We all have them. Those apps we open without thinking. Not because we need anything in particular, but because they feel… safe, in some…

African regulators are holding back growth of cryptocurrency on continent, finds report

While the rapid adoption of cryptocurrencies may be likely in Africa — given the continent’s high inflation rates, volatile currencies and underdeveloped banking — regulators are holding back its growth, a new report has found.

The State of Crypto: Africa report, released last week by SA founded cryptocurrency platform Luno in conjunction with Norwegian research organisation Arcane Research, reveals that the legality of Bitcoin and other crypto assets varies significantly across the region, with over 60% of African governments yet to clarify their position.

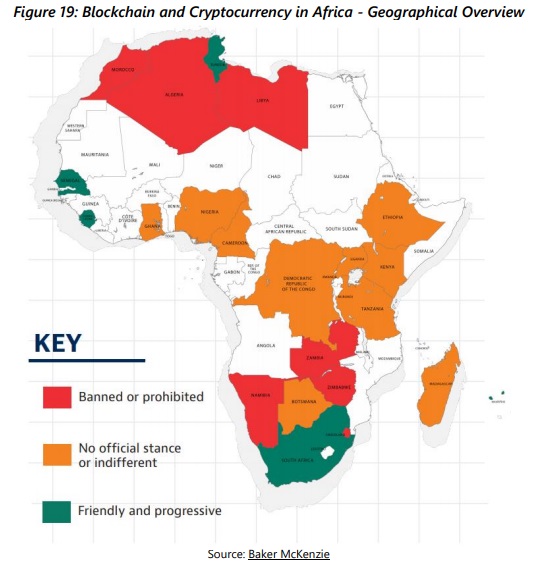

“While some nations maintain a positive stance, multiple counties have issued complete or partial bans. For whatever reason, North African countries have taken the most hostile position (see the below screengrab of a graphic from the report),” the report’s authors said.

The most common stance of African regulators towards cryptocurrrency is that of caution, a new report has found

Algeria, Libya, and Morocco have all issued bans against the use of cryptocurrencies, while Egypt’s religious legislator has passed a decree, prohibiting their usage.

The report’s authors said the most common position, however, is one of caution.

It said countries such as Kenya, Ghana, Lesotho, Swaziland, Uganda, Zambia, and Zimbabwe have advised discretion regarding cryptocurrency usage while not actively banning them.

Other countries such as Namibia and Burundi, while also not banning usage, have issued bans against trading, citing the lack of consumer protection as the motive.

“The opacity of cryptocurrencies has so far motivated the majority of decision making among governments. Regulators so far have focused their actions on the effect that cryptocurrencies can have on their citizenry. Volatility, lack of governance, and the proliferation of scams are the most commonly cited motivations,” said the report’s authors.

The report said the growing, young and mobile-native population on the continent is more likely to adopt a new financial system, and cryptocurrency has a particular role to play servicing the unbanked. But there are obstacles that must be overcome for cryptocurrencies to reach their full potential in Africa.

“While much of the focus elsewhere has been on investment, speculation and trading, the utility benefits of cryptocurrencies are more needed in Africa than other continents.

“Cryptocurrencies present solutions to many of the financial challenges in Africa. The current context is ideal for an alternative money system to take root,” said Marius Reitz, General Manager for Africa at Luno.

Featured image: MichaelWuensch via Pixabay