Artificial Intelligence (AI) is no longer just a buzzword. It is embedded in everyday work, from drafting emails to automating entire workflows. For Memeburn’s…

SA fintechs allow consumers to compare finances via POS terminals

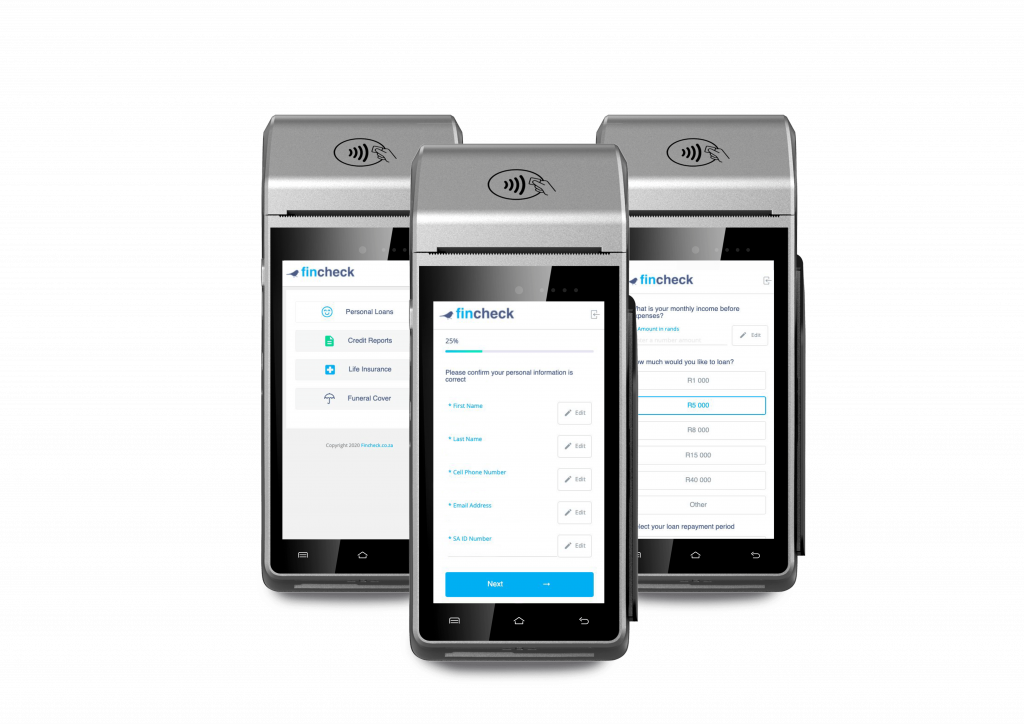

Fincheck, a leading local fintech startup has partnered with Dashpay, a payment, and merchant solutions provider, to provide a variety of personal on-demand finance facilities to customers via a large number of Newland point of sale (POS) terminals.

Local fintech startup collaborates with Dashpay to manage SA customers financial positions via Newland POS terminals

In an official press release, Michael Bowren, a director of Fincheck addresses the collaboration with Dashpay and reiterates their app’s vision to assist South Africans in their financial decisions.

“We are excited to work with Dashpay on this initiative. The Fincheck vision is to allow all South Africans to compare various banks, lenders, and insurers across the country, for free. This collaboration between Fincheck and Dashpay is an innovative solution, and one which has the goal of assisting South Africans make a better financial decision.”

Dashpay is a division of a JSE-listed company called Capital Appreciation. Capital Appreciation supplies Newland Payments devices across South Africa and the Southern African Development Community (SADC) regions.

The Newland device is available on the Android platform, which enables the POS to process traditional credit card purchases simultaneously while operating a number of applications.

Newland Payments is reportedly the second-largest point-of-sale (POS) manufacturer worldwide.

Dashpay has the capability to process credit card purchases while Fincheck is an app that allows users to access and compare offers from more than 80 banks, lenders, and insurers in South Africa.

The collaboration provides users the opportunity to choose a preferable form of finance and apply for their personal finances by downloading the Fincheck app and linking it directly to terminals.

Free to use, the comparison feature aims to cover unexpected expenses their users may encounter.

Benefits for SA users

Aside from providing users the opportunity to compare financial offers from major banks, lenders, and insurers across SA, which also include short term and long term loans varying from R1,000 to R350,000, merchants also benefit from this innovation.

Dashpay merchants provide customers the opportunity to explore numerous finance features for purchases. Working hand-in-hand, when a customer has made an application with Fincheck, communication becomes streamlined for the customer. Essentially, the new service will lessen the administrative burden for merchants and provide an ease-of-access to a much-needed service for customers.

Benjamin Powell, managing director of Dashpay explains that the collaboration aims to help users manage their finances effectively, even in unexpected situations.

“A seamless partnership like the one with Fincheck will assist consumers in managing their finances quickly and easily. Whether it’s an emergency vet bill for a sick pet, additional finance to help purchase necessities, unexpected medical expenses, or other expenses which life presents from time to time – this integrated solution will make it both simpler and safer to access long- and short-term finance from a reputable financial services institution, via Fincheck”.

Future features

According to reports, customers will gain access to credit reports for free, helping them understand their current financial situation due to the innovative collaboration between Dashpay and Fincheck.

The feature will include a clear step-by-step guide on how to improve customers’ credit scores and overall financial health.

Read more: Nigerian fintech startup receives $25 000 in funding

Read more: Fincheck has landed R4.4m from investors reveals founder

Featured image: Michael Bowren, CEO of Fincheck (Supplied)