South Africa’s esports scene is set for a major showdown as Hyprop and MTN introduce SHIFT COD, a Call of Duty tournament forming part…

ImaliPay brings fintech options to South African gig workers

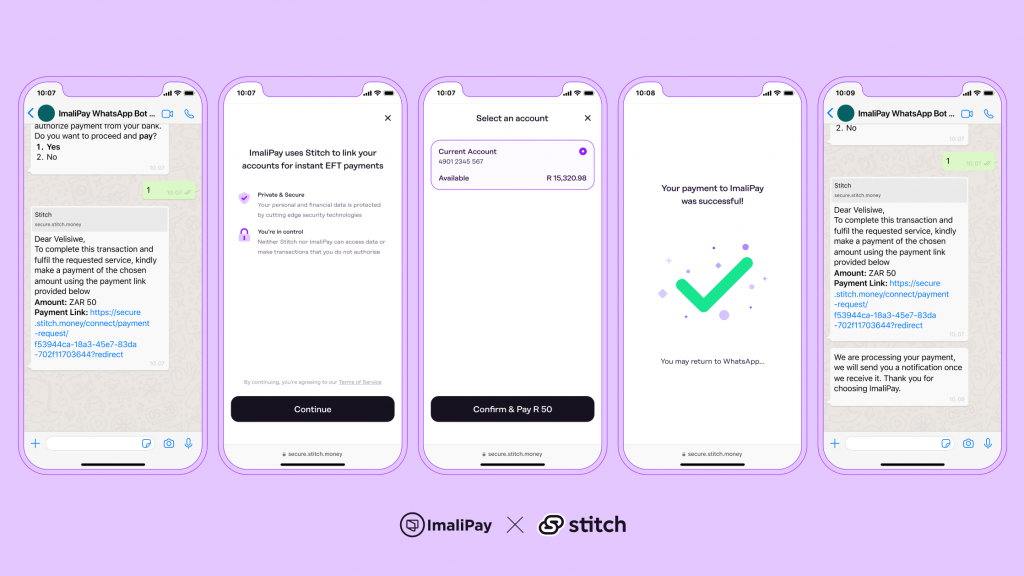

Fintech platform ImaliPay has announced its expansion into South Africa. This move leverages a partnership with Stitch to rely on its payment and open banking infrastructure. ImaliPay enters the country with vendor partnerships already in place to facilitate buy-now-pay-later services.

Through ImaliPay gig workers can buy petrol, airtime other tools through a WhatsApp chatbot

Since launching in 2020, ImaliPay has powered over 400 000 litres of fuel, and enabled a total of 30 million trips on ride-sharing platforms in Kenya and Nigeria. They’ve also enabled gig workers to generate savings and access affordable insurance.

ImaliPay provides gig economy workers with access to tailored digital financial services via a one stop shop, including savings, insurance and a buy-now-pay-later marketplace through which workers can affordably access essential tools needed to perform their jobs and earn more revenue.

With ImaliPay, customers can purchase key working capital inputs like fuel, smartphones and airtime, when they need them, to increase their productivity.

“In South Africa alone, there are over four million gig workers,” said Group Partnerships Manager at ImaliPay, Alexandria Akena. “We want to be able to drive more inclusive financial participation for all of them. We are entering South Africa with a robust ecosystem of marketplace vendors that will serve our customers nationwide.”

Kiaan Pillay, co-founder and CEO of Stitch, said, “We’re super excited to be working with the ImaliPay team as they launch in South Africa, and to help them get more money into the hands of the significant gig worker population in this market. Seeing innovative fintech companies like ImaliPay expand to new markets in the matter of weeks and provide compelling products is one of the main reasons we started Stitch.”

Featured image supplied by ImaliPay