South Africa’s esports scene is set for a major showdown as Hyprop and MTN introduce SHIFT COD, a Call of Duty tournament forming part…

What SA fintech disruption really looks like

We spend a lot of time thinking about the concept of “disruption” in personal finance. It’s more than just business, we want everyone to feel more financially secure and we believe that investing is the way to do this.

When we conceptualised OUTvest we wanted to encourage the entire investment industry to be more accountable to its promises, and it’s a disruption that we have yet to properly communicate. We call it OUTcomes based investment.

In the world of personal investments discussions tend to centre round how well a client is doing based purely on the growth of their investments including relative performance.

But when you do that, you also need to know that the start and end dates make a huge difference to any performance measurement.

Is the return time-weighted, or money weighted return? Is it net of fees? While this can be highly technical, there is actually little information that is of value to the customer.

What an investor really ought to focus on, is “How am I doing in relation to my original investment objective, after all fees”.

To achieve this, we believe, is the real disruption, and it requires one to reinvent the dialogue of an industry that tended to focus on telling clients all about the technical details and less about the outcomes. You have to make the client’s plan and outcome the most important part of your service.

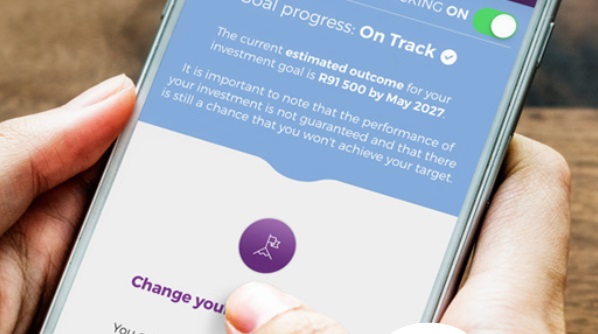

At OUTvest, we track the performance of every client against their unique investment objectives, even if they update their objectives. We use our state of the art tracking system, InvesTrac as one of the most important measures of our success.

Today we can report that 79% of all contracts, invested according to our recommendations, have achieved at least 95% of their objectives net of all fees. This includes inflation-plus growth estimates.

The other important way that you can improve OUTcomes, is to reduce and control fees. For those who are familiar with the relationship between asset managers and financial planners, the revenue model traditionally is based on charging the client a percentage of their total savings.

The more they save, the more the respective asset manager and financial planner earn in Rands, despite the fact that the workload or service level doesn’t really change materially.

As investors have become savvier they have begun to question fee models and tried to educate themselves on where the costs really lie.

Unfortunately, a lack of full transparency means that some investors still battle to find the true total cost of their investment which has a meaningful impact on their investment outcome.

The OUTvest ONEfee model charges a flat fee of 1.5% on all assets, capped at R4500 until your investment value reaches R2.25-million whereafter you only pay 0.2% per year. And there is nothing else to pay, that is the only fee that you pay on your investment with us… and we are genuinely changing the way that South Africans pay to invest.

After the launch of ONEfee and our Retirement Annuity (RA) in January 2020, we wrote more future business in a single month than almost all of 2019 combined. We received a number of Retirement Annuity (RA) transfer requests which included clients from well- established asset managers.

To us, this defines “disruption” – changing an industry business model at its core. For us, it has been particularly rewarding to see the way that some financial planners have responded to what we are doing.

These financial planners business models go beyond simply selling products, and they see the OUTvest offering as a starting point to help them build wealth for their smaller clients.

We are hoping that competitors will respond to this new innovation and focus more on investment outcomes. We welcome it and we are already planning to meet them on the new investment frontier: Helping clients meet their investment and savings goals.

*OUTvest is an authorised FSP

This article was written by Grant Locke, head of OUTvest and sponsored by AlphaCode, a Rand Merchant Investment Holdings initiative.

Featured image: Screenshot from OUTvest

Company Office is a subscription-based press office service.