Chinese consumer electronics company Honor is set to unveil its latest lineup of smart devices for the South African market. How about we forecast…

Catalyst Fund selects three Africa-focused fintech startups for accelerator programme

Three Africa-focused fintech startups — namely Turaco, Chipper Cash and Salutat — have been selected to join the Catalyst Fund‘s accelerator programme.

The Catalyst Fund is a fintech accelerator that helps startups create and deliver accessible, affordable and appropriate products for the under-served.

The accelerator, which is managed by BFA, was founded in 2016 with the support of the Bill and Melinda Gates Foundation and JPMorgan Chase & Co.

Each of the four fintech startups will receive between $50k to $60k in non-equity funding

All three startups operate in Africa. Turaco is based in Kenya and Atlanta, in the US, and Salutat in Singapore. Only Chipper Cash, which is based in the US, has African founders.

The three startups were selected for the programme together with Brazilian investment platform Diin.

US tech publication TechCrunch reported in an article last Friday (21 June) that each of the four startups will receive between $50 000 to $60 000 in non-equity funding. The startups will also benefit from six months of technical assistance.

In a statement on Medium on Monday (24 June), BFA Associate Kelly Nguyen explained that the four startups were selected as they focus on low-income customers and because they use of technology to reach customers living in low-tech and remote locations.

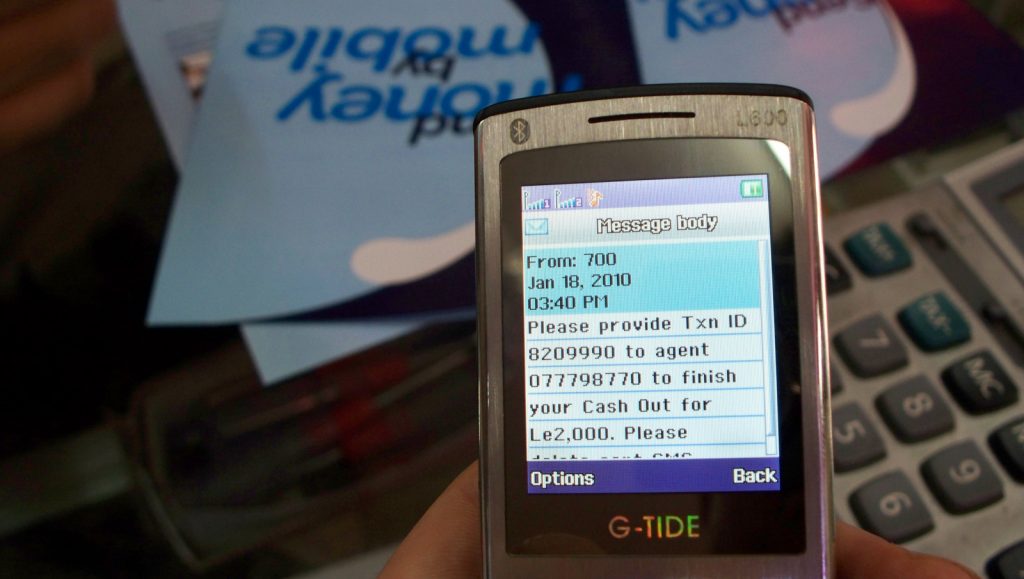

San Francisco based Chipper Cash was launched last year by Ham Serunjogi and Majid Moujaled. The startup provides a peer-to-peer (P2P) mobile money transfer service that is available in Ghana, Kenya, Rwanda, Tanzania and Uganda.

The startup’s East African and West African headquarters are in Kenya and Ghana, respectively.

Last month, Chipper Cash announced that it had raised a $2.4-million seed round led by California-based Deciens Capital and now plans to launch a merchant-focused consumer-to-business (C2B) mobile payments product (see this story).

Nguyen, in the same post, explained that Chipper Cash’s product creates “profound value” for low income customers by allowing them to easily transact for no charge.

Singapore-based Salutat is a customised communication platform that helps traditional financial institutions improve customer-relationships and customer engagement.

The startup uses advanced technology to help traditional financial institutions better understand and connect with low-income users through a more appropriate communication tool.

Nguyen explained that Salutat uses behavioural science to enhance conversations between loan officers and end-customers. By doing so the startup reduces the need for many face-to-face interactions and phone calls.

Earlier this year Salutat was selected to join Middle East and North Africa (MENA) fintech accelerator Startupbootcamp Fintech Dubai (see this story).

Turaco based in Nairobi and Atlanta, in the US, was founded in 2018 by Ted Pantone and Peter Gross. The startup provides low-cost, simple and accessible insurance products to low-income customers.

The startup, Nguyen explained, partners with businesses to provide accessible insurance products — with insurance payments as low as $2 — to blue collar workers as a business-to-business service (B2B).

US startup publication Hypepotamus reported in an article in October last year that Turaco’s expansion plans include Uganda and Tanzania.

Read more: Chipper Cash CEO on why African startups aren’t launching the next Paypal

Featured image: Institute for Money, Technology and Financial Inclusion via Flickr (CC BY-SA 2.0)