We all have them. Those apps we open without thinking. Not because we need anything in particular, but because they feel… safe, in some…

Questions for Uprise.Africa over alleged fake R25m Intergreatme crowdfunding pledge

It was touted as the biggest ever equity crowdfunding raise by an African startup — an African record. But questions are now being asked about crowdfunding platform Uprise.Africa and a R25-million fake pledge made to SA startup Intergreatme.

The Johannesburg based regtech company Intergreatme — founded in 2016 by James Lawson, Dewald Thiart and Luke Warner — has an identity management platform which provides users with control of their identities across financial services, telecommunications and insurance.

The controversy started in May last year, when Intergreatme announced that it had raised over R32.6-million in a campaign run on local equity crowdfunding platform Uprise.Africa. At the time Uprise.Africa CEO Tabassum Qadir (pictured above) called it “a record in equity crowdfunding in Africa”.

But this was as far from the truth as could be.

In December last year, after receiving a tip-off from an investor who had taken part in the campaign, Ventureburn reported that the startup had to give back over R25-million.

Uprise.Africa head Tabassum Qadir faces questions over an alleged R25m fake pledge during Intergreatme’s crowdfunding campaign last year

The investor forwarded Ventureburn an email that was sent by Uprise.Africa (not Intergreatme, as we previously reported) to investors on 30 September 2019. This email informed those that took part in the raise that the startup would only be accepting R6-million, because the source of the funds from five pledges “failed the platform’s compliance process”.

When contacted at the time for comment, Qadir declined to go on record to explain what exactly made the pledges suspect.

When asked whether he could confirm whether the over R25-million that was withdrawn, was linked to politically exposed individuals, Intergreatme’s Thiart said only that he “cannot confirm or deny that”.

Nokuthula Jessica Maaga and the R25m pledge

Ventureburn can now reveal that the R25-million consisted of five pledges made by a Gauteng woman, Nokuthula Jessica Maaga, who it is understood is now being investigated by First National Bank (FNB) and the Financial Intelligence Centre (FIC).

The truth of what transpired, however remains contested.

Qadir claims that the R25-million existed, but that the bank never cleared it because the source of income for the funds, could never be proven, as required by the FIC.

Thiart however, claims that Maaga led them all on by providing spoofed emails from her bank and fake proof of payment receipts, and that she never had the money in the first place.

Speaking to Ventureburn, Thiart said he had enough of rumours circulating and wanted to tell the story of what really happened.

Thiart took over from Warner as CEO in October last year. He said Warner had handed him the reigns because he is planning to pursue business interests in the UK.

The aim of the equity crowdfunding campaign was to raise R32-million from the crowd. Shortly after the startup launched the campaign on Uprise.Africa, and on 17 May 2019, Thiart and his co-founders met Maaga for the first time in Intergreatme’s offices.

Maaga allegedly claimed that she’d heard about the campaign via a friend or relative who was one of a few thousand people to receive an email from the startup announcing the upcoming campaign.

Thiart informed Ventureburn that the mailing list had come from members of the public who had signed and provided their email addresses in the visitor’s book for the building in which Intergreatme’s offices are situated.

Thiart further said that Maaga told him and his co-founders that she was a prominent local business person who was a silent investor in a number of businesses including a hospital in Centurion and a telecommunications firm. She also told them that she often visited Dubai.

Maaga had apparently then asked how much Intergreatme was looking to raise during the campaign and had then offered to make a pledge to cover the entire targeted amount for the campaign, namely R32-million.

After being told by the founders that this would not be possible and that each pledge was limited to a R5-million threshold, Maaga said she would make five pledges of R5-million each.

She proceeded to make an electronic transfer of funds (EFT) payment at the office, to Uprise.Africa’s Standard Bank bank account, while at Intergreatme’s offices. At the time Warner took a photo of the proof of payment receipt that reflected on her tablet.

Warner would later claim to Ventureburn that Maaga had used a “fake FNB app” when making the payment.

At midday on 21 May 2019, along with five family members (see above image, with Maaga pictured seated on the right, while Warner is second from the left, standing, with Thiart next to him) who she had brought along with her (see below image), Maaga arrived at the offices, to sign the five pledges of R5-million each.

On the same day Qadir updated Uprise.Africa’s website to ensure that the R25-million total reflected on the site, even though the amount had not yet arrived in the equity crowdfunding organisation’s bank account.

Maaga scheduled a dinner for 23 May 2019 with the startup’s founders, but cancelled this at the last moment. She also cancelled a further dinner invitation she’d made for 27 May 2019 (claiming a family member had been in a car accident).

