t operate in Delaware you don’t pay any state corporate income tax ($225 annual Franchise Tax) and

shareholders, directors and officers of the corporation do not have to be residents of Delaware.

I also decided on a Corporation or C Corp as they are the market standard for tech startups looking to raise VC funding in the US.

3) Hire a lawyer to handle your registration process

You have three options regarding filing of company registration documentation: do it yourself ($90); engage a company for partial filing, similar to a shelf company in South Africa ($200 to $400) or engage a lawyer for the complete registration process ($500 to $2000).

I decided to engage a lawyer for the entire registration process as I needed to tailor Feastfox’s Certificate of Incorporation and Bylaws to include specific clauses which were not part of standard Delaware General Corporation law.

I used UpCounsel, an online marketplace, to find the right lawyer.

4) Get a Delaware-registered agent

All Delaware corporations, are required by law, to appoint a Delaware-registered agent. This is a third party address service that receives your company’s important notices and mail (eg legal notices and other state correspondence), scans and emails it to you. Feastfox used Delaware Registered Agent ($45 per year).

5) Register for federal tax

To register for state taxes and open a bank account you will need an Employer Identification Number (EIN). You will receive an EIN when you register with the Internal Revenue Service (IRS) — the federal tax authority in the US.

If you already have a valid IRS personal taxpayer identification number you can register and apply for your corporation’s EIN online.

As an alternative you can get an EIN by mailing or faxing Form SS-4 to the IRS or getting your lawyer to submit it for you.

6) Register for state tax

If your corporation is operating in the US you must register for state tax. Since each state will have its own tax regulations, requirements can vary and can be complex. There are often also county and city registration and reporting requirements to consider.

I decided to hire an accounting firm ($125 per month retainer) to handle state tax filings.

7) Open a bank account

You will need your corporate documents, EIN and a physical address to open a bank account.

Rather opt for larger national banks (Chase, Bank of America, Citi) over smaller regional ones because they tend to be more experienced in dealing with corporations with foreign directors and shareholders.

I chose Silicon Valley Bank which is focused on technology companies.

8) Get office space

You generally need a credit score to rent office space in the US. Until you build up your credit history you should opt for co-working or shared office space like WeWork.

9) Build you credit score early

Building a credit score in the US is time consuming. Start with opening a business credit card at a bank that reports to a credit union. You may need to put down a deposit to secure the credit limit but this will be a good investment in building a reputable credit score for any future borrowing.

10) Employees and payroll taxes

If you are hiring employees in the US you will need to navigate the complex federal and state payroll reporting requirements.

Feastfox uses a payroll package called Gusto which handles payroll reporting requirements, federal and state tax filings as well as salary payments to each employee.

Read more: SA eating out app Feastfox nets $175 000 from Silicon Valley investors

Featured image: Ronile via Pixabay