Artificial Intelligence is no longer a distant promise or a Silicon Valley experiment. It’s embedded in the now. South Africans are already using generative…

3 of 6 startups former Dimension Data head has invested in headed by Saffers [Updated]

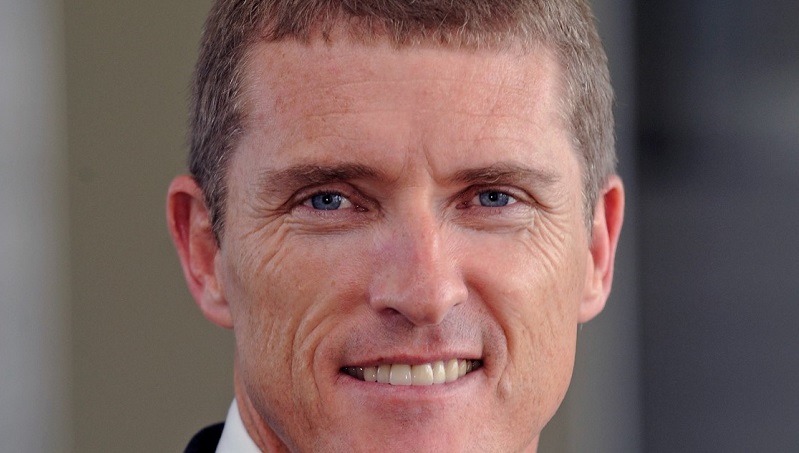

Former Dimension Data head Brett Dawson revealed today that he has invested in six startups, and has formed Campan, an investment company. Three of the startups have been founded by Saffers, or South Africans living overseas.

The three startups are Australian based social networking site Gather Online in which Dawson has invested R10-million and UK-based startups Fourex — which makes fast, easy and efficient forex its primary objective — and Free2cycle which aims to transform wellbeing by reimagining the cycling commuter business model.

Dawson said there was no “strategic reason” why three of the six investments are in startups founded by South Africans living overseas, rather these were just from those he had met in his network.

y three of the six companies he has invested in are headed by Saffers.

Read more: The low-down on Gather Online’s R10m investment, next round, expansion plans

He said in a press release today that Campan will invest in and nurture businesses that are poised to challenge existing business models through the positive application of technologies such as automation, artificial intelligence, data exchanges and cloud-based solutions, among others.

“Campan is a vehicle through which I can live out my passion for enabling new companies that use technology as an engine to make substantial positive differences in terms of industry and process,” he said in the press release.

Dawson would not disclose the investment amount and details of all six deals (he has only disclosed that of Gather Online, while Wrapistry deal size was disclosed by the founder himself).

Campan’s portfolio includes:

- Gather Online, a social networking site. The platform which was founded in 2015 by South Africans Michael van Andel and CEO David Price is based in Australia and has offices in Johannesburg. Dawson has invested R10-million in the startup.

- BrandHubb, which was founded by Rob Anderson, allows users to personally follow all of their favourite brands within their social media sites.

- Fourex is a UK-based company founded by Oliver du Toit and the late Jeff Paterson, London-based South African. The company makes fast, easy and efficient forex its primary objective.

- Free2cycle is a UK-based initiative which aims to transform well being by reimagining the cycling commuter business model. The organisation announced Dawson as the chairman in July last year.

- Ubusha Technologies, a South African identity governance and privileged account management solutions provider, focussed on cyber security.

- Wrapistry which provides the ultimate gifting experience. Dawson was involved with Genesis Capital in a deal that saw the two invest R4-million in the startup in November last year (see Ventureburn’s earlier story here).

He says his vision for Campan is to become a leading incubation platform that nurtures emerging, transformational Fourth Industrial Revolution businesses to make a real difference to society.

Dawson is also involved in investing in tech startups via 12J venture capital (VC) company Anuva Investments.

In March Anuva Investments business development manager Natasha Nicolakakis told Ventureburn that the company’s “C” class shares, are “guided by Brett Dawson and focused on the tech space”.

Dawson told Ventureburn that some of the six deals have been channeled by Anuva Investments to take advantage of the tax break that 12J vehicle allows investors.

UPDATE 7 May 2018 Editor’s note: Dawson said there was no “strategic reason” why three of the six investments are in startups founded by South Africans living overseas, rather these were just from those he had met in his network.

Dawson told Ventureburn that some of the six deals have been channeled by Anuva Investments to take advantage of the tax break that the 12J vehicle allows investors.