By 24 May 2019, when the money had still not reflected in Uprise.Africa’s bank account, Maaga made a second payment of R25-million directly to Intergreatme’s FNB account, citing an act of good faith. Thiart says her reasoning at the time was that when the second amount reflected, it could be reversed to her account.

This would have meant that in total she would have paid over, R50-million. However, the second amount failed to show up in their bank account.

Thiart claims that during this time Intergreatme made enquiries to Qadir on whether the money had arrived in Uprise.Africa’s bank account, but was told that it had “not yet cleared”, which Thiart took to mean the money existed, but still needed to pass the necessary compliance checks.

On 31 May 2019, when neither payment had yet to clear, Warner visited the address that Maaga had placed on the pledge.

Maaga was not present at the address at the time, but was at her mother’s home in Parkhurst, Johannesburg instead. Warner then went there. When she welcomed him in, Maaga told him that everything was in order and forwarded him an email she claimed was from her personal banker at FNB, stating that the money still needed to clear.

The email, dated 31 May 2019 and sent by a “Richard Bartman”, stated that the funds would be released within the “current working day”.

“Please accept our apologies for the delayed authorisation. As a bank we had to ensure her funds are going into a well vetted entity and that she was the one making the transfer. This is standard protocol for Corporate and Wealth clients who travel a lot,” reads the email, containing the email signature of the “Richard Bart”.

The amount however never reflected. Ventureburn sent an email to Richard Bartman’s/Bart’s email address this week, but it bounced.

This, while Thiart claimed he, and in later months one of his board members, were unable to find any “Richard Bartman” who worked at FNB. Intergreatme’s CTO James Lawson meanwhile, claimed the email was spoofed.

Questions for Uprise.Africa

After Maaga cancelled a third dinner invitation on 3 June 2019 due to a “family emergency”, Intergreatme’s founders began to get suspicious that something was wrong and decided to begin proper investigations with Qadir.

Thiart says at this point Qadir told them not to report the incident to their board. Neither did she take steps to remove the R25-million amount that reflected on the site. He claims that her advice instead was that they keep quiet about it and rather find another investor to plug the gap.

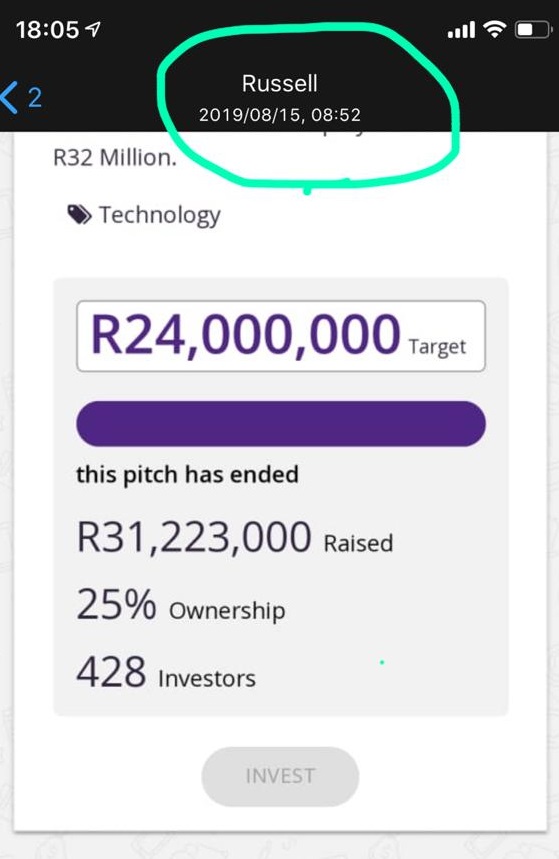

Thiart later forwarded to Ventureburn a screenshot of a message he had received on 15 August 2019 from the startup’s then legal advisor, Russell Warner (see above image).

The screenshot showed that as of 15 August 2019, Uprise.Africa’s website was still incorrectly reporting a total raise 0f R31.2-million and not, the about R6-million figure that the raise concluded with.

Thiart said at the time, he found it strange that Qadir would instruct them not to inform the board.

That wasn’t the only thing to irk Thiart. “We could never understand why Tabz (Qadir) never wanted to meet this person (Maaga),” he said.

He believes that Qadir had inferred that the R25-million actually existed, when she told them it still needed to be cleared. “Why did Tabz tell me that her personal banker told her the money was not cleared?” he asks.

He claims that at the time Uprise.Africa’s policy was only to update pledge amounts once the money for that particular pledge reflected in the organisation’s bank account.

