Local corporate and investment bank Nedbank has invested an undisclosed amount in Cape Town based aerial data-analytics startup Aerobotics. The bank was the lead investor in a Series-A round in which several other investors also took part, including a number from Silicon Valley.

Among those that took part in the round (see below note at the foot of the story for the remaining list of investors) were online investment marketplace AgFunder and Silicon Valley investor Joe Caruso.

No ad to show here.

Cape Town based venture capital 4Di Capital, which together with the Savannah Fund last year provided seed funding of R8-million to the startup, also took part in the round.

Earlier today online business publication Moneyweb reported that Nedbank had made the investment through its R100-million VC fund as part of the bank’s strategic focus on agri-finance.

When contacted by Ventureburn, Aerobotics co-founder Benji Melzer would not disclose the amount or equity stake.

He said the startup planned to use the investment to fund further commercialisation and product development.

Nedbank’s investment into Aerobotics is reported to be part of the bank’s focus on agri-finance

Aerobotics has developed Aeroview, a data-analytics platform that uses satellites, drones and artificial intelligence to help farmers optimise crop performance and reduce input costs. In addition, the company’s solutions can be applied in the crop-insurance sector.

The company has built a client base of farmers and agricultural consultants beyond South Africa with operations in Australia and the UK.

The startup, which was founded in 2014 by James Paterson and Benji Meltzer, was part of the fifth cohort of Google’s San Francisco-based Launchpad Accelerator. The startup graduated from the cohort last month, Meltzer told Ventureburn today.

The company is also an alumnus of London-based Startupbootcamp InsurTech.

Though he declined to comment on the specifics of the deal itself, Justin Sprat — who also took part in the deal — told Ventureburn in an email that the co-founders are “exceptional”.

“I invest primarily in software businesses where there is a competitive moat, which I view as a combination of exceptional talent and a unique solution to a big or important problem. AB (Aerobotics — Ed) has these ingredients in spades.”

Sprat declined to provide names of any other startups he has invested in, saying that his angel investment portfolio is “tiny, so I wouldn’t count me on any list”.

Read more: SA drone startup Aerobotics secures R8m in funding from 4Di, Savannah Fund

Read more: Silicon Valley bound: Aerobotics team set to jet off to US for Launchpad Accelerator

Ventureburn editor Stephen Timm also contributed to writing this piece.

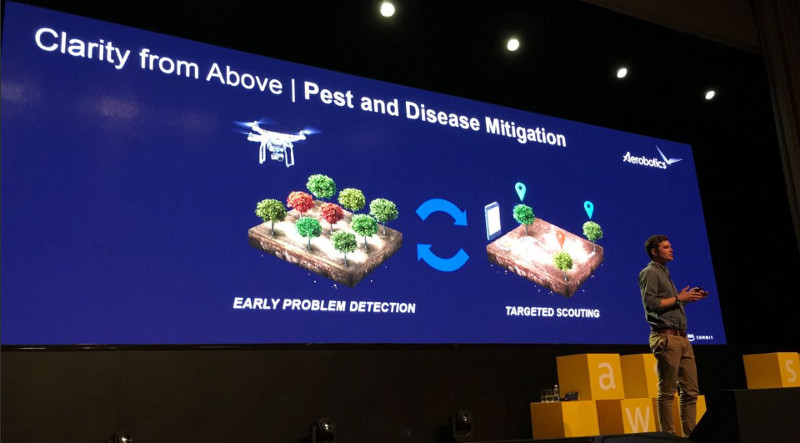

Featured image: Aerobotics CEO and co-founder James Paterson speaking at the AWS Summit in Cape Town (Aerobotics via Twitter)

*Editor’s note (13 July 2018): This story was updated by Ventureburn editor Stephen Timm when Aerobotics co-founder Benji Melzer provided comment following initial publication of the article.

**(17, 18 and 23 July 2018): The other investors that participated in the round were INGWE, Lee Edwards (the former CTO and VP of engineering at Teespring), AngelList (Asset Management) and Justin Sprat who is the head of business, Sub-Saharan Africa at Uber, according to a list provided by Aerobotic’s PR representative.

While AngelList is a platform for startups, angel investors, and job-seekers looking to work at startups, it is however not clear in some instances who exactly these investors are, as more information was not provided by the representative.

Though he declined to comment on the specifics of the deal itself, Sprat told Ventureburn in a subsequent email that the co-founders are “exceptional”.

“I invest primarily in software businesses where there is a competitive moat, which I view as a combination of exceptional talent and a unique solution to a big/important problem. AB (Aerobotics — Ed) has these ingredients in spades.”

He declined to provide names of any other startups he has invested in, saying that his angel investment portfolio is “tiny, so I wouldn’t count me on any list”.