In a move that signals a major leap forward in generative AI, OpenAI has quietly rolled out ChatGPT-5, its most advanced model to date….

Nomba secures $30m to overhaul African payments

Nomba, a payment service provider for African businesses, has raised $30 million in a pre-series B funding round led by Base10 Partners, a San Francisco-based venture capital fund that has invested in Nubank, Plaid, and Brex. The equity funding round was oversubscribed, with participation from Helios Digital Ventures, Shopify, Partech, and Khosla Ventures.

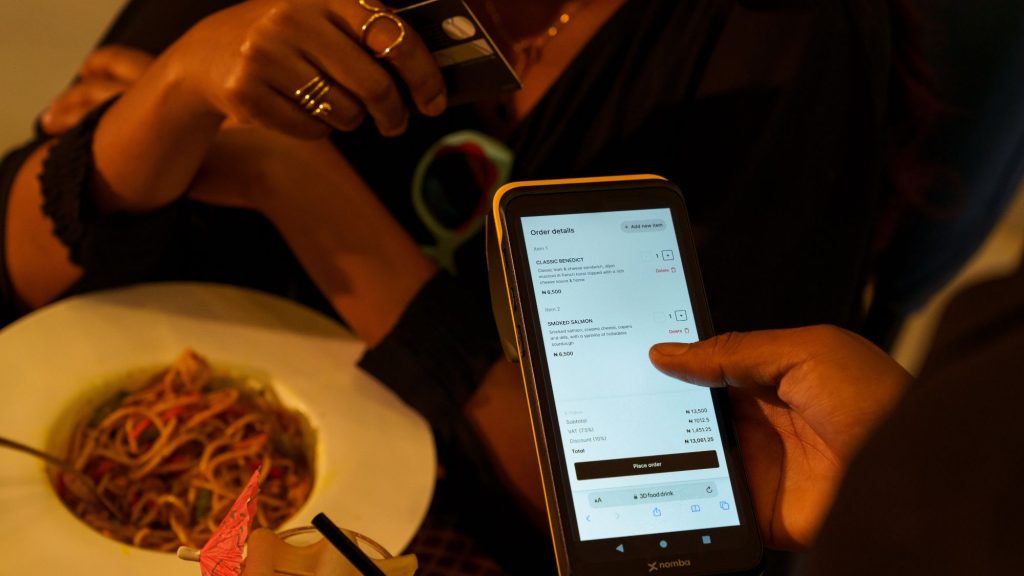

Despite the growth of digital payments across Africa, most businesses still only have access to generic point-of-sale machines to support the collection of payments. These machines also typically work in isolation from the rest of the business operations, leading to inefficiencies in their business processes.

With this new funding, Nomba aims to deliver payment solutions that are designed for the specific services that businesses provide, enabling them to operate more efficiently and deliver excellent customer experiences.

For example, restaurants will be able to access menus, manage inventory, receive payments, and perform other business functions all from the same hardware. For transport and logistics companies, Nomba’s solutions will enable them to directly connect their transactions to payments, creating a more seamless experience that increases sales and profitability.

Starting in Nigeria, Nomba will also deliver a range of business tools, including invoicing and order management solutions, to improve efficiency and reduce the cost of operations for businesses across the continent. It is a fully licensed payment service provider that serves more than 300 000 businesses – from solo-preneurs to large organisations – with payment solutions to help them grow and thrive.

Since launching in 2016 as “Kudi.ai,” a chatbot integration that responds to financial requests on social apps, Nomba has evolved over the years into a profitable, omnichannel payment service provider. The company processes $1 billion in monthly transactions, which represents a market-leading gross transaction value (GTV) for a payment service provider in Africa.

Before this funding round, Nomba had only previously raised $5 million in funding, leveraging those funds to successfully grow the business and deliver solutions that have positively impacted hundreds of thousands of businesses across Nigeria.

This new capital will enable the company to deliver more solutions for businesses in Nigeria, across Africa, and in other markets, as opportunities may emerge.

According to Yinka Adewale, CEO and co-founder of Nomba, “We see payment as a business model, not just a product, and we want to make it easier for businesses to take advantage of all that is possible in their payment processes to support their continued growth and success.

“We have a long list of products we have been working on, and the funds we have raised as well as the investors that have backed us give us a lot of confidence about what can be achieved with more effective payment solutions in the hands of business owners.”

Luci Fonseca, partner at Base10, said, “Nomba’s track record of innovation and capital efficiency makes it one of the most exciting start-ups in Africa. We are thrilled to be supporting them to deliver their game-changing solutions to power growth and continued success for businesses in Nigeria and beyond.”

The funding round will enable Nomba to further innovate and develop its products and services, empowering African businesses to grow and thrive through customised payment solutions. The demand for more effective payment solutions is high, and the company is well-positioned to lead the way in the African market.

READ NEXT: Funding boost fuels Oakantswe Construction’s success