AI chat is no longer just about faster answers or conversational tone. Search.com, a division of Public Good, has launched a generative AI search…

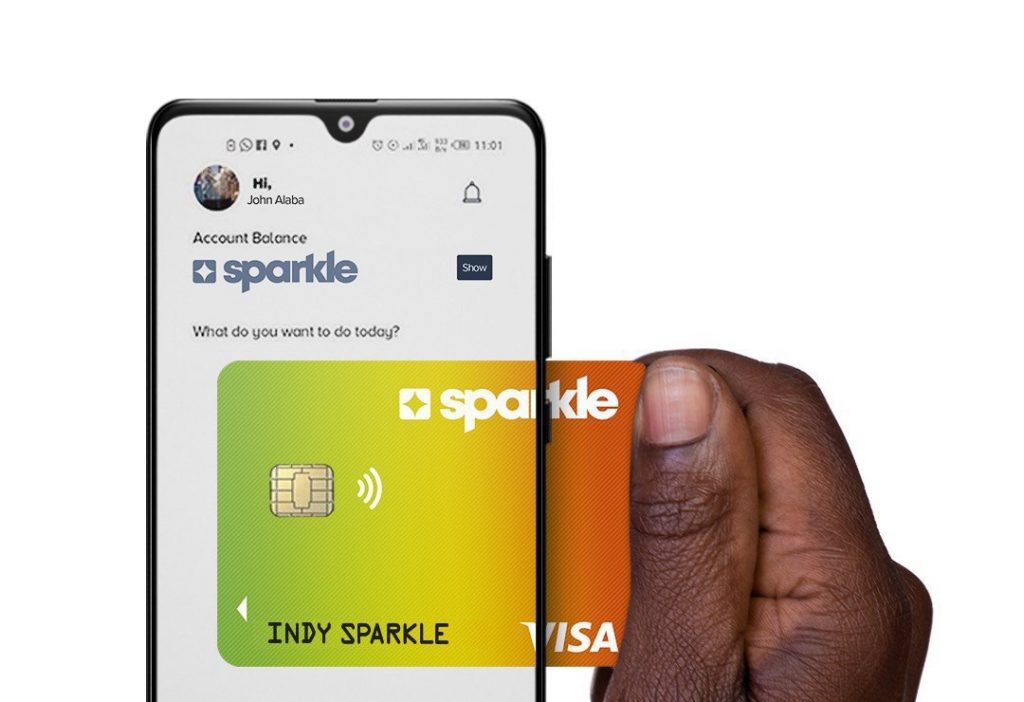

Nigerian fintech startup partners with Visa to empower SME’s

Digital banking startup, Sparkle has announced a new collaboration with Visa that aims to benefit consumers, entrepreneurs, and SMEs across Nigeria through the expansion of payment methods

The new partnership will promote consumers to support local SMEs through the easy-to-use digital payment system

The partnership will enable Sparkle to provide issuance of Visa cards to its users, benefiting consumers, entrepreneurs, and SMEs across Nigeria.

Uzoma Dozie, founder and chief of Sparkle explains that the new partnership is a major milestone not only for the startup but for the Nigerian eCommerce industry and local SMEs.

“Our partnership with Visa will bring a wide range of benefits to Sparkle’s customers, individuals, entrepreneurs, and SMEs. We are excited to work with Visa as we strive to re-define e-commerce by removing barriers to business using technology and data. Working with a global partner like Visa allows us to deliver a bespoke and personalized service for our customers by tapping into large networks so they can fulfil their full potential.”

Sparkle claims that the new partnership will allow its customers greater freedom and flexibility in how they make payments. This means that Sparkle customers will be able to make in-app payments with an embedded Visa virtual card.

In addition, Sparkle customers will also be able to make either eCom or mCom payments using their Visa virtual card with Visa-branded companion plastic cards attached to their Sparkle profile.

The partnership also means that Sparkle customers will benefit from a range of other digital payments initiatives from Visa, for example, by scanning the interoperable EMVCo Quick Response (QR) code or just entering an Alias such as phone number or merchant till number to pay for goods at merchant outlets.

Sparkle customers can receive cross-border remittances from family and friends who are Visa cardholders into their Sparkle Account.

Founded in 2020, Sparkle has grown into a digital ecosystem providing financial, lifestyle, and business support services to Nigerians across the globe.

Established by entrepreneur, tech pioneer, and financial inclusion advocate, Uzoma Dozie, Sparkle aims to help Nigerians fufil their financial and lifestyle needs.

The partnership with Visa also highlights Sparkle’s commitment to enabling best-in-class global solutions for its digital-only proposition.

Read more: Nigerian healthtech startup to create prestigious genomics facility in Nigeria

Read more: Local enterprise programme applications open

Featured image: Sparkle, supplied