However, he claims that Qadir broke her and the organisations’s own rules by adding the R25-million to the amount raised by the startup on Uprise.Africa’s webiste. Qadir, he claims, later told them she had only done so under pressure from Warner.

“The rules were very clear and also discussed in our discussions. You make a pledge, transfer the cash, the website gets updated then round closes and then only do you receive the shares,” Thiart pointed out.

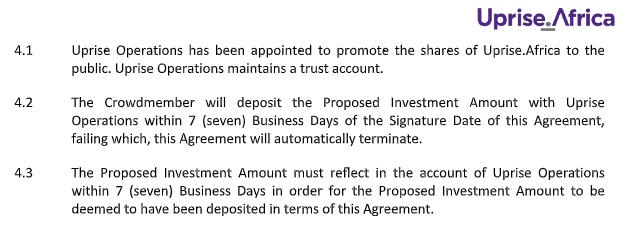

Ventureburn has seen a copy of the agreement Uprise.Africa presents to potential investors, of which term 4.2 of the agreement (see below) reads that: “The crowd member will deposit the proposed investment amount with Uprise Operations within 7 (seven) business days of the signature date of this agreement, failing which, this agreement will automatically terminate.”

Thiart alleges that after Intergreatme’s campaign, Qadir changed the policy to state that pledges didn’t need to reflect in the organisation’s bank account before the amounts were updated on the crowdfunding organisation’s website.

He alleges that Qadir attempted to solicit the services of Intergreatme’s lawyer Russell Warner. Thiart in describing such solicitation went so far as to use the word “hound”.

However, subsequent to the publication of this story, Thiart clarified that the startup’s former legal advisor had now confirmed to him that he never did any work for Uprise. Africa. “He went for an interview, but nothing materialised,” said Thiart.

Russell Warner also contacted Ventureburn subsequent to the publication of this story to confirm this. He added that “it’s not fair to say that Qadir ‘hounded’ me.” “Nothing came of the meeting and Uprise is accordingly not a client of mine, nor has it ever been,” he said.

Thiart said that when Intergreatme’s board became aware of the situation, they were furious. The board apparently ordered a press release and this information to be made public.

Thiart said they drafted a release in August 2019 and then passed it to Qadir. Thiart claims that she cut substantial parts of the release out, before sending it to investors on 30 September 2019.

‘She was just mentally unstable’

Thiart and his co-founders remain puzzled as to what exactly transpired. It is unclear what Maaga’s motive was, when on the surface she gained nothing financially from the fake pledges. This has led Thiart to believe that someone may have set her up to do it.

“We could not understand the motive for someone (Nokuthula) to fake this whole transaction as there was nothing in this for her. She pretended and faked POP and e-mails from FNB. To what gain?” questions Thiart.

He said when he asked Qadir what Maaga’s possible motive was, she had responded by telling him that “some people are just mentally unstable”.

Thiart said he and his co-founders had heard that Maaga had a mere R30 000 or R40 000 in her account.

Her name also cropped up in online searches.

In a 2013 Facebook post, a user posted in an estate agency group warning that under the pretence of being a buyer, she’d sent “fake proof of payment” receipts to her agency. Others commented on the post that they were “also looking for her”.

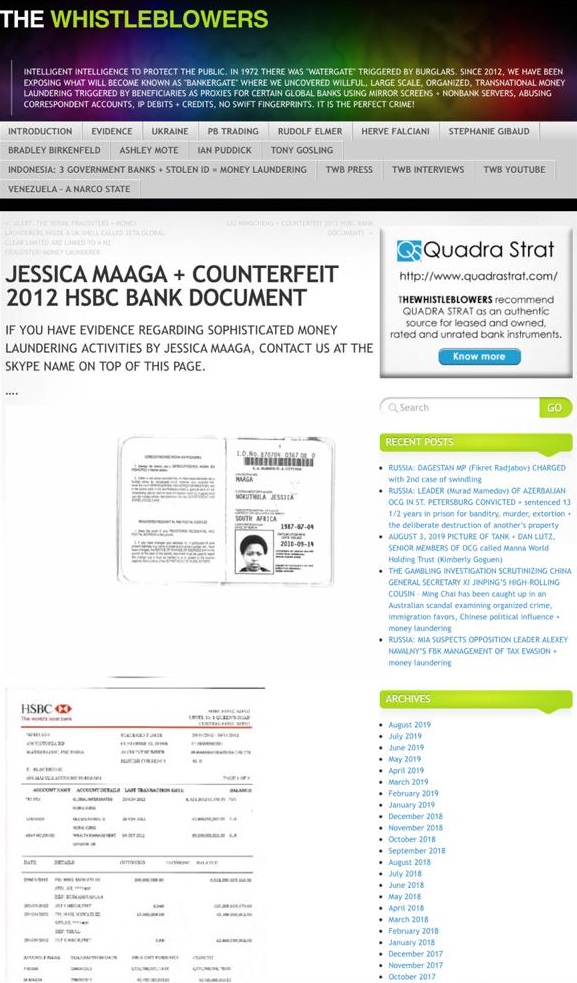

In addition, a now defunct website called The Whistleblowers listed her, along with a copy of her ID, as someone linked to a “counterfeit 2012 HSBC bank document” (see below screenshot).

