We all have them. Those apps we open without thinking. Not because we need anything in particular, but because they feel… safe, in some…

Report reveals MENA tech startups raised $1-billion in 2020

A report conducted by MAGNiTT, the largest venture data platform that tracks startup investments in emerging markets has indicated that startups in the MENA region have raised just over $1-billion in investment funding despite the economic impacts of the pandemic and a drop in investment deals.

MENA startups raised over $1-billion in 2020

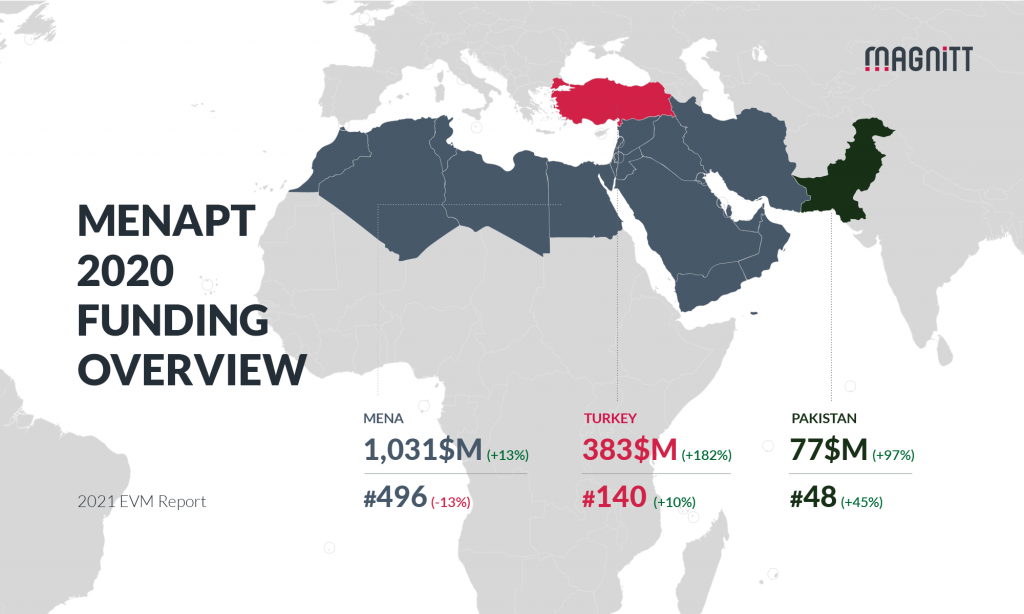

Titled the 2021 Emerging Venture Markets Report , this is the first time that the report analyses and compares has expanded its coverage of tech startups beyond the MENA region and included enterprises in Pakistan and Turkey.

Philip Bahoshy, MAGNiTT’s CEO attributes the success of tech startups to a demand for innovation to tackle challenges faced in 2020.

“2020 was a rollercoaster year that highlighted the importance of leveraging data to make opportunities visible across borders. COVID-19 rapidly accelerated the adoption of technology across emerging markets, creating larger markets and more opportunities to scale. By tracking and analyzing startup investments in 19 countries and counting, we have been able to provide real-time intel to governments, founders, and investors to support them in making informed decisions and policies.”

The report

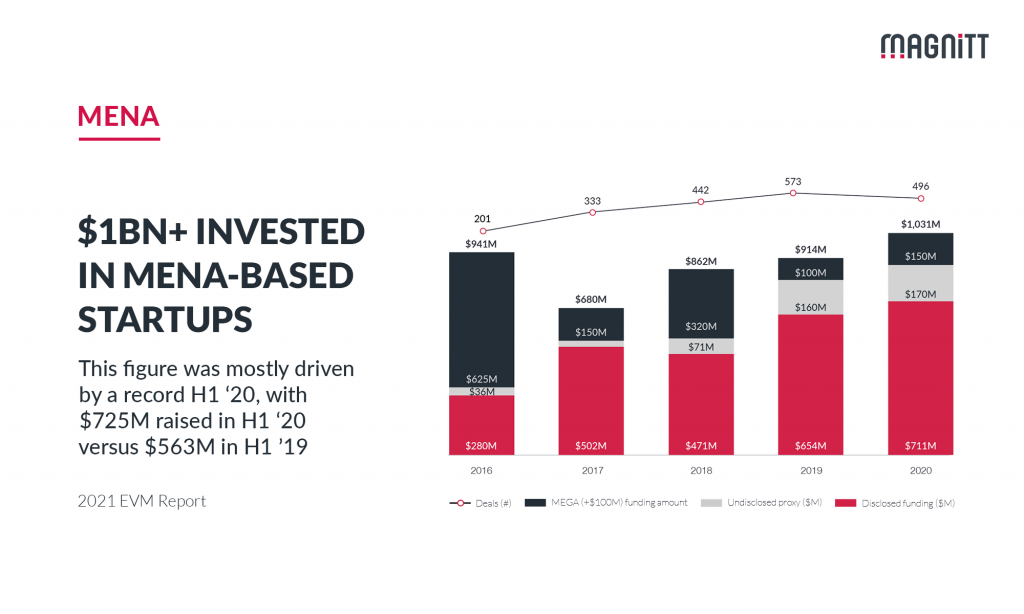

The report indicates that although there was a ‘record’ increase of just over $1-billion invested in tech startups based in the MENA region, the capital was distributed across a few deals in 2020. The total number of transactions decreased by 13% with 496 deals recorded.

“The full-year’s data illustrates that the $1BN figure was mostly driven by a record H1 2020, with $725M raised in H1 2020 versus $563M in H1 2019 (+29% increase YoY),” MAGNiTT explains in a press statement.

The three main countries which held the top spot for investment as indicated by the report were the UAE, Egypt, and Saudi Arabia.

Impacts of Covid-19

Last year, the investment landscape was shifted due to the impacts of Covid-19. MAGNiTT’s report found that in the second half of 2020, investment deals decreased by 35% with 198 reported.

In addition, early-stage ventures and pre-seed investments decreased as the report found that investors and venture capital firms focused more on Seed and Series A investments, recorded between $100K to $3-million. In comparison, 2019’s report showcased that all deals were less than $100K.

A number of industries grew in demand in 2020 as indicated by the report, these include:

- eCommerce

- Fintech

- Healthcare

“….E-Commerce & FinTech, retained top spots by the number of deals, with the two sectors together representing 24% of all deals in 2020. Similarly, the amount invested in Healthcare startups more than tripled, increasing by +280% to $72-million.”

The future for startups

With the pandemic still plaguing the world as we kick off 2021, global investors are optimistic that startups will be further pushed to innovate and create products and solutions to pressing global challenges.

Courtney Powell, Chief Operating Officer at 500 Startups, expresses that the investment landscape for 2021 looks promising.

“2021 will be the tipping point for entrepreneurship in MENA. It’s the culmination of years of work throughout the ecosystem by key stakeholders, most especially the Founders. Deal flow is healthy and getting stronger every day, there’s more capital available than ever, and there’s an intense hunger to see the region diversify away from historical GDP drivers and become a leading knowledge economy.”

The full report can be downloaded here.

Read more: Cape Town tech startup creates ‘Airbnb’ for film locations

Read more: Ghana fintech startup secures $700k investment

Featured image: heylagostechie via Unsplash