In a move that signals a major leap forward in generative AI, OpenAI has quietly rolled out ChatGPT-5, its most advanced model to date….

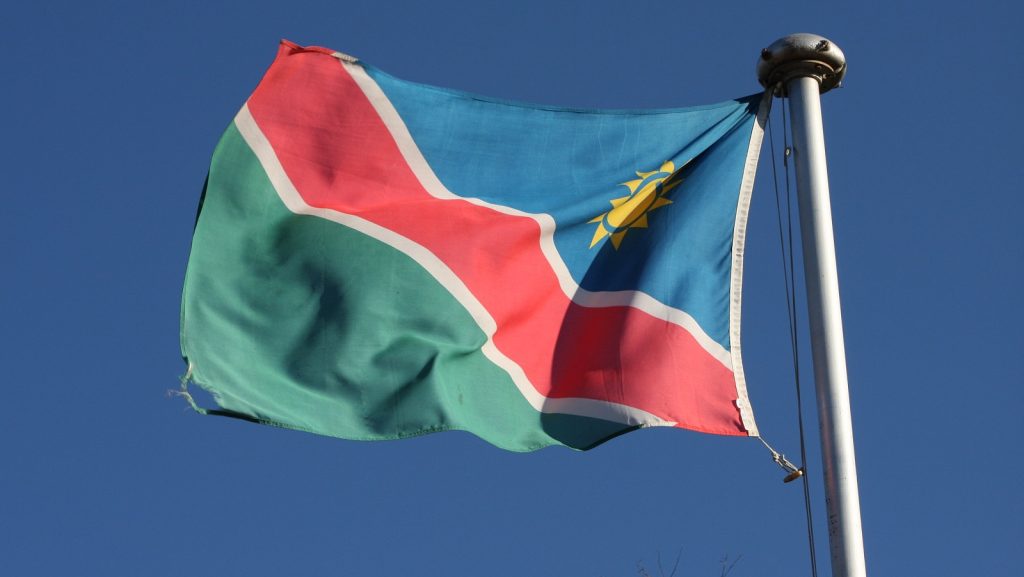

Namibia to get its own business angel investors network

The African Business Angel Network (ABAN), in partnership with Greentec Capital Africa Foundation, has announced that it will next week launch the Namibian Business Angel Investor Network (NABAN) in Namibia’s capital, Windhoek.

The launch will be part of a series of events, held on 2 and 3 March, which will include an informal information session with relevant parties in the ecosystem, as well as full-day masterclass with the founding members of NABAN. The masterclass will be followed by an informal dinner.

The activities will take place at The Village Opera House, Lilliencron Street in Windhoek.

The events are being organised by the Greentec Capital Africa Foundation in partnership with ABAN, with the support of GIZ, the German Development Co-operation on behalf of the German Government.

ABAN and Greentec Capital Africa Foundation will launch the Namibian Business Angel Investor Network on 2 and 3 March in Windhoek

The Masterclass will be conducted by long-time investor and president of ABAN, Tomi Davies, with an introduction by Thomas Festerling, CFO and co-founder of Greentec Capital.

This, while the full-day Masterclass will unpack the entire investment spectrum from deal origination, valuation, due diligence, negotiation, post-investment monitoring, exits as well as the fundamentals of managing an angel network.

Launch follows earlier moves

Moves to set up NABAN were initiated a number of years ago by the Namibia University of Science and Technology (NUST) through its Fablab and GIZ, Greentec Capital Africa Foundation’s head of programmes Kirstin Wiedow told Ventureburn.

At the time the GIZ and the Fablab held engagements with the industry following pitching events and assessments of the need to foster more early stage investment and support for startups.

“Alas the Fablab, who championed the cause closed in 2019 and since then GIZ and GCAF with ABAN took the reins to make sure this intervention for the local ecosystem still comes to be,” said Wiedow.

At present startups in Namibia battle to get hold of small seed amounts needed to grow their business.

Start-up Namibia project manager Anna Vambe pointed out in an earlier statement that at present only big tickets are available from the limited number of established private equity and venture capital players in Namibia, starting from 4 million ($270 000) Namibian dollars and upwards.

“We really need Angel investors to bridge the gap for seed financing starting with investments from 100 000 Namibian dollars, which Namibian startups are so desperately looking for.

“In addition, angel investors bring with networks, access to markets and much needed technical assistance for our startups,” she noted.

Featured image: Alex Smith via Flickr (CC BY 2.0)