We all have them. Those apps we open without thinking. Not because we need anything in particular, but because they feel… safe, in some…

Capitec Pay: Ozow leads way to new payments future

Capitec has partnered with Ozow, amongst other players, to launch a new payment solution that could potentially revolutionise the banking sector in South Africa. The partnership will create an innovative ecosystem for payments and establish greater financial inclusion in the country.

Currently, nearly one in four South Africans are unbanked, highlighting an urgent need for more inclusive financial services. The integration of Ozow’s platform with Capitec Pay through South Africa’s first proprietary open banking-payments API will provide a simpler and more accessible payment solution for underserved consumers and businesses.

Open banking enables third-party developers to build applications and services around financial institutions, providing safer, easier ways to pay while broadening accessibility. With API integration of Capitec Pay, Ozow is positioning itself as a leader in the push for open APIs with banks in South Africa.

Mastercard’s latest annual New Payment Index revealed that 97% of South African consumers plan to use a digital payment method in the next year. Capitec Pay offers a simple, fast user experience that is aimed at delivering benefits to merchants in terms of guaranteed settlements, automated reconciliation, and improved uptime thanks to bank-side monitoring.

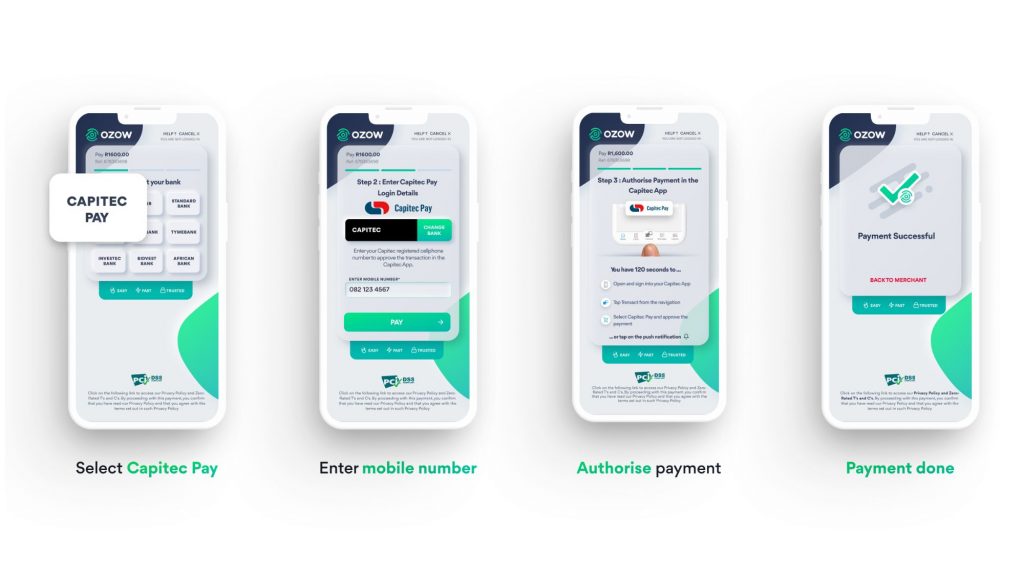

Capitec Pay will be integrated into Ozow’s Pay by Bank offering, which is a simple, secure, and easy payment solution that lets customers pay directly from their bank to the merchant without the need to use a bank or credit card.

With Pay by Bank, funds will be transferred directly from the customer’s personal bank account to the merchant account as soon as the authentication of a transaction is complete. This significantly reduces payment operations costs, the incidence of fraud, and processing times.

The Capitec Pay system lets clients identify themselves with their mobile phone number or ID number, rather than the username and password combination that has been the primary method for users to access their bank accounts.

The final payment is approved in a pop-up confirmation message in the app, providing added security to customers. Consumers can also revoke consent and opt out at will, at any time.

According to Thomas Pays, CEO of Ozow, cybersecurity has always been a top priority for the company. Pays explains that cybercriminals are becoming more sophisticated, and there is an onus on banks and fintechs to collaborate on the building of secure, efficient, and reliable means of transacting for the consumer.

“We can see the impact this kind of innovation is having in global markets. It has the potential to improve economic growth, and my team will continue to engage with all banks to support them in adopting open APIs for better third party payment provider (TPPP) and fintech integration,” he says.

Jerome Passmore, head of Capitec Pay, believes that the Ozow-Capitec partnership is poised to revolutionize the way South Africans transact and engage with their finances. Passmore says that using Capitec Pay, clients can feel safe shopping online by simply approving transactions within the Capitec banking app.

“Apart from providing our banking clients with peace of mind that their bank account information will be protected, the convenience of using Capitec Pay provides a quick, easy checkout, and seamless payment experience,” he explains.

The partnership between Ozow and Capitec presents a more secure, accessible payment option for customers and demonstrates a commitment to democratising Africa’s emerging neobank landscape. Pays encourages other banking institutions to join the digital revolution and embrace the future of payments.

These partnerships are a significant step towards achieving greater financial inclusion in South Africa. By providing a simpler and more accessible payment solution, the partnership has the potential to revolutionise the country’s banking sector and establish a more inclusive financial sector.

- For more information, visit http://bit.ly/3mbgoBy

READ NEXT: Innov8 signs 5-year deal for U-Image wireless ultrasound