We all have them. Those apps we open without thinking. Not because we need anything in particular, but because they feel… safe, in some…

With crypto winter over here are six SA startups to watch

With experts reporting in recent months that crypto winter is now over, things are hotting up in the SA crypocurrency scene — with five major SA crypto deals valued at over R60-million having being announced since the beginning of this year.

The deals are a sign of how active the vertical has become on the country’s tech scene.

If you’re an investor, startup or a crypto enthusiast who is looking to get involved in the vertical, here are six SA crypto startups you should keep an eye on. Here they are:

VALR

VALR is a Joburg-based cryptocurrency trading platform that enables customers to buy, sell, store and transfer cryptocurrencies.

Last week Wednesday (3 July) the platform announced that it will today at 11.11am launch ethereum-rand (ETH/ZAR) trading to allow customers to buy and sell Ether, the native cryptocurrency of the Ethereum blockchain, directly with rand.

The startup, which is backed by funding from former FNB head and venture capitalist Michael Jordaan, was founded last year by CEO Farzam Ehsani (pictured above, left), CPO Badi Sudhakaran (pictured above, right) and CTO Theo Bohnen.

In March the trading platform announced it had raised $1.5-million in a seed round led by US crypto exchange Bittrex (see this story). Ehsani told Ventureburn that the deal had been concluded at the end of July last year.

VALR launched bitcoin-rand (BTC/ZAR) trading last month. Ehsani, commenting in an earlier statement, said the startup is “delighted” by the market’s response to its bitcoin-rand trading launch. “And in just three weeks VALR now represents about five percent of SA’s 24-hour trading volume,” he added.

VALR pays market-makers — customers that provide liquidity to its platform — 0.1% of their total trade value, bringing a “negative fee” structure to the market for the very first time.

Market-takers — customers who execute trades immediately — are charged 0.2%, what VALR claims to be the lowest fee on the market.

VALR’s platform uses artificial intelligence and machine learning to streamline the ID verification process, allowing new customers to be verified within minutes. It also offers an advanced application programming interface (API) that allows automated trading on the platform.

The startup plans to launch more cryptocurrency-rand trading pairs in the near future.

Luno

Luno is a bitcoin and ethereum exchange that was founded in 2013 by CEO Marcus Swanepoel and CTO Timothy Stranex. The company has its headquarters in London and operates across Africa, South East Asia from its regional hubs in Singapore and Cape Town.

The exchange announced in a statement yesterday (10 July) that it had launched ethereum-rand trading with zero fees for market makers and 0.2% for market takers.

Luno claims to have over 2.7-million customers or wallets across 40 countries.

Luno Africa GM Marius Reitz, commenting in the same statement, said the exchange has “invested heavily” in scaling in anticipation of the next cryptocurrency surge by upgrading its platform, opening new offices in new countries and increasing its team.

“We have very robust technology systems to reinforce and expand our business as we prepare for the bull run that takes us to mass adoption and a stable market. We expect a sharp shift from using traditional financial systems to the next step in the evolution of money,” said Reitz.

Since its launch in 2015, Luno has raised over $13-million in funding. Its investors include the Naspers Group, Rand Merchant Investment Holdings, Balderton Capital, Digital Currency Group and Venturra Capital.

Centbee

Centbee is a Johannesburg-based Bitcoin Satoshi’s Vision (BSV) wallet and merchant payment startup. The startup was founded in 2017 by co-CEOs Angus Brown (pictured above, left) and Lorien Gamaroff (pictured above, right).

Gamaroff is a leading expert in blockchain tech and cryptocurrencies, while Brown — the former CEO of eBucks.com — has 20 years’ experience in payments and banking.

In April, Centbee announced that it had raised £1-million from Ayra Ventures and CoinGeek founder Calvin Ayre (see this story).

The startup, which is said to support the original Bitcoin protocol in the form of Bitcoin SV (BSV), claims it has made it easy for customers to buy Bitcoin SV at over 50 000 till points in South Africa.

