South Africa’s esports scene is set for a major showdown as Hyprop and MTN introduce SHIFT COD, a Call of Duty tournament forming part…

Stitch adds Capitec Pay to its impressive API offering

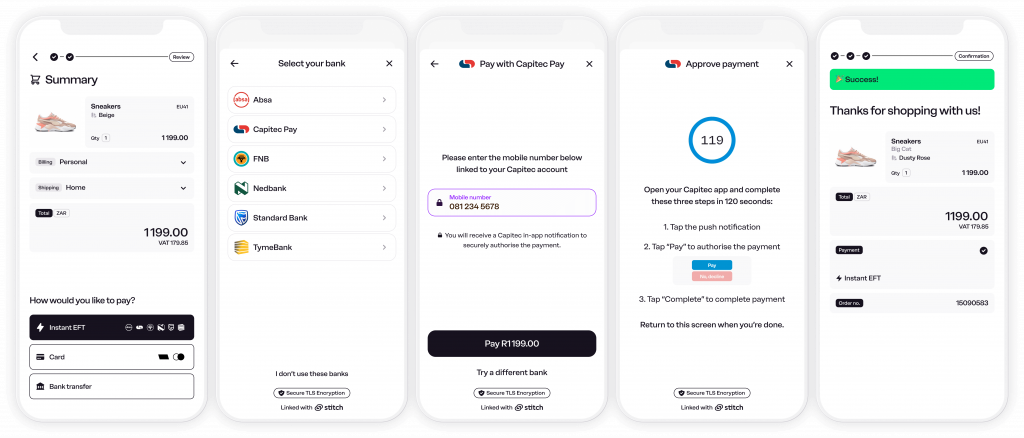

South Africa-based payments company, Stitch, is expanding its payments infrastructure offering by integrating Capitec Pay into its API. This integration will allow Stitch clients to offer their customers the option of paying via Capitec Pay, in addition to existing Stitch payment methods.

Capitec Pay was launched recently as part of an initial push towards open banking, allowing users to make payments using their mobile, account or ID number. Through Stitch, Capitec users can now choose Capitec Pay as a payment method at checkout and approve payments in their Capitec app.

This move by Stitch reinforces its role as a leading payments infrastructure player in the market, enabling businesses to connect to the financial system and deliver delightful payment experiences for their users.

Stitch president Junaid Dadan said, “We’re excited to see this sort of innovation coming to life in the South African market. As infrastructure players, we ensure our clients are always able to leverage advancements like Capitec Pay through their Stitch integration so they can continue to offer their users even more choice in how they want to pay.”

Existing Stitch clients will not need to carry out any additional deep development work, and businesses won’t need to develop a direct bank integration. New Stitch customers can easily combine Capitec Pay with other payment methods such as Instant EFT, Direct Deposit, and CashPay via a single integration, with seamless reconciliation across methods.

Stitch emerged from stealth in February 2021 and raised $21 million in Series A funding in February 2022.

It launched its flagship product, one-click checkout solution LinkPay, in April 2022, and expanded beyond Instant EFT with the launch of Direct Deposit in November 2022. Its backers include PayPal Ventures, TrueLayer, firstminute capital, The Raba Partnership, CRE Venture Capital, Village Global, Zinal Growth, and angels including founders and early builders from Chipper Cash, Monzo, Venmo, GoCardless, Plaid, Unit, and more.

Payments innovation in South Africa has been moving at a rapid pace, with incumbents and fintechs alike launching new solutions to enable South Africans to move money and participate in the digital economy. The addition of Capitec Pay and PayShap to Stitch’s API offering is the latest example of this trend.

Stitch is a payments infrastructure company that helps businesses launch and scale faster while operating more efficiently. Stitch payments APIs and tools dramatically reduce the effort required for businesses across sectors to connect to the financial system and deliver delightful experiences for their users.

The company has offices in Cape Town and Johannesburg, South Africa, and Lagos, Nigeria, with global staff. Its flagship solution, LinkPay, is the first in Africa to tokenise financial accounts to enable one-click and variable recurring payments.

READ NEXT: Blockchain Africa: Empower Africa for global competition