In a pioneering effort to tackle South Africa’s growing digital divide, WeThinkCode_ and South Cape TVET College have partnered to roll out an 18-month…

‘One-click API’ Stitch now makes it easier to move money

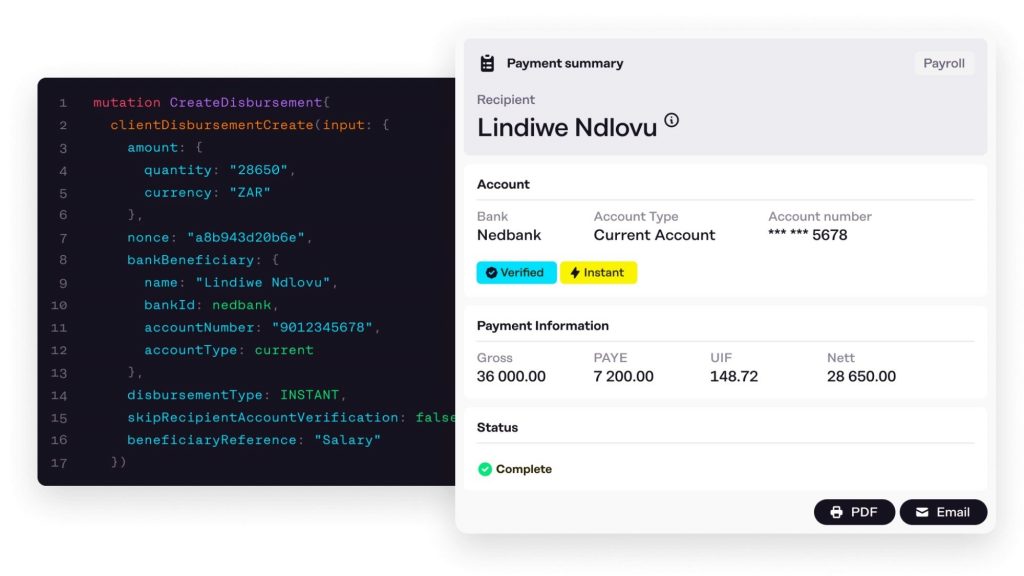

Payments and data API fintech start-up Stitch has unveiled its latest solution, Stitch Payouts, set to make it easier and faster for businesses to move money. Businesses can now initiate custom flows of funds and easily send money to vendors, suppliers, customers, employees and more – all over API.

Payouts can be combined with Stitch LinkPay, launched in April this year, to also enable seamless one-click pay-ins directly from users’ verified financial accounts, confirms Stitch chief product officer Junaid Dadan.

He says the payouts process can often be manual, complex, and tedious for businesses in South Africa, who often need to work across multiple bank integrations and payments providers to manage payouts on a monthly basis. Also, reconciliation is often manual.

The start-up therefore enables businesses to automate this process via a single API, saving them valuable time and costs while helping them manage float, track payouts in progress and verify recipient accounts.

“With Stitch Payouts, businesses no longer need to manage manual bank payments or deal with multiple bank and PSP dashboards. They can create custom flows of funds to move their money however they need to, directly from their application or payments operations software,” explains Dadan.

He adds that virtually any business that needs to send frequent payments to customers, vendors, employees and more can benefit from the new solution. This includes:

- fintech apps and crypto platforms which can enable users to link their primary financial account (such as a bank account) to withdraw funds whenever they need.

- marketplaces and platforms, such as ride-hailing services, who can now enable suppliers to easily cash out.

- e-commerce businesses who can enable instant refunds and same-day settlement for merchants.

- insurers who can easily disburse funds to verified accounts and speed up the claims payment process.

- and HR teams who can easily automate payroll.

Integrating Stitch Payouts

Payouts can be used for efunds, withdrawals, and disbursements.

Furthermore, businesses can choose between same-day settlement or instant settlement, and:

- initiate payments in real-time over API: These can be sent to any domestic account in South Africa on a per-transaction basis or in bulk. Payments can be tracked with status checks via webhook or query

- let Stitch manage float: Businesses can transfer funds to Stitch as float. They will monitor and track the balance against payout requests, notify businesses and queue pending payments when float balance is running low, so they won’t need to initiate payout requests again.

- reduce fraud and guarantee payments: Stitch will guarantee payouts are settled into customers’ verified accounts on their behalf, mitigating failed payments and fraud.

Businesses interested in integrating Stitch Payouts can access test credentials and get started in minutes via the Stitch self-serve platform.

The South Africa-founded Stitch emerged from stealth in February 2021 and expanded into Nigeria in October 2021. The firm raised $21 million in Series A funding in February 2022.

Backers include PayPal Ventures, TrueLayer, firstminute capital, The Raba Partnership, CRE Venture Capital, Village Global, Zinal Growth (the investment vehicle of Checkout.com founder Guillaume Pousaz) and angels, including founders and early builders from Chipper Cash, Monzo, Venmo, GoCardless, Plaid, Unit and more.

Stitch has offices in Cape Town, Johannesburg, and Lagos.

ALSO READ: African fintech start-up Yellow raises $20m in debt financing