We all have them. Those apps we open without thinking. Not because we need anything in particular, but because they feel… safe, in some…

Xapo boom: Wealthy SAns turn to USD and Bitcoin

Amid a sharp increase in financial emigration, many affluent South Africans are now looking to move their money offshore to safeguard their wealth, especially now that the Pension Fund Act has bumped up the limits of offshore exposure across total portfolios to 45%.

This, according to experts, offers instant diversification to lower currency risk and taps into markets that are outperforming the volatile Rand. However, seeking out foreign bank accounts in the likes of Switzerland, Malta and Portugal require either dual residency or a level of wealth that makes them attainable to nothing other than high net worth individuals.

Xapo Private Bank chief executive Seamus Rocca describes the US dollar as the meta currency of the world, backed by this country’s powerhouse economy. He says, “The USD remains the safest option in terms of long-term value protection. It is a key lever for long-term wealth and there is never a bad time to invest in USD.”

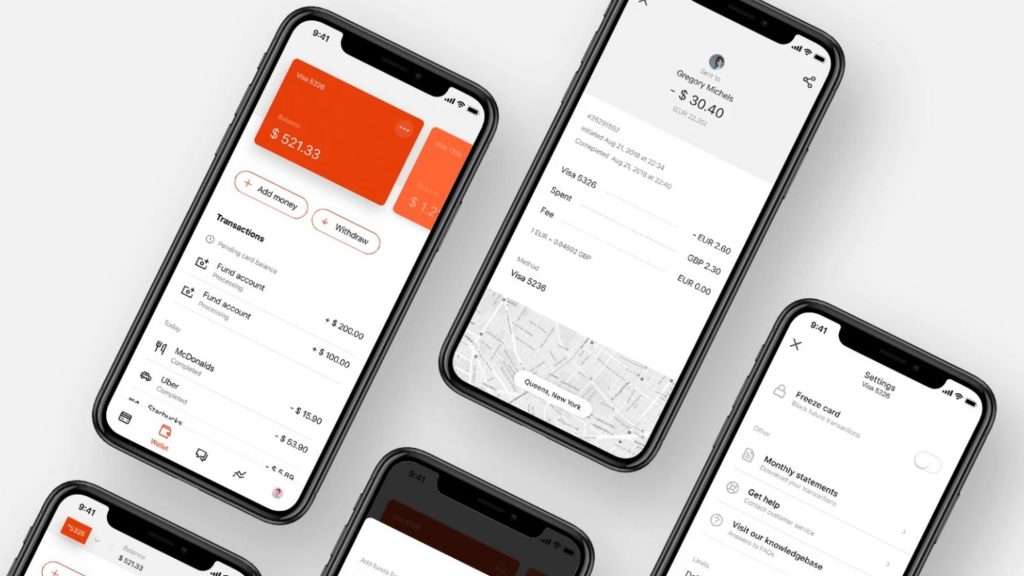

With its head office in Gibraltar, Xapo Private Bank is the only fully licensed global private bank that combines traditional banking in USD with a Bitcoin wallet. The bank, compliant with strict United Kingdom and European Union banking regulations, accepts applicants from all over the world and allows customers to onboard digitally in under ten minutes.

Geopolitical, government, inflation and devaluation concerns are real risks that concern many around the world, adds Rocca. He believes is not just the rich or those born in certain countries that should have the ability to protect their savings in a private bank.

“Xapo Private Bank aims to solve a very real problem that many are faced with every day. How can I protect my savings from increasing uncertainties and circumstances outside of my control?” Rocca asks.

The Saïd Business School graduate says before Xapo Private Bank, there was no way to interchange Bitcoin and fiat currency within the same secure account. New technologies are, however, here to stay, leading the way for innovating offshore investment opportunities.

“We don’t encourage our members to trade crypto. We believe that a small allocation of your wealth in Bitcoin is sensible. It also makes funding your Xapo account much easier and faster.” explains Rocca.

“Bitcoin is the only cryptocurrency worth investing in for the long term for three reasons: It is sovereign (not controlled by any government, company or individual); it is finite (only 21 million Bitcoin will ever exist and therefore will remain in demand); and it is the most secure blockchain-based currency.”

Bitcoin, now surging at more than 39% month-on-month, is seemingly going “mainstream” with the recent announcement that South African retail giant Pick n Pay is accepting Bitcoin payments in over 1 500 retail stores, indicating the consumer demand for holding and spending Bitcoin is on the uptake. This is also in line with international trends.

Xapo is an international private bank that accepts members who may apply and join the bank from anywhere in the world, digitally. Like other licensed banks in Europe and the United Kingdom, deposits at Xapo Bank are guaranteed for up to $100 000 under the Gibraltar Deposit Guarantee Scheme. It is currently paying 4.1% interest on USD, available on demand, with no lock ups.

As the world’s first fully licensed crypto-native bank, Xapo was conceptualised and funded in Silicon Valley and uses best in class technology to safeguard its members’ and its own reserves. It holds one of the world’s largest distributed reserves of Bitcoin.