We all have them. Those apps we open without thinking. Not because we need anything in particular, but because they feel… safe, in some…

Data marketplace tech startup secures early-stage funding

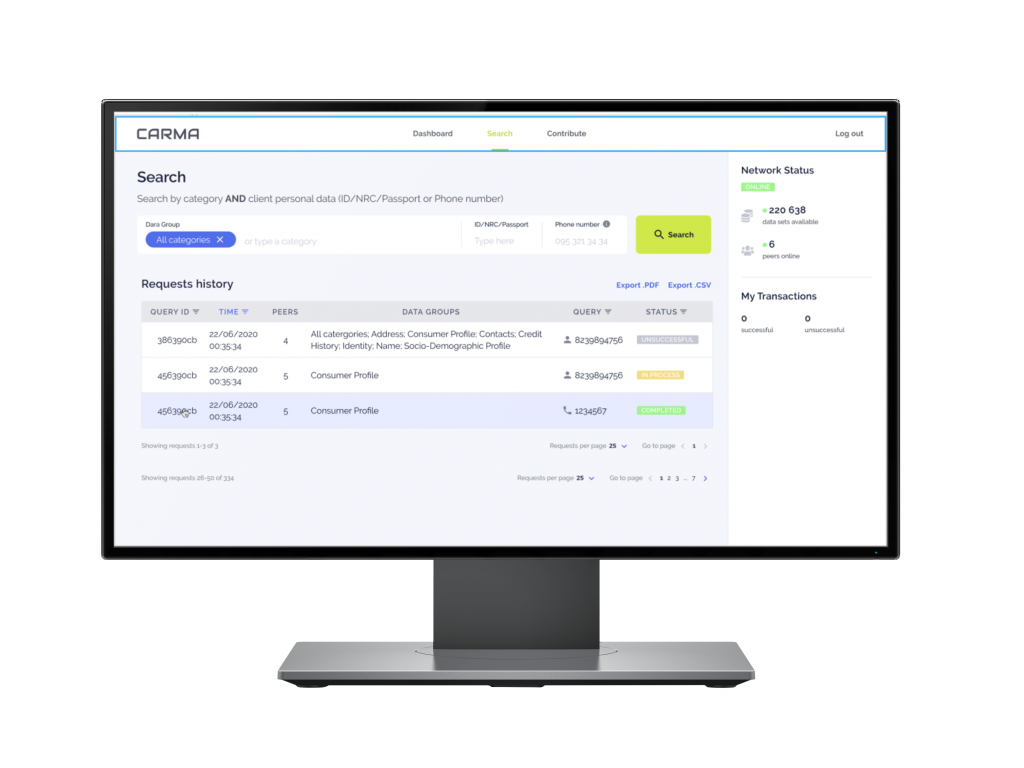

CARMA, a data marketplace tech startup that aims to fill the gap in the credit reference and lending space where credit history and other traditional data sources are limited, has secured an undisclosed amount of early-stage venture capital from Mictotraction.

The secured funding will be used to expand its operations across sub-Saharan Africa and launch its headquarters in Lagos, Nigeria

Ted Martynov, CARMA’s co-founder, and CEO explains that the secured funding will allow the tech startup to expand its overall offering.

“Our early-stage venture funding allows us to invest in growing our presence across sub-Saharan Africa and our ability to address the gap in the credit data ecosystem while strengthening our network of clients. We are also focusing on supporting companies with quality data in the credit decision process to avoid non-performing loans. We anticipate strengthening our services across the region, which will bring us closer to helping companies enhance data sharing to build proper credit assessment procedures.”

Bridging gaps with CARMA

Founded in 2020, CARMA’s innovative technology provides unmatched service to unbanked individuals. With the inclusion of digital banking and the growth of fintech’s across Africa, CARMA has created a platform and service that allows lending organisations access a credit assessment of potential lenders, even those who are unbanked and underserved.

This, in turn, allows individuals to access loans more efficiently in many cases where credit bureaus fall short of records for the unbanked. Lending organisations are provided real-time data on applicants and is an effective credit referencing service

By aiming to fill the gap in African countries where credit history is not available, CARMA will as a result provide support to the fintech industry with access to customer data where data sources are limited.

This service of providing extra data points and credit assessments will assist lending and non-lending organisations to monetize their data to create a “passive revenue stream.”

With headquarters planned to launch in Nigeria, CARMA will provide lenders in the West African country with real-time credit information on potential lenders and data contributors. This will provide a much-needed service to Nigeria as a report by the World Bank private credit bureau coverage 2019, indicated that only 14% of adults in Nigeria have a credit history from a credit bureau.

Microtraction is a Venture Capital firm that invests in Africa’s most remarkable teams at the earliest stage of their venture.

Chidinma Iwueke, Partner at Microtraction comments on their most recent investment into the data marketplace tech startup.

“We are excited to be CARMA’s partner as part of their Africa rollout. Microtraction supports several great tech teams across the continent and we are acutely aware of the gap in access to credit data, which we believe is a fundamental one to fill. Providing a solution that addresses this lack of data improves the quality of business processes and also helps the mass populous with access to financing, which of course, is very critical during these times as the world continues to fight a health and economic crisis. We look forward to working with CARMA as we continue to support teams working to address infrastructural challenges across Africa.”

Read more: Egypt’s Brantu secures seven-figure funding

Read more: Local agritech startup secures $1.5-million in funding

Featured image: Ted Martynov, CARMA’s co-founder, and CEO (Supplied)