HONOR has officially opened pre-orders for its much-anticipated HONOR 400 and HONOR 400 Pro smartphones in South Africa — ushering in a bold new…

Simon Dingle sees crptocurrency as shaping new economic order [Extract]

Money, argues SA investor and speaker Simon Dingle who has been designing crypocurrencies since 2011, is perhaps the most important human invention after language. But who really owns it — you or the banks?

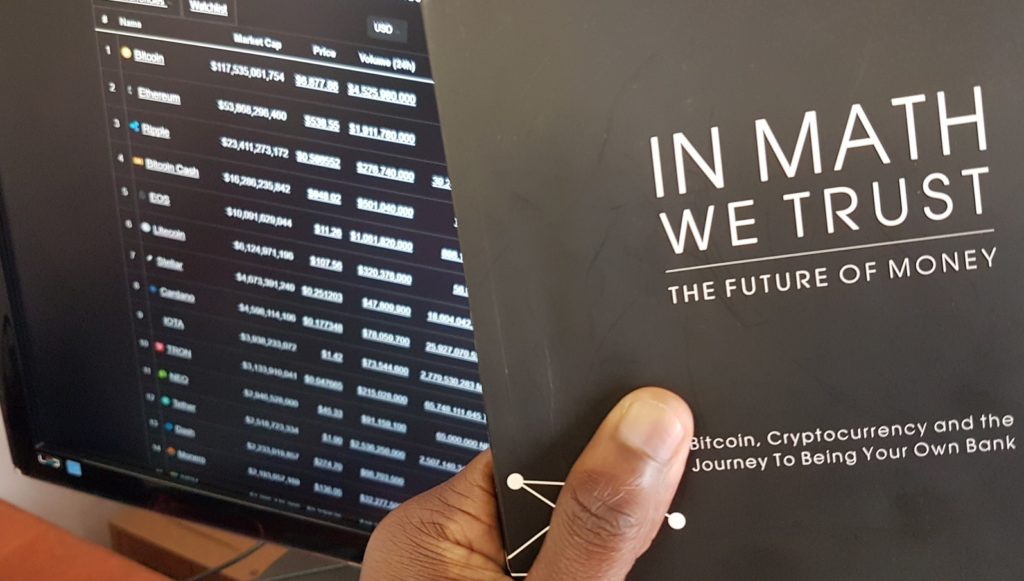

In this extract from his latest book In maths we trust: The future of money released earlier this year, Dingle paints a vision of a future where people themselves are able to control and store their own wealth using digital money such as bitcoin or Ethereum.

The new economic order

The future economy is one in which money flows in and out of your world seamlessly without the friction of banking infrastructure and with more ways for you to earn income from your spare hard drive space, seats in your car, rooms in your house or time on your hands.

When you need to make a decision involving value the systems will ask, for the rest of the time it’ll all be happening in the background.

Just as flushing toilets and electric lights went from being ultra luxury items in the nineteenth century to something that almost anyone could have a hundred years later, so internet access, online entertainment and other things that only the rich could afford in the past are becoming available to all.

The new economic order is inclusive and creates new opportunities for social welfare projects and jobs. All it needs is an electronic financial system that doesn’t discriminate, and we have that now.

Individuals are increasingly appreciating their ability to store monetary value themselves without banks, writes Simon Dingle

The new order will be made possible by a trust paradigm that drives middlemen and their fiefdoms out of business and revolutionises the way we think about economics and government.

Being your own bank

Financial businesses will adapt or die in this new world of money. Without requiring trusted third parties the role of the bank is evolving. Individuals are increasingly appreciating their ability to store value themselves using new tools that make it safe and easy.

You need a bank now, but in the future they will have to compel you to do business with them.

Being your own bank doesn’t mean never dealing with banks again — as appealing as that prospect may be to you — nor does it mean living in the woods in a bomb-proof bunker with a temperament primed for the apocalypse.

What it does mean, in this context, is being in control of your own finances in a system that acknowledges your ownership.

The money is yours

Being your own bank means not having to rely on companies telling you when and how you may use your money and, most importantly, recognition that your money is yours and not legally the property of a company that may or may not be able to give it back to you when disaster strikes.

When you have to borrow money, being your own bank means borrowing it directly from others who don’t rely on a company that must grow to sate shareholders and feed and army of overpaid executives.

Repayment terms must be fair and individualised to pass scrutiny in a world where transactions can’t be concealed.

Banks will transform into something new in this environment, and they almost certainly won’t be quite as big as they were in the beginning of the twenty-first century.

This whole fractional reserve situation and the resulting chaos that it exposes us to when markets collapse is probably also something we could do without.

One opportunity for banks of the future is to offer marketplaces for people seeking financial services like loans or insurance. They may or may not be storing value on behalf of customers, but there will be no confusion as to whose money it is.

The technology is ready and a better story about trust is waiting to be told.

All the future needs now is you.

Get Simon Dingle’s ‘In math we trust: The future of Money’ is available for purchase on Loot.co.za. Visit the book’s page here.