Artificial Intelligence (AI) is no longer just a buzzword. It is embedded in everyday work, from drafting emails to automating entire workflows. For Memeburn’s…

An interview with Chipper Cash VP, Wiza Jalakasi

Ventureburn has its own podcast, Venturepod.

Available on Spotify, Apple Podcasts, Amazon Music, Castbox, Pocket Casts, RadioPublic, Anchor and Stitcher (Google Podcasts and Overcast coming soon) you’ll now be able to listen to insightful conversations with startup founders, entrepreneurs, VCs and others who are involved in Africa’s rapidly evolving startup landscape.

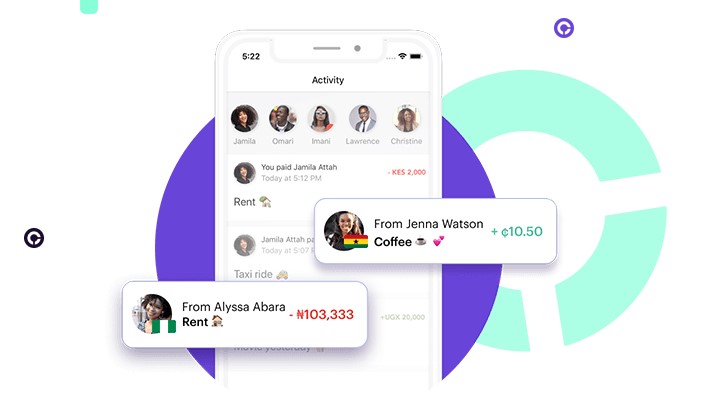

Our first episode is a conversation with Wiza Jalakasi, VP, Global DevRel at Chipper Cash about the state of the African startup landscape and how Chipper Cash came to be.

Read an excerpt from the interview below and listen to the full interview on any of the above platforms.

(Text edited for clarity)

Brendon Petersen (BP): Wiza, thank you so much for joining me on the inaugural episode of the new podcast we have at Ventureburn. We’ve obviously spoken before, full disclosure for everyone listening, I MC’d your launch when you launched in South Africa. That really drove my excitement for startups across the country and the continent and what you guys are doing (at Chipper Cash) is phenomenal. So I’m really glad that you’ve made the time because I know you are super busy. Thank you so much for joining us.

I think there’s a lot we have to chat about because a lot has happened since the last time we spoke.

Wiza Jalakasi (WJ): No man Brendon, thank you so much. It’s a pleasure and an honor to be here, especially for the inaugural episode. I do remember the South Africa launch event. It was quite interesting to just chat through some of the perspectives about what’s happening. In so many ways South Africa feels very much like the rest of the continent, but in some ways, it does not, and it’s pretty interesting to experience how those nuances are teased out from a practical perspective, especially through the fintech lens. It’s a market I’m really, really excited about and excited to be sharing more about Chipper, our vision, and what we think we’ll be able to do extremely well here as well as in the rest of the continent.

BP: Let’s do a little bit of a background dive before we dive into this whole conversation. You’re Chipper Cash right now, for the people who don’t know who Chipper Cash is, the simple way to put it is you’re a fintech company. I remember when you guys told me that you had gotten funding from the Jeff Bezos expedition fund, because my immediate response was “oh, my former boss”. I used to be part of Amazon’s Global launch team, so I’m well-versed with things to do with that man. I don’t say that in a derogatory way.

What is Chipper Cash other than being a fintech company because that’s a very generic way to describe yourselves, I think.

WJ: Yeah, absolutely. Chipper Cash is a gateway to freedom of movement of money.

BP: I think I’m gonna be using that.

WJ: I literally just made up right now.

We’re an app that allows users to move their money to wherever they need it to be and our focus is on intra-Africa cross-border payment corridors. Say for example you are sitting in Uganda and you need to move some money to Nigeria or you need to move some money to Rwanda or you need to move some money to South Africa, Chipper Cash is aiming to be the cheapest, easiest and fastest way for you to do that as a starting point. And then we’re layering all of these additional ancillary financial services on top, such as fractional investing in U.S. stocks, which is pretty new. We just launched that product in Uganda, we’re the first in the market. There we’re also looking at virtual and physical debit cards that are tied to your Chipper Card balance so you can generate new types of cards and fund them in USD or whatever local currency so that when you’re trying out a new eCommerce website, you can put on a card that you can easily dispose of.

