The recently launched Cathay Africinvest Innovation Fund will invest ticket sizes of between €3-million and €15-million or the equivalent in local currency, Cathay Innovation co-founder Denis Barrier has recealed.

The fund, which was launched earlier this month, is managed by Tunis-based investment and financial services company AfricInvest and Cathay Innovation. The latter is the venture capital (VC) arm of French-Chinese private equity firm Cathay Capital.

No ad to show here.

In a joint statement last Wednesday (10 April), the two firms said the fund — which is projected to be capitalised at €150-million — will contribute to the development and scaling up of innovative companies .

The Cathay Africinvest Innovation Fund expects to invest in 15 to 20 companies within the next three years

In addition, the Cathay Africinvest Innovation Fund team will provide selected companies with high value-added support through its multidisciplinary expertise and networks.

First investment this year

Barrier told Ventureburn in an email on Monday (15 April) that the fund will be open to successful startups from any sector, but will have a specific focus on fintech, logistics, artificial intelligence, agritech and edtech startups.

The fund’s first investment, he pointed out, is likely to take place some time this year, along with a first closing of the fund. “We expect to invest in 15 to 20 companies within the next three years,” he said.

Barrier said using AfricInvest’s strong networks and offices in Tunis, Lagos, Abidjan, Nairobi, Casablanca, Algiers, Cairo, Port Louis, Dubai, and soon Johannesburg — the fund will be able to invest in any country on the continent.

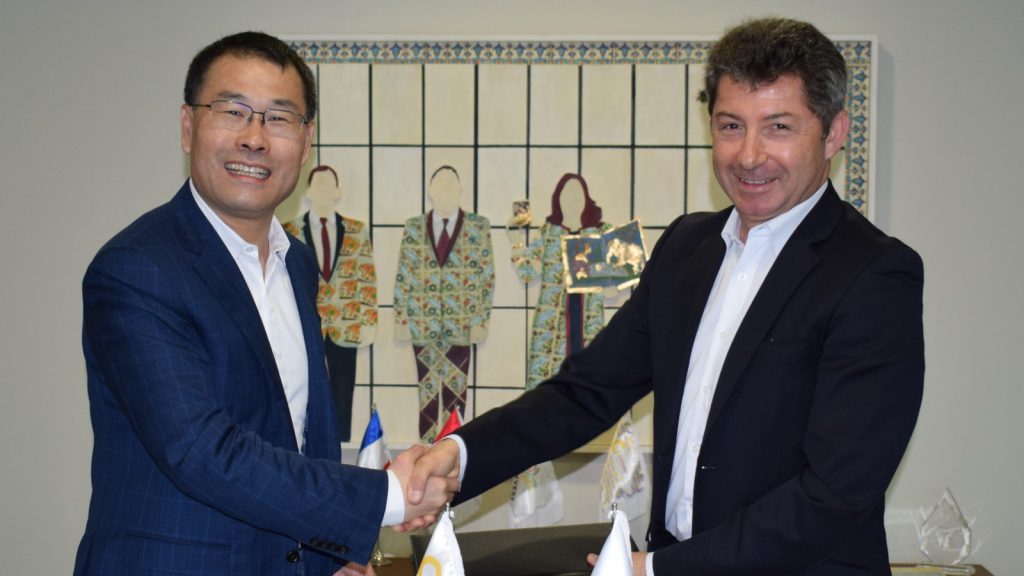

Commenting in an earlier statement, AfricInvest co-founder and managing partner Aziz Mebarek (pictured above, right) said his firm is excited about the combination of experience, expertise and networks that will be delivered through the partnership.

“Our combined objective is to provide support to a new generation of African companies in cutting-edge fields, with the ambition to grow them regionally and globally,” said Mebarek.

Cathay Innovation co-founder and chairman Mingpo Cai (pictured above, left), commenting in the same statement, said the partnership is based on shared vision and values, as well as what he described as ambitious objective in terms of impact and return on investment.

Said Cai: “We are convinced that this partnership will contribute to changing the financing and development of innovation in Africa”.

Featured image, left to right: Cathay innovation co-founder and chairman Mingpo Cai and AfricInvest co-founder and managing partner Aziz Mebarek (CathayCapital via Twitter)