Have you ever wondered how much easier travel has become, thanks to the digital innovations shaping our world? Exploring new destinations used to mean…

Chinese fund Shaka VC completes sixth deal in as many months since launching

Venture capital fund Shaka VC last month concluded its sixth deal less than six months since launching, when it invested an undisclosed amount in Ugandan logistics company Pinktie.

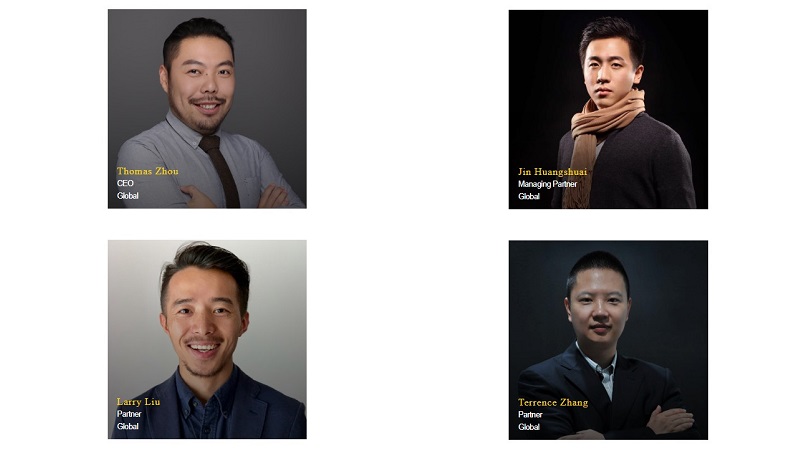

Speaking to Ventureburn yesterday from Nairobi where Shaka VC has an office (it also has offices in Kigali and Lagos), the fund’s partner Larry Liu said he and his three partners — Thomas Zhou, Jin Huangshuai and Terence Zhang (all pictured above with Liu) — aim to achieve a closing of the fund in the next three to six months at $100-million, all from Chinese investors in China.

Since it was set up in October the four have raised $50-million, and invested in six companies — four in Nigeria and two in Uganda.

While he did not want to reveal details such as the investment amount and stake that the fund has taken in each investee company, Liu was able to tell Ventureburn that the fund is currently deploying up to $1-million in investees, with the aim of increasing this to a maximum of $5-million.

Shaka VC aims to achieve a closing of its fund in the next three to six months of $100-million

The four in Nigeria include two fintech companies (one of these is K-Pay), a second-hand medical equipment company which has both a Chinese and Nigerian partner and a gas distribution firm.

In Uganda the fund has invested in Pinktie, which is run by a Japanese Korean and payment platform A Pay.

The investments follow a one-month trip Liu and some of his colleagues took in January to various countries on the continent. Some of the deals were concluded then, while others preceded the trip or were made following the trip.

Liu, who is just 28-years-old, left his job in the aerospace sector to come to the continent in 2014 and has been there ever since, involved in various entrepreneurial projects and startups — including as the marketing director of ecommerce platform Kilimall which grew from 20 to 250 people.

While some might voice concern about Chinese investment on the continent, Liu stressed that the VC fund is independent of the Chinese government and is rather made up of capital drawn from private investors who invest via an offshore account (at the time of speaking to Ventureburn he could not say where the account is domiciled). “We’re not related to politics,” he added.

And while at least one deal — the second-hand medical equipment company in Nigeria — includes a Chinese entrepreneur, Liu said the fund’s first choice is to invest in a company run by an African entrepreneur who has some international experience.

Second best would be to invest in a firm involving a Chinese-African partnership, with Liu adding that he likes the “integration part”.

Shaka VC plans to bring 20 African entrepreneurs on a trip to China in April. Liu said the VC aims to announce more details then, including the names of all those entities it has so far invested in.

*Correction: We mistakenly had it that Shaka VC would in April bring 20 Chinese investors to Africa, when it will in fact be taking 20 African entrepreneurs in the same month to China.

Featured image: Shaka VC partners (from top left to bottom left) Thomas Zhou, Jin Huangshuai, Terence Zhang and Larry Liu (Shaka VC)