Funny anecdote, if you sign up to the New York Times or any of the Dow Jones properties, including the Wall Street Journal, if you sign up with your card, you can’t cancel online. You can sign up with your card online, but you can’t cancel online. You have to like call to cancel your subscription and it’s a US phone number, it takes forever for them to answer. You’ll be put on hold for like 10-15 minutes, so virtual cards have an interesting use case because you can try out services. And if you don’t like the service, you can just cancel the card without affecting all of your other value. There’s like a lot more stuff that we’re getting into. Dabbling over here a little bit in the crypto space for countries where there’s a regulatory framework including South Africa. And then we’re gonna layer on all the various things that people need to do with their money. We’re targeting a young smartphone first audience who are used to getting things pretty much on demand. They don’t like waiting. That’s the type of person that we’re looking to serve.

BP: You’ve just described me and when you mentioned the New York Times, I looked at my iPhone and my iPad because I have a New York Times subscription. Luckily done through Apple, I was able to cancel my New York Times subscription that way, but I do know the pain that you’re talking about because I got friends who have experienced that.

WJ: Yeah, the moment somebody has your card details, they can tokenize it. And if they tokenize it, they can make it really hard to cancel. And most people don’t know that.

BP: Talking about the things that Chipper Cash is tackling makes me wonder what the lightbulb moment was that inspired the creation of this company. Why was Chipper Cash founded? What was the thinking behind it?

WJ: Alright cool, so I’m going to speak to the extent that I can on behalf of the founders, I think it’s important for me to state that I am not part of the founding team, though I was one of the earliest executives. But basically, Chipper Cash was started by Ham Serunjogi and Maijid Moujaled who are Ugandan and Ghanaian respectively, so they’re both young people. Majid just turned 30 this year and Ham is 29.

They met while studying in the United States at Grinnell College in Iowa and developed a very organic friendship over shared interests in both business and technology. Over the years they became pretty close and were just chatting about different types of problems that they could solve and they eventually committed to each other to get some industry experience and then at some point find a problem that makes sense to attack on the continent and figure out what they could do to give back to the continent where they’re from. So yeah, they graduated from Grinnell and then Ham went on to work at Yahoo and Facebook, and then Maijid went to work at image on Facebook and on Yahoo, and then Ham went to go work at Facebook for some time. They kept in touch and eventually reconnected in the US after some time.

They were discussing whether it made sense to start a business to solve some of these problems and then they established a business called Critical Ideas. That’s actually the name of the parent company, Critical Ideas Incorporated, and they were iterating towards various solutions that could be built. When they came across mobile money they were like, payments is a very big area and they’ve both experienced the challenge of trying to receive money in the US from Africa and also trying to send money from the US to Africa.

Where there is support for the corridors, the cost is usually extremely high.

If you look at the World Bank data on the cost of remittances, Southern Africa is the most expensive region in the world to send money to and receive money from globally.

There’s a sustainable development goal to bring down the cost of remittances globally to I think around 3% and SSA is still, for most corridors 15 plus percent.

They were like like, yeah, this is a pretty big problem and why don’t we try to build an app around it and test it quickly? I don’t think anyone, even them, were prepared for the response to that initial tryout. They launched initially in Ghana and Uganda and saw an extremely crazy uptick in volume.

Around this time is where my intersection with the founders comes in.

At the time, I was at the time working at a startup called Africa’s Talking which provides infrastructure for software developers and businesses to integrate telecom services like SMS, USSD, phone calls etc. At the time we were in the very privileged position of having a pretty strong marketshare from all of the African startups and they were using our services for SMS OTPs when you sign up for the app. I could infer from the number of SMS they were consuming, I could infer directly proportionally the number of new users that were signing up, because each and every new user would have to get an OTP SMS to verify their phone number. So one day I’m looking through my analytics dashboard at Africa’s Talking, and then I see this startup that’s been growing at least 100 to 150% per month for like the past year and it’s this Chipper thing.

My initial reaction was that this is definitely something fishy and that this might be fraud so let’s take a deeper look.

At this point I knew nothing about the company and then coincidentally the same week the Chipper founders raised about $2 million, I think it was a seed round, from a bunch of US celebrities including Joe Montana. I read the article on TechCrunch and I was like hey this is a little bit weird, isn’t this the same Chipper app that we’re seeing?

I jumped in there and looked at the data and I’m like, OK, this is definitely the same Chipper app, so let me actually try it.

I signed up from Kenya, at the time they just launched Kenya, and I was able to sign up very quickly. I was so impressed with the entire onboarding flow and how things went that I wrote a thread on Twitter.

Ham reached out, we had a few conversations and it was clear that we shared similar worldviews in terms of how we think the industry is going to evolve and I just immediately wanted to find some way of collaborating with them.

At the time I just started a new role at another startup called Hover, so it wasn’t an appropriate time to have any conversation but we stayed in touch over the subsequent months and I think I must have recruited like 6 people before officially joining at the start of January 2021.

Read more: Carry1st partners with PayPal and Chipper Cash to bring payments to Africa