Thiart said: “I am almost 100% assured that she does not own and have anything to do with any of the companies (she) listed. We tested some of what she said and it all turned out to be a lie.

“For example she claimed to own the Mercedes Benz garage in Sandton on Rivonia road. Not true. She claimed to know one of our shareholders very well, also not true. Wherever we scratched, we found lies.

“Even if she did own these companies, we agreed that we needed the full funding to allocate resources to these projects.

“Nothing could be done without funding, without her money. I would have been more than happy to do stuff for her for free or at cost if this all turned out okay,” he said.

One thing Thiart does recall is how Maaga and her family members always appeared excited and happy when meeting with them, but as soon as the camera flashed, their happy expressions gave way to emotionless faces.

“They laughed and cheered with us, but as soon as the camera came out they seemed annoyed and irritated,” he explained.

‘Trapped in excitement, then in fear’

Recalling how she had fooled them, Thiart says: “It was well rehearsed”.

“As founders we know we also made mistakes by not going to our board and the press sooner and not seeing the red flags, and reflecting on this now almost seems silly that we didn’t pick up on the fakeness of this all.

“We were trapped in the excitement and then in fear. Yes, we were taken for a big ride and we could have handled the situation much better. But so we learn and better ourselves. And believe me this was a very difficult time for us,” said Thiart.

He also referred to a rumour that the company had been buying its own shares. “None of us had that amount of cash to do this regardless as pledges had to be backed up with cash before they were updated on the Uprise website,” he said.

“I can confirm that some employees including myself did buy shares to be part of the campaign and test the process and also have exposure to Intergreatme shares.

He said in total, no more than R28 000 worth was bought by Intergreatme employees, which was done in their personal capacity and was not against the rules set-out by Uprise.Africa. “This amount is also insignificant based on the greater amount achieved,” he added.

Warner comments that he and his co-founders were told, that they would go to jail for “tipping off”. He further said: “so as AML regulations have it you have to wait for the suspicious person to complete the transaction. Then only have they committed a crime. So we reported to the FIC, FNB / RMB Fraud etc… ”

“It was a terrible time for us personally. Caused alot of tension with our board. Quite frankly, the first few weeks, we were just in total utter shock, it was hard to believe the magnitude of it. To this day, I still don’t understand the motive,” he added.

Thiart said what added to the stress of the situation was that the process to finalise the entire crowdfunding raise had taken months to conclude, with investors only getting their shareholder certificates some time earlier this year.

In the mean time he had to put up with friends ambushing him at braais to ask him whether he had “run off with their money” or not.

Having been unable to raise the full R32-million, Thiart and staff members, had to take salary cuts of 40% to 50%. The company also had to let go of seven of its 12 employees.

Thiart is clear when he said: “I’m gatvol of Uprise.Africa”.

‘Failed to meet compliance’

Qadir however argues that the R25-million payment did exist, but that her bank had flagged it, as it couldn’t find proof of income for the amount. She said the amount never reflected in Uprise.Africa’s bank account.

Commenting to Ventureburn Qadir claims that while she erred in failing to announce to the media at the time that the R25-million was not invested in Intergreatme, there was nothing untoward in the way she had acted around the payment.

She further claims that her bank phoned her and told her that Maaga would never meet Uprise.Africa’s compliance procedure. She added that she discovered that Maaga was involved in an HSBC matter, (perhaps referring here to the entry in 2012 on The Whistleblowers touched on above), without elaborating further.

“Luke called me from his office and told me he had a R25-million pledge and wanted to confirm it. The proof (of payment) was sent. The proof was sent by our compliance department. During this time he was sending photos of lunches, dinners. They wanted me to come to the dinner, lunches. But I said I can’t.”

When asked what made Maaga a “politically exposed individual”, Qadir explained that she was linked to Galela Telecommunications, but was vague on how this made Maaga politically exposed or in what way she was linked to the company.

When asked what the link was between Galela and Maaga, Warner said “apparently her and her family trust owned a majority stake in the firm”.

