Equity crowdfunding platform Uprise.Africa has opened what could be possibly South Africa’s first live equity-crowdfunding campaign to investors, with the launch yesterday of Jacana Media’s Storied SA initative.

The campaign, which aims to fund the publication of more African literature was launched yesterday at 2pm and will run until 15 April, Uprise.Africa chief marketing officer Inge Prins told Ventureburn in a phone call today.

No ad to show here.

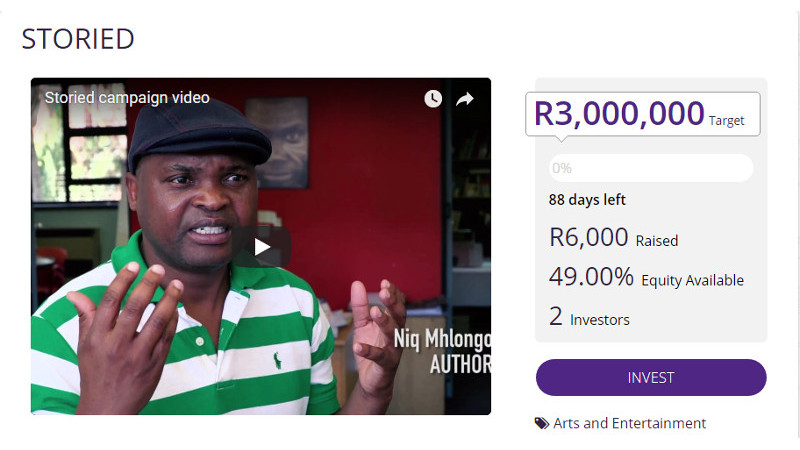

The platform aims to raise R3-million over the next 88 days in return for 49% equity for investors. At the time of publication, the platform had raised just R6000 from two investors.

Storied SA project manager Leabiloe Molapo said she was both “excited and nervous” to be part of perhaps South Africa’s first equity crowdfunding campaign.

The Jacana Media imprint plans to use the funds raised for the printing and publication of a story collection of 10 titles. These include books by authors such as local authors Fred Khumalo and Zachariah Rapola, she said.

She said while initially the titles would be published in English, the publisher does plan to at a later stage bring out books in indigenous African languages.

Molapo said Jacana Media opted to go the equity crowdfunding route as it was “a meeting of ideas” after Uprise.Africa approached the company at a time when the publisher had been looking for funding.

She added that the company had not however approached any bank for funding before deciding to go with equity crowdfunding.

Uprise.Africa’s Storied campaign could possibly be South Africa’s first live equity-crowdfunding campaign

A risk warning on the campaign page cautions potential investors on dilution, illiquidity, loss of investment and rarity of dividends.

Last week, the platform’s COO Patrick Schofield said that Uprise.Africa would, upon launching its first campaign, engage with the Financial Services Board (FSB) get clarification on licensing requirements.

Prins said that the platform had shared the campaign with the Financial Services Board (FSB) and that the regulator had not raised any concerns about the campaign.

Read more: Uprise.Africa to launch first crowdfunding campaign this month says COO Schofield