According to an article in crypto publication CoinGeek, Centbee has established relationships with retailers that include Picknpay Hypermarket, Shoprite, Checkers, Builders Warehouse, Dion Wired, Ackermans and Pep.

Gamaroff in April said Centbee will launch payment and remittance products this year.

Revix

Revix is a digital investment management platform which allows anyone anywhere in the world to create a diversified portfolio or “bundle” of the world’s top cryptocurrencies.

The startup’s proprietary technology plugs into global exchanges, while a smart pricing algorithm seeks out the best available pricing for investors on reputable exchanges.

Revix claims its platform gives investors exposure to over 80% of the cryptocurrency market through a portfolio or “bundle” of the top 10 cryptocurrencies. Investors on the platform can invest from as little as R500.

The startup was founded last year by Louis Buys (pictured above, left) and Sean Sanders (pictured above, right) and launched its crypto bundles in April.

In April, JSE-listed investment group Sabvest announced that it had acquired a 30% stake in the digital asset management platform (see this story). The deal is part of a R11-million investment deal between the startup and Sabvest (see this story).

Revix has said it plans to expand into the UK and Europe in the third quarter of this year as well as Australia and New Zealand in the first quarter of 2020.

Coindirect

Coindirect has developed an end-to-end crypto trading platform that allows users to buy and sell coins directly on its peer-to-peer marketplace.

The startup, which is registered in the Isle of Man and was founded in 2017 by South Africans Donald Jackson, Jesse Hemson-Struthers, Nicholas Haralambous, and Stephen Young.

The exchange claims it currently supports over 40 different cryptocurrencies, which the startup claims is the largest offering in Africa.

In addition, Coindirect also supports 15 different trading pairs. The startup’s platform also caters for data-sensitive users in markets where data costs are high and coverage can be limited.

In February, the startup announced that it had raised a €1-million investment round led by London-based investor Concentric with the participation of Blockchain.com and MakerDao (see this story). At the time, it claimed to have 40 000 users in South Africa.

The startup plans to expand to Nigeria, followed by Kenya, Ghana and other key African countries.