Thiart however claims the name “Galela Telecommunications” never came up in discussions they had with Qadir about the incident.

Ventureburn attempted to verify whether Maaga indeed worked at Galela Communications by contacting a number of professionals via LinkedIn who the social media site lists as working for Galela Telecomnunications. None of these people had responded by time of publication.

What is however known is that the company was one of six entities that in 2016 bid for a R1.5-billion government tender to roll out broadband to under serviced parts of the country. None of the bidders qualified.

Qadir said the subsequent meetings that she held with the Intergreatme co-founders were not secretive meetings, but rather “crisis meetings”. She added that she told the startup’s founders not to tell their board about the incident until they had gathered more proof of what had happened.

Thiart questioned why, if the first amount failed to meet compliance by Standard Bank, why FNB had never called the startup to tell them that the second amount had also not met its compliance checks.

Qadir promised to send proof from her bank to substantiate her claim that Maaga’s R25-million transaction was turned down because her income could not be proved.

However, later Qadir said she because Uprise.Africa is “strictly” governed by the FSCA and POPI regulations, “it is unable to disclose any more information”.

Qadir said she could only confirm that neither Uprise nor any of its officers or directors, had any pre-existing relationship with the investor that signed a pledge to invest the R25-million and that the investor was introduced to Uprise by Intergreatme, as the investor had approached the startup directly.

While Qadir had initially claimed that the funds did exist but had merely failed to pass the bank’s compliance checks, in her latest response, she changed her stance to allege that the funds may not even have been actually available.

“The investor, source of funds and whether in fact the funds were actually available, did not pass the strict compliance protocols. The investment thus never materialised,” she said.

Ventureburn also asked Qadir via email why two blog posts (see here and here) on Uprise.Africa’s website still reflected that R32-million was raised in the campaign, but she did not respond. Neither did she edit or remove the posts after Ventureburn alerted her to them.

Ventureburn also sought comment from Thundafund founder Patrick Schofield, who has a significant stake in Uprise.Africa. He referred all questions for comment to Qadir. On a second attempt by Ventureburn to facilitate any comments, Schofield summarily blocked Ventureburn on WhatsApp.

Finally, in an attempt to find out who Maaga is, Ventureburn dialled the cellphone number that Thiart provided for her. On the first attempt the call was answered, but then after two seconds went dead.

When Ventureburn tried a second time, a network message said “the number that you have dialled is currently busy”.

A search of Companies and Intellectual Property Commission (CIPC) records reveal that Maaga is listed as a director in several companies, most of which (with the exception of NJ Maaga Investment Ltd and Ivey Commerce Pty Ltd), are either in de-registration or have been de-registered.

De-registration occurs where companies fail to lodge annual returns to CIPC and pay required fees.

So, who then is Nokuthula Jessica Maaga and what was her real motive behind wanting to invest R25-million in a South African startup? The questions are far from answered.

Read more: Uprise.Africa remains compliant with the ACfA’s code [Right of Reply]

Read more: Uprise.Africa did not breach our code finds African Crowdfunding Association

Read more: Uprise.Africa to refund all investors in R4.2m Sun Exchange crowdfunding campaign

Read more: African Crowdfunding Association probing controversial Uprise.Africa

Read more: EXCLUSIVE: Intergreatme’s over R32m crowdfund – reduced to R6m after ‘suspect pledges’

Read more: Uprise.Africa mulling offers from four investors for R40m Reeva documentary campaign

Read more: Uprise.Africa launches R40m Reeva Steenkamp documentary crowdfunding campaign

Read more: How we raised R29m in seven days via crowdfunding – Intergreatme man [Q&A] [Updated]

Read more: SA’s Intergreatme sets Africa crowdfunding record with over R28m raised in just days

Read more: SA regtech Intergreatme out to raise R24m through crowdfunding site Uprise.Africa

Editor’s note (15 May 2020): This article was amended after Qadir and Uprise took issue with the word “hounded”.

Amendments were also made on 8 May and 11 May 2020 to this story, after subsequent to the publication of this story, Intergreatme CEO Dewald Thiart clarified that the startup’s former legal advisor Russell Warner had now confirmed to him that he never did any work for Uprise. Africa. “He went for an interview, but nothing materialised,” said Thiart.

Russell Warner also contacted Ventureburn subsequent to the publication of this story to confirm this. He added that “it’s not fair to say that Qadir ‘hounded’ me.” “Nothing came of the meeting and Uprise is accordingly not a client of mine, nor has it ever been,” he said. His comments have now been included in the story.

Featured image: Uprise.Africa CEO Tabassum Qadir (Facebook)