We all have them. Those apps we open without thinking. Not because we need anything in particular, but because they feel… safe, in some…

Getihu, investment fund for SaaS startups launches with opening of Cape Town hub

Getihu, an investment fund for early-stage software and data as a service (Saas, DaaS) startups, officially launched in South Africa last night (14 March) with the opening of an innovation hub in Cape Town.

Getihu was founded last year by serial entrepreneur Ryan Paterson and chief investment officer Thomas Schmider. Schmider co-founded one of Europe’s biggest game developers Infogrames Entertainment in 1983, which went on to acquire US-games developer Atari Inc in 2008.

Paterson (pictured below), who is also Getihu’s chief entrepreneur officer, told Ventureburn that the fund — which started off with the founders investing their own money — invests between $25 000 and $500 000 in return for a minimum 25% stake in the Saas and DaaS businesses.

“We are looking for B2B focused companies with an already existing platform and at least one client,” he said in a phone call.

He said the fund plans to officially launch another hub in Lyon, France in June.

Commenting on the fund’s decision to base its first hub in Cape Town, he said the fund was not looking for companies in Cape Town alone.

“We are looking for companies all over the continent. We are interested in investing in companies that are non-South African,” he stressed.

So how will the fund source these startups?

Paterson said Getihu will not run innovation challenges, pitch events or scouting tours.

“We are doing it through our own research and networks,” he said, adding that “at any one time we are looking at three or four companies”.

He said the fund aims to add between one and three companies per year to its portfolio in the next seven years, with the ultimate goal of growing the portfolio to between 15 and 20 companies.

‘Not focused on exits’

Paterson also pointed out that Getihu has a different approach to equity investment, and that the investment fund will not be using the typical “venture capital model”.

“We are not looking for exits,” he said.

He explained that Getihu will instead employ a long-term approach aimed at building a portfolio of companies.

“We’ve taken a 24 month view. Our focus is on building local traction in the first 12 months, and thereafter international traction in the next 12 months,” he said.

Getihu invests between $25 000 and $500 000, in return for a minimum 25% equity stake

He said Getihu will also be operationally and strategically involved in the portfolio companies — with the fund acting as an accelerator — adding that the businesses will benefit from the founders’ own experience as well as Getihu’s business networks.

Getihu’s portfolio companies will also receive support from the fund’s partner companies.

Paterson said the fund will assist portfolio companies expand into Europe by setting up a “European equivalent” for its portfolio companies.

The companies, he said, will also get assistance around legal, accounting and recruitment issues.

Building an ecosystem

While the Cape Town hub will serve as Getihu’s office in South Africa, it will also serve as a “home” for its portfolio companies.

The hub consists of co-working spaces which include 14 desks.

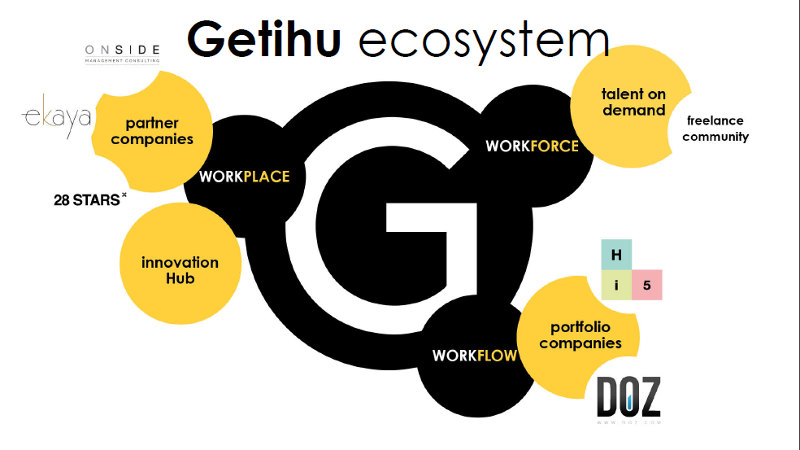

Through the innovation hub, the fund wants to create an ecosystem that will support both Getihu’s portfolio and partner companies.

Getihu’s partner companies include management consultancy On Side Consulting, stills production agency eKaya Productions and full service creative studio 28 Stars.

The three partner companies will provide Getihu’s portfolio companies with services ranging from user interaction and user experience (UI and UX) design to tech management consultancy.

He also said Getihu’s first South African portfolio company, cloud-based HR platform Hi5, will be be working from the hub for the next six to 18 months.

Read more: Hi5, from side-project to servicing 1700 companies across five countries

“All of us will effectively freelance in the next 10 years,” he said, adding that the company believes this business evolution will be supported by “a market place of talent on demand”.

As a result Getihu is looking for design, digital marketing and software engineering freelancers, with the objective he said, being t0 use the “on demand talent pool” to help grow portfolio and partner companies.

He said that Getihu’s portfolio companies align with this vision of “work and talent on demand”.

Other than Hi5, the fund’s other portfolio company is DOZ, a French marketing platform that uses freelance marketers.

On Hi5 investment

He said Getihu’s investment in Hi5 was motivated by the growing importance of data regarding happy staff, adding that Hi5 has built “a big data set” on the matter.

“His company will scale very easily, they have done relatively well in a short space of time,” he said, referring to Hi5 founder and CEO Gary Willmott.

Paterson said Getihu is looking to help Hi5 expand to Europe, Australasia and the US.

Willmott would not disclose how much had been invested into the company, but he told Ventureburn that he had been approached by the fund last year and had over the last six months been “aggressively negotiating” with Getihu.

He said with his startup targeting expansion into the US, UK, Australia and New Zealand, he is looking forward to benefit from Schmider and Paterson’s advice and experience.

Disclosure: Ventureburn parent company Creative Spark is a Hi5 client.