Fintech is one of the most attractive tech sectors for investment in Africa — and Nigeria, together with South Africa and Kenya, is leading the way on the continent when it comes to the number of hot fintech investments.

A report (opens as a PDF) released in March by French venture capital (VC) firm Partech Africa found that at least 33% of total funding raised by African tech startups last year was in the fintech sector, with a total of 42 deals accounting for $379-million.

No ad to show here.

When it comes to disclosed 2018 deals of over $5-million, five Nigerian startups fintech startups — Mines, Flutterwave, Paga, Paystack and Lidya — raised close to $50-million, against South Africa’s Jumo and Yoco collective over $80-million last year.

There have some notable deals this year too, with startups Kudi, TeamApt and OneFi all having raised notable investments of at least $5-million each.

In the below six startups, Ventureburn did not include Mines, Flutterwave or Paga.

We did not include Paga, which raised $10-million in a Series-B funding last year (see this story), because the mobile payments company was founded in 2009 — and is therefore not a startup any longer.

We did not include Flutterwave (which raised $10-million last year — see this story) and Mines (which raised raised $13-million also last year — see this story) as although both have Nigerian founders, both companies are based in the US.

Here then are six Nigerian fintech startups to watch:

Paystack

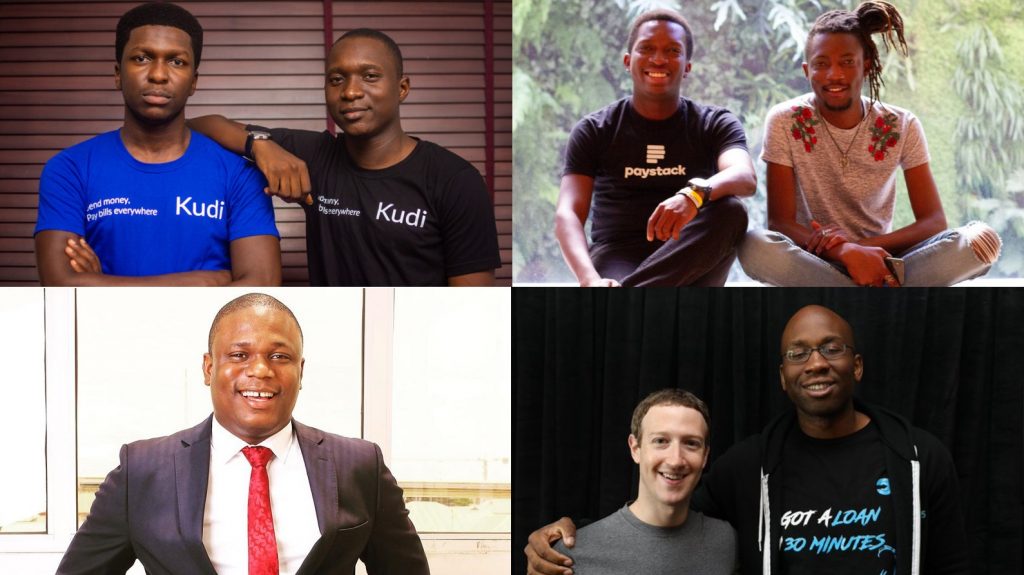

Nigerian payments startup Paystack was founded in 2015 by CEO Shola Akinlade and CTO Ezra Olubi (pictured above, left to right).

In August last year the startup announced that it had raised $8-million in a Series A funding round led by US payments company Stripe (see this story). The deal was one of the biggest by an African tech startup in 2018 (see this story).

At the time US tech publication Techcrunch reported that digital payments giant Visa and Chinese internet company Tencent were also involved in the round.

The startup, which has offices in both Lagos and San Francisco, enables Nigerian businesses to accept Mastercard, Visa and Verve cards.

In addition, the startup also supports payments through mobile money transfer services. The startup claims over 17 000 organisations use its platform. Paystack charges 1.5% and 3.9% on local and international transactions, respectively.

The startup is on a hiring spree. Last month the company posted several calls on its Twitter account for a number of available positions, ranging from a French speaking technical product specialist to a product specialist that can speak Mandarin.

Crunchbase estimates that the Lagos-based startup has raised up to $9.5-million in funding through five rounds since its launch. In 2016 the startup raised $1.3-million in seed funding from several investors including Comcast Ventures, Singularity Investments, and Tencent.

The startup made history in 2015 when it became the first Nigerian startup to be invited to join Y Combinator’s Accelerator programme (Check out the startup’s application here).

Kudi

Fintech startup Kudi is set to expand its network of bank agents in Nigeria and launch new financial products.

This, after the startup in April announced that it had raised a $5-million Series-A round led by Paris-based venture capital firm Partech (see this story).

The startup provides users with financial services that include payments, money transfers and cash withdrawals.

Y Combinator (YC) CEO Michael Seibel, together with the startup’s existing investors YC and Khosla Ventures, also participated in the round. The deal will see Partech general partner and Partech Africa Fund co-lead Tidjane Dème join Kudi ‘s board.

Kudi was founded in 2016 by CEO Adeyinka Adewale (pictured above, right) and CTO Pelumi Aboluwarin (pictured above, left), with its first product going to market in 2017.

