Artificial Intelligence (AI) is no longer just a buzzword. It is embedded in everyday work, from drafting emails to automating entire workflows. For Memeburn’s…

Standard Bank acquires 35% stake in fintech, TradeSafe

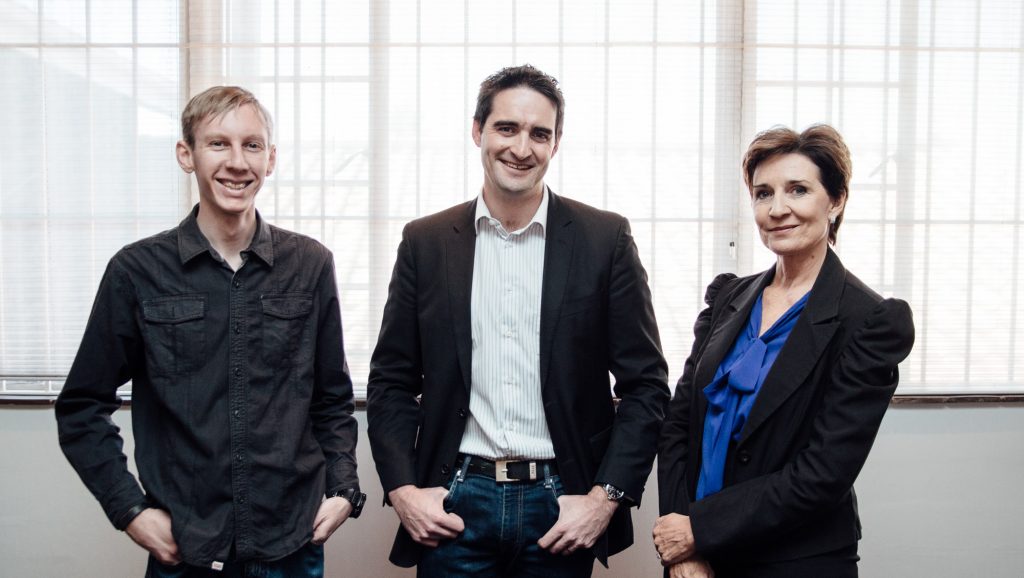

Standard Bank has acquired a 35% equity stake in digital escrow company TradeSafe Escrow.

The partnership will allow for TradeSafe to target commodity and M&A transactions which are greater than R25-million.

CEO of TradeSafe, Jethro O’Brien explains that the partnership with Standard Bank comes at a pivotal moment as the rates of scams, fraud, and more are continuously increasing in the country.

“Both TradeSafe and Standard Bank realised the necessity for a fast, secure, and affordable escrow solution in the wake of the increasing volume of scams, fraud, and unpaid invoice payments in South African commerce. Our fees come in at a fifth of what a reputable law firm or bank would charge in a transaction.”

As part of the investment, Standard Bank has appointed two non-executive directors to the TradeSafe board. Standard Bank also has management oversight of TradeSafe’s escrow account and is fully involved in the process for payment instructions that TradeSafe initiates.

With Standard Bank putting their money where their mouth is, they have introduced a second release payment function allowing TradeSafe to target commodity and M&A transactions which are greater than R25-million.

TradeSafe

Established in 2013, TradeSafe is one of the longest-running digital escrow company in South Africa.

TradeSafe is an online escrow platform that safeguards the buyer’s funds in a transaction involving two or more parties.

The funds are only released to the seller, and other approved beneficiaries once the buyer receives the goods or services in the agreed condition.

In addition, the fintech is the first digital escrow organisation in the world to offer API gateway services, which allows for online marketplaces and stores to offer escrow payments to customers.

CEO of TradeSafe, Jethro O’Brien, said, “Both TradeSafe and Standard Bank realised the necessity for a fast, secure, and affordable escrow solution in the wake of the increasing volume of scams, fraud and unpaid invoice payments in South African commerce. Our fees come in at a fifth of what a reputable law firm or bank would charge in a transaction.”

As part of the investment, Standard Bank has appointed two non-executive directors to the TradeSafe board. Standard Bank also has management oversight of TradeSafe’s escrow account and is fully involved in the process for payment instructions that TradeSafe initiates. “The bank will provide a second release payment function,” O’Brien added. “This means that with our increased governance, security, and credibility, TradeSafe will now be able to target commodity and M&A transactions greater than R25 million.”

TradeSafe has recently renovated its platform and its new website. Its API offering also incorporates new payment gateways such as SnapScan and Ozow.

“We also employed Standard Bank’s proprietary host-to-host technology which allows for automated payments,” added O’Brien.

Kuben Chetty, Head of Client Solutions at Standard Bank, expressed that there is a strong need for a digital escrow solution within South Africa given the rise of digital transactions and especially as buyers and sellers seek ways to mitigate transaction fraud.

“Standard Bank is very excited with its investment in TradeSafe Escrow and this provides both parties the opportunity to explore ways to leverage each other’s capabilities to help their clients transact securely.”

Read more: Local healthtech startup receives investment funding

Read more: SA-owned LightWare receives $1.5-million investment