South Africa’s esports scene is set for a major showdown as Hyprop and MTN introduce SHIFT COD, a Call of Duty tournament forming part…

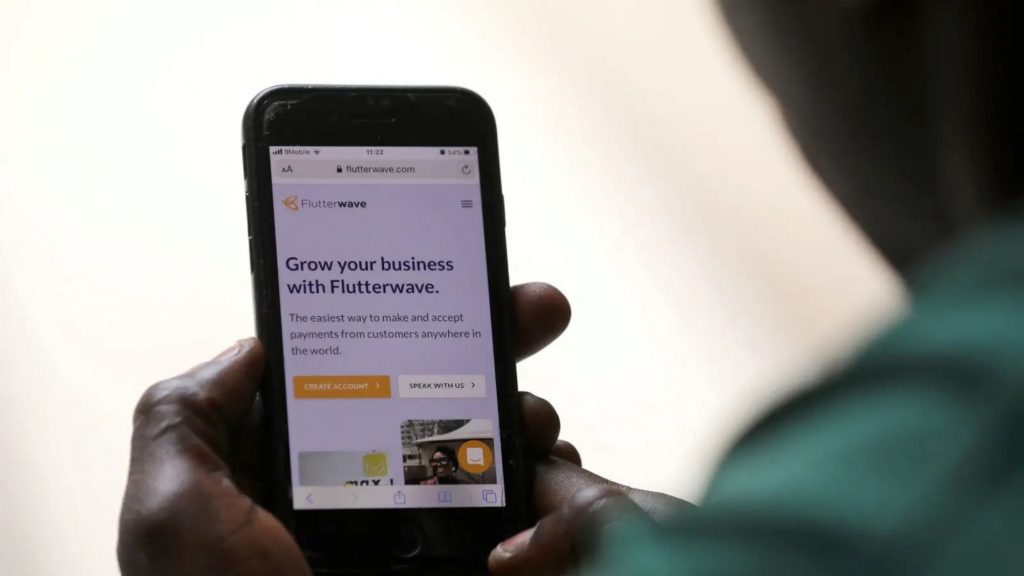

Flutterwave accounts frozen in Kenya amid court probe

A court in Kenya has frozen more than $40 million in accounts belonging to an Africa-focused payments giant, Flutterwave, under the country’s anti-money laundering laws. Earlier this year, Flutterwave raised $250 million, valuing the start-up at more than $3 billion.

Reuters reports that founded in 2016 in Nigeria, the San Francisco-headquartered firm, specialises in individual and consumer transfers, one of several fintech firms facilitating and capitalising on Africa’s booming payments market.

Earlier this year, the firm raised $250 million, valuing the startup at more than $3 billion.

Kenya’s Assets Recovery Agency sought and was granted a High Court order to freeze several accounts with three banks belonging to Kenyan-registered Flutterwave Payment Technology Ltd.

Implications of Flutterwave ban

Flutterwave confirmed it owned the company. It said in a separate statement that claims of financial impropriety in Kenya were “entirely false”.

The court order, which is dated 1 July, stops the start-up from any transactions from more than a dozen accounts with three banks, which held $43 million in dollars, sterling, euro and Kenyan shillings.

“These orders shall subsist for a period of 90 days as provided in section 84 of Proceeds of Crime and Anti-Money Laundering Act,” judge Esther Maina said in a ruling pending a full hearing and final order at a later date.

Flutterwave said its operations were regularly audited and it continuously engaged regulatory agencies to stay compliant.

ALSO READ: ‘One-click API’ Stitch now makes it easier to move money