Partech said the round — which according to this US Securities and Exchange Commission filing is likely to have commenced in March — brings Kudi’s total investment since inception, to $6.7-million.

The startup currently has an agent network of over 4500 merchants and processes over $30-million in payments a month.

Last year the startup was among one of 12 startups selected to join the first Google Launchpad Accelerator Africa class. The startup was also selected as a finalist in both the 2017 Ecobank Fintech Challenge and 2017 AppsAfrica Innovation Awards.

TeamApt

In February TeamApt announced that it had raised $5.5-million in a Series-A round led by Nigerian venture capital (VC) company Quantum Capital Partners (see this story).

TeamApt — which is based in Lagos and was founded by Tosin Eniolorunda (pictured above) in 2015 — supplies financial and payment solutions to Nigeria’s largest commercial banks — including Zenith, UBA, and ALAT.

Techcrunch reported in an article at the time that it planned to use the funds to expand its white label digital finance products and pivot to consumer finance with the launch of its AptPay banking app.

Quoting Eniolorunda, Techcrunch said TeamApt has a developer team of 40 in Lagos.

In a report also in February, business daily Business Day Nigeria said the investment is historic, as it is the first deal involving a Nigerian VC which has crossed the $5-million mark in funding technology startups in the country.

Business Day Nigeria said that since it was founded, TeamApt has signed up 100,000 Nigerian businesses and that it currently serves three million customers and processes monthly transactions valued at $160-million.

OneFi

In March, Lagos based finance company OneFi announced that it had acquired payments solutions startup Amplify for an as yet undisclosed amount (see this story).

Lagos based Amplify said the deal — which took effect on 1 March — will see OneFi add Amplify’s assets, trademarks, as well as the fintech’s flagship products AmplifyPay and mTransfers to its portfolio.

The acquisition will also see Amplify co-founder and CTO Maxwell Obi join OneFi as a head of payments and SME services, while Amplify co-founder and CEO Segun Adeyemi will leave to pursue new ventures.

It’s been a busy year so far for the startup. In the same month it announced that is had secured a $5-million debt facility from New York and Nairobi-based debt platform Lendable (see this story).

OneFi said the investment would be used to deploy more loans on its consumer facing mobile platform Paylater. The platform also helps users transfer money, recharge airtime and pay bills.

OneFi was founded in 2012 by CEO Chijioke Dozie (pictured above with Facebook’s Mark Zuckerberg) and director Ngozi Dozie. OneFi has raised a total of $13.8-million in venture capital.

OneFi said in March that since launching Paylater in 2016, the consumer facing platform has deployed over $60-million across 750 000 loans — approving over 1500 loans daily at an average of $80 per loan.

In 2017, Paylater was one of three African startups selected to join the fifth class of Google’s Launchpad Accelerator. In the same year, the platform was also one of 20 finalists of the Ecobank Fintech Challenge. Last year, Paylater was one of five finalists in the fourth edition of the AppsAfrica Innovation Awards.

Lidya

Lidya’s platform assists small African businesses to manage their funds as well as access credit. The startup was founded in 2016 by Ercin Eksin and Tunde Kehinde (pictured above, left and right).

In May last year the startup announced that it has raised $6.9-million in a Series-A round led by Silicon Valley-based philanthropic investment firm Omidyar Network (see this story). The deal was one of the biggest by an African tech startup in 2018 (see this story).

At the time Lidya said the funding would be used to scale operations in Nigeria, as well as to launch in new markets in Africa, in addition to hiring more staff and expanding the company’s loan book.

Since its launch, Lidya claims it has provided over 1500 loans to business operating in retail, farming, tech, hospitality, and logistics.

In 2017 the startup — which is a participant of the MasterCard Start Path Programme — raised $1.25-million in a seed round led by Accion Venture Lab.

Piggybank.ng

Automated savings platform Piggybank.ng announced in June last year that it had raised $1.1-million in seed funding (see this story).

The $1.1-million investment was led by LeadPath Nigeria co-founder Olumide Soyombo. Two venture capital firms, Village Capital and Ventures Platform, also participated in the round.

The platform which targets low-income Nigerian millennials was founded by Somto Ifezue, Odunayo Eweniyi and Joshua Chibueze (pictured above, left to right) founded in 2016.

Last year’s round follows the $50 000 seed funding that the startup received in 2017 from Village Capital (see this story).

The company, which helps its 53 000 users, known as Piggybankers, save about $55 per month — claims it has recorded between 20% to 35% growth in users.

Piggybank.ng’s platform is free to anyone and users can save from $1 a day. Users get to restrict withdrawals until an agreed date. Alternatively, users can withdraw their savings on a quarterly basis, whereby savings drawn outside of the agreed day attract a five percent early withdrawal fee.

Savers can expect to earn on average six percent per annum on automated savings or 10.95% per annum on the fixed deposit product, Safelock where they can withdraw funds once per quarter.

The startup has participate in several accelerator and business development programmes, including Google Launchpad Africa, Blackbox, CcHub’s Pitch Drive and Google for Entrepreneurs.

*