Artificial Intelligence (AI) is no longer just a buzzword. It is embedded in everyday work, from drafting emails to automating entire workflows. For Memeburn’s…

We’re betting on investing R250m in startups over next 3 to 5 years – HAVAÍC head

Venture capital (VC) company HAVAÍC is betting on an exciting next three to five years. This, after the Cape Town based VC deployed R40-million in five investments and one follow-on investment in 2019.

So bullish is the VC’s CEO Ian Lessen (pictured above), that he’s even willing to put a figure to it.

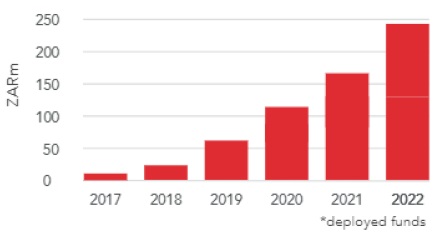

Writing in a performance review (opens as a PDF) of 2019, Lessem said he expects the VC to grow its portfolio size to R250-million by 2022 (See the below graphic).

Much of his bullishness is built on Africa’s growth in VC investments.

HAVAÍC’s Ian Lessem expects the VC to secure and deploy R250m over the next three to five years

“Venture capital in Africa continues to grow as more and more local startups meet with international success and attract interest from both local and foreign investors,” he said.

In 2019 the VC entered the East African market and invested in two new Kenya based companies, virtual postbox startup MPost (see this story) and Tanda, which makes it easier for shop owners to sell electronic services, and said it is experiencing a “rapid increase” in deal flow from the region.

In South Africa the VC led a R6-million further funding round in Aura, which has developed a cloud-based security and safety platform (see this story).

In addition, it has invested in three SA companies which it said are already seeing success in international markets, namely: healthtech HearX, Sortd (see this story), a US based firm which has developed a subscription-based productivity suite, and about $550 000 (R8-million) in biotech 3X4 Genetics (see this story).

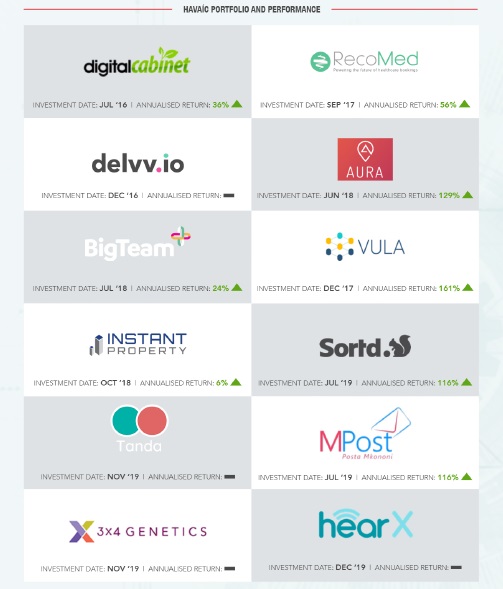

A screenshot below, from the HAVAÍC’s report, depicts the VC’s current portfolio and return generated for investors so far for each respective portfolio company.

‘We’re looking at 85% returns’

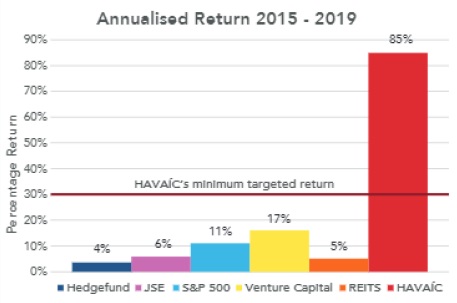

Lessem said HAVAÍC targets returns of at least 30% internal rate of return (IRR) per annum or 5X returns over a five-year period.

“However, with our carefully constructed portfolio, pre and post investment support and involvement from our professional management team, as well as expert strategic support, our portfolio companies are performing well above this hurdle, with annual returns sitting at 85%,” he said (See below graphic).

Said Lessem: “With our portfolio now comprising of 12 exciting early stage high growth tech companies, and this portfolio doubling year-on-year every year since HAVAÍC first started investing, and being one of the most active VC investors locally, HAVAÍC is well placed to continue delivering these returns to our investors.”

With talk like this, Africa’s VC sector may well and truly be on a bull run.

Read more: HAVAÍC reveals its invested about $550k in SA biotech startup 3X4 Genetics

Read more: HAVAÍC, institutional funder invest further R6m in Aura

Read more: SA trio behind US-based startup Sortd net funding from HAVAÍC [Updated]

Read more: HAVAÍC invests undisclosed sum in Kenyan virtual postbox startup MPost

Featured image: HAVAÍC CEO Ian Lessem (Supplied)