Ovex

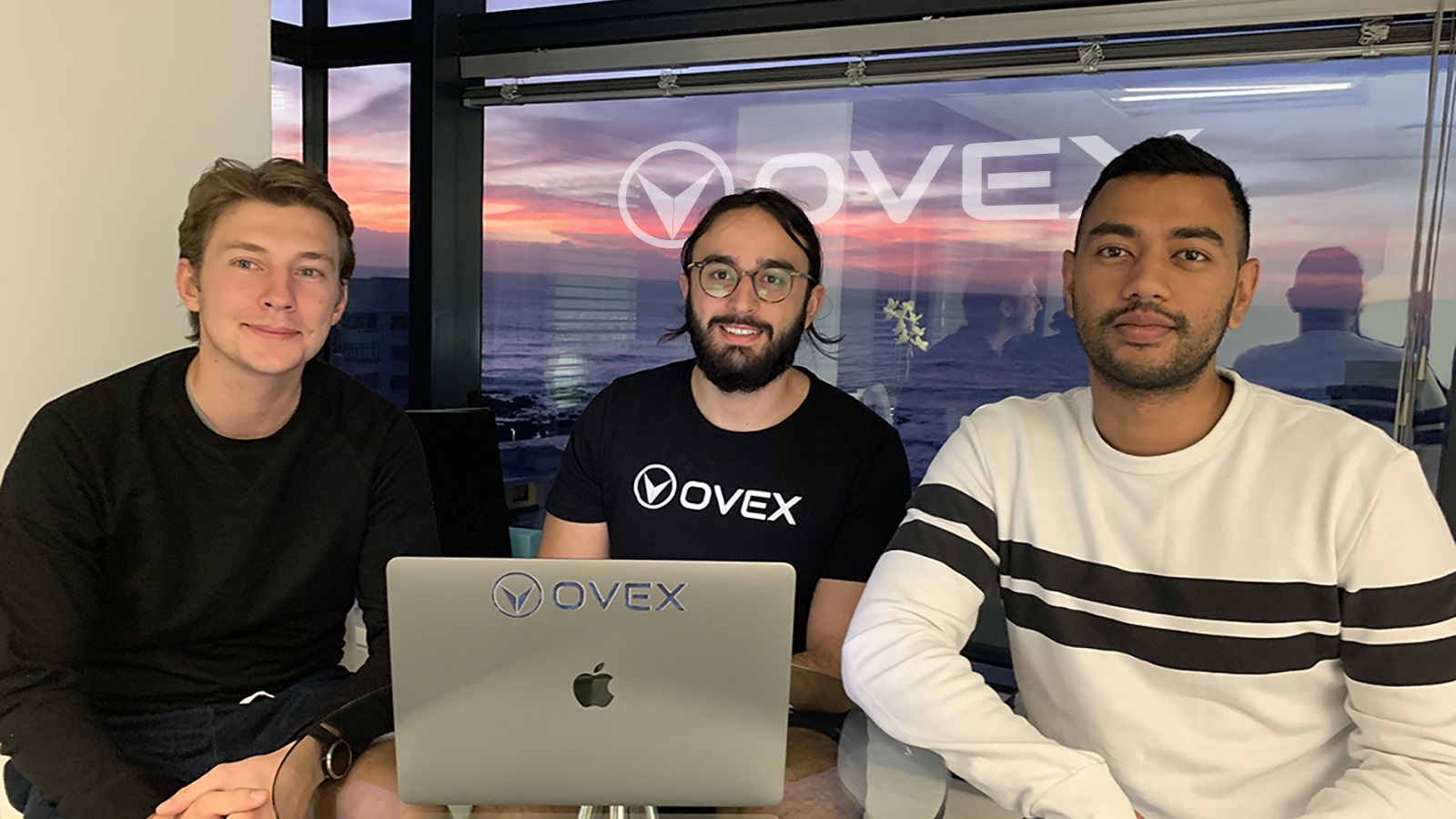

Ovex is a Cape Town based cryptocurrency exchange that was founded last year by CPO Tom Masojada, CEO and product architect Jonathan Ovadia and CTO Nikhar Ramchunder (pictured above, from left to right).

The startup launched its platform in March and claims it makes it easier for South Africans to buy and sell over 18 digital assets using their rands.

In April, Silicon Valley based SA entrepreneur Vinny Lingham — through his venture capital firm Newtown Partners — invested undisclosed an undisclosed in the startup (see this story).

In May, Ovex announced that it had secured a seed investment from Cayman Islands-based crypto asset management firm Invictus Capital. The deal, the startup said, was “less than R10-million” (see this story).

Ovex’s has signed partnerships with Lingham’s blockchain identity firm Civic , as well as with San Francisco based TrueUSD. Its deal with the latter allows Ovex users to purchase TUSD — a US dollar backed stable coin — at the bank rates and have it deposited directly into their Ovex account wallet.

This while the use of artificial intelligence along with the Civic partnership enables Ovex users looking to draw more than R20 000 to fulfil Know Your Client and Anti Money Laundering (KYC/AML) requirements in minutes compared to days as is typical on other platforms.

Read more: Everything you need to know about the South African cryptocurrency ecosystem

Read more: Michael Jordaan backed crypto trading platform VALR raises $1.5m seed round [Updated]

Read more: SA startup Centbee raises £1-million from Calvin Ayre in Series-A round

Read more: JSE-listed investment group Sabvest acquires 30% stake in crypto platform Revix [Updated]

Read more: SA crypto platform Revix to launch with JSE-listed firm R11m [Updated]

Read more: Crypto exchange platform Coindirect raises €1m in round led by Concentric

Read more: Vinny Lingham’s Newtown Partners invests in crypto exchange Ovex

Read more: SA crypto exchange Ovex deal with Invictus Capital ‘was less than R10m’

*Ventureburn editor Stephen Timm and writer Daniel Mpala both contributed to this piece.