We all have them. Those apps we open without thinking. Not because we need anything in particular, but because they feel… safe, in some…

Sefa approved R1.4-billion worth of loans

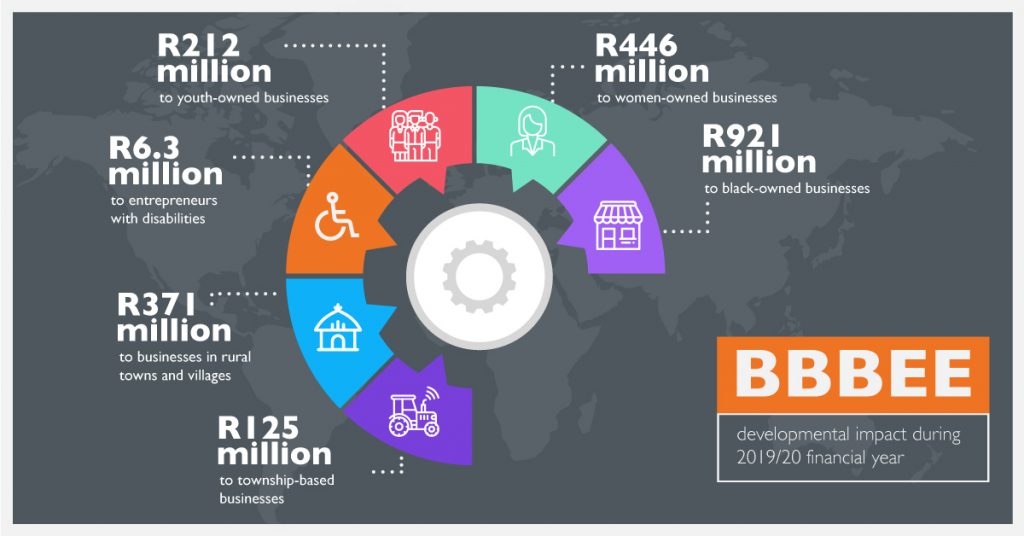

South Africa’s Small Enterprise Finance Agency (sefa) has announced that it approved R1.4-billion in loans for the financial year of 2019/2020 and reportedly assisted over 74 000 small businesses.

Sefa’s annual report for 2019/2020 has further indicated that loan book activity has seen a 99% increase since the previous financial year, which was reported at R703-million.

sefa approved R1.4-billion in loans for 2019/2020 financial year

In addition, the report showcases the agency’s dedication to strong corporate governance with an unbroken clean audit record.

Mxolisi Matshamba, CEO of Sefa relays the agency’s commitment to adhering to auditing standards.

“We have had unqualified clean audit opinions since sefa’s inception in 2012.”

Sefa

Sefa offers affordable and accessible financial products and services to SMMEs in a range of sectors including services, manufacturing, agriculture, construction, and green industries in South Africa.

The main objectives of the agency are to facilitate economic growth, alleviate poverty, and stimulate job creation through loan and credit facilities on offer for qualifying SMMEs.

Matshamba explains that sefa has developed its offering throughout the financial year of 2019/2020.

“In addition to giving a financial lifeline to thousands of small businesses across this country, we are also introducing creative new ways to extend finance. For instance, over this past financial year, sefa introduced new products like the Blended Finance programme and Small Business Innovation Fund (SBIF).”

The Blended Finance programme offers both a grant and a loan to small businesses whereas the SBIF focuses on supporting startups.

Future funding plans

The agency has announced that it plans to roll out more than a billion rand in assistance programme and initiatives to aid small businesses recover from the financial impact of the pandemic.

Khumbudzo Ntshavheni, Small Business Development Minister provides insight into the future planned initiatives in the foreword to the annual report.

“To stimulate economic recovery as a result of the Covid-19 pandemic for the SMME sector, the department, through sefa, will introduce various SME [small and medium enterprise] – and informal and micro-enterprise – programmes to the value of R1.23-billion for economic recovery and R776-million for Covid-19 response. These programmes will comprise debt relief, credit guarantees and other instruments that address the different funding constraints,”

Various reports have indicated that one of the keys to economic recovery in South Africa is the growth and revival of local SMMEs in spurring job creation and economic growth.

Read more: Sefa’s Small Business and Innovation Fund to finance 100,000 startups, SMEs [Updated]

Featured image: Minister of Small Business Development Khumbudzo Ntshavheni (GovernmentZA via Flickr)