Artificial Intelligence (AI) is no longer just a buzzword. It is embedded in everyday work, from drafting emails to automating entire workflows. For Memeburn’s…

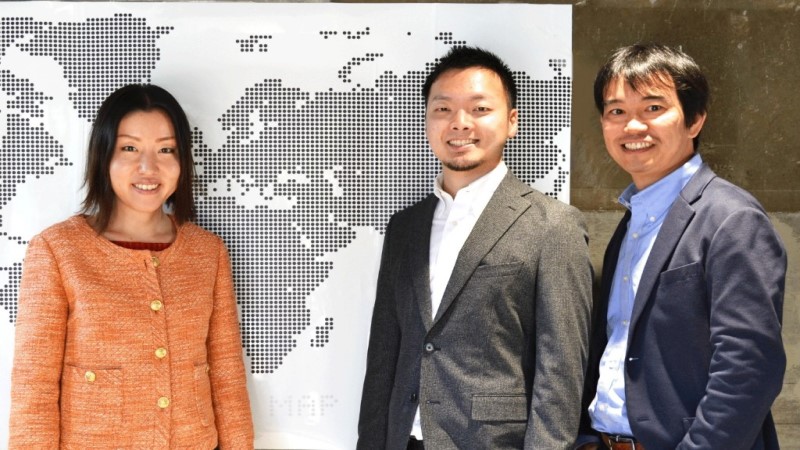

How Tokyo-based VC, Samurai Incubate Africa invests in African startups

This article is brought to you as part of a new partnership between two of Africa's foremost news and information platforms for African tech startups, Ventureburn and Techpoint Africa.

Samurai Incubate is a Japanese early-stage venture capital firm and incubator. Via its Samurai Incubate Fund, the firm claims to have invested in more than 100 startups since its inception in 2010.

In 2018, the VC firm decided to create an arm for its investments in Africa: Samurai Incubate Africa. By launching its first fund, the firm began investing in startups on the continent that same year.

The Japanese venture capital firm has invested in a number of African startups

Ugandan payments platform startup, Swipe2pay; Kenyan postal service, MPost; Nigerian fintech startup, Wallets Africa; and Rwandan fintech startup, Exuus were among the first African startups to get funded via the new fund.

In January 2020, Samurai Incubate Africa announced the launch of its $18.2-million second fund to consolidate the company’s efforts in Africa. And just last week, the firm announced its first investment from the Samurai Incubate Africa Fund II in Nigerian home service startup, Eden Life.

Asides Eden Life, Samurai Incubate Africa has invested in 20 other African startups since setting foot on these shores two years ago. For this reason, Techpoint Africa caught up with the managing partner of the Tokyo-based VC firm, Rena Yoneyama as she gives insights on how they invest.

What does VC investment mean to Samurai Incubate Africa?

Venture capital investment has an important role to strengthen a startup ecosystem. VCs can only invest in a company having a possibility to scale rapidly and exponentially and make big returns, for example, if you’re a seed-stage, at least 10 to 20 times within ten years.

Generally speaking, foreign investment flows in a market where there is a return and business makes a strong economy and attracts more investment. This cycle contributes to one aspect of economic growth. Without this perspective, a startup ecosystem in emerging markets wouldn’t grow properly.

Who founded or runs Samurai Incubate Africa?

The company was founded in May 2018 by the founder of Samurai Incubate Inc, Kentaro Sakakibara, who is also the CEO. The team consists of four members as of today.

How did Samurai Incubate Africa begin investing in African startups?

We’re always trying to be the first mover. In 2018, we realised the huge opportunities and potential of African startups and decided to participate in the ecosystem as the first Japanese VC.

Every VC has an eye or eyes in certain markets, kindly tell what market Samurai Incubate Africa is interested in and why?

We are particularly interested in Nigeria, Kenya, and South Africa because they are the countries with top startup ecosystems in the continent. Ghana is also an interesting market as well; there are very strong and tenacious founders there.

How do you determine that a startup is investible?

We invest in people. Sometimes we hear, “This business is something that no one else has come up with.” However, it is highly unlikely and usually, someone in another country has already come up with or launched it. Therefore, the ability to execute is of real importance.

We use criteria such as their ability to take that idea to the next level, build a team, make the product, generate revenue, and scale exponentially. Also, there are a lot of hard things happening regularly on a daily basis and therefore we see if they can persevere and tenaciously move forward without giving up in that situation.

In addition, we’d like to know what kind of problem and whose problem they are trying to solve, how they will solve it, and why they believe that it’s necessary to do so by themselves.

By Samurai Incubate Africa’s standards, what should a startup not be doing?

Premature scaling.

Many founders in Africa plan to expand into other countries from the beginning because a market in a country is generally not large enough. However, it’s too early to do so before reaching a product-market fit. Geographical expansion needs a lot of resources and every market is different.

Unless they find enough customers who use and pay for the product in the market where they have an advantage, they can’t grow their business even if they sell the same thing to different markets. It’s better not to make a product than sell it without confirming if there are customers who have needs.

At what stage of growth do you usually invest in startups and why?

We focus on the seed stage. We’ve been a seed-stage VC for the last 12 years in Japan, and therefore it is the stage which we have the strongest capabilities at.

What is Samurai Incubate Africa’s average ticket size?

Our ticket size is between $50,000 – $200,000. On average, $100,000. But we also invest between $200k to $500k in follow-up Series A rounds.

How does Samurai Incubate Africa deal with bad investments?

We don’t call any investments “bad” investments. Even if companies don’t scale or are shut down, they were established by hardworking founders possessing a strong will and passion. Nobody has the right to define an investment in such a company as a bad one.

What industries are of most interest to you?

We are especially interested in fintech and agritech, though we’re sector agnostic. As for our new fund, we cover insurtech, agritech, logistics and mobility, eCommerce, energy, and entertainment.

What investment opportunities have you regrettably passed on and why?

I try not to cite specific names, but there are a lot of great companies that we couldn’t reach out to. There has been a number of instances where founders could not find us an investor as we keep a ‘low profile’.

Which startups are currently in your portfolio? Would you like to disclose how much you invested in each of them?

In Africa, we have invested in Wallets Africa, Bamboo, Complete Farmer, Eden Life, LULA, SimbaPay, and MPost among others. We don’t disclose the amount of investment we make unless the startups decide to.

How can founders reach you?

Founders can send us an email at africa@s-inc.asia

The original version of this article appeared on Techpoint Africa on 15 July. See it here.

Featured image: The Samurai Incubate Africa team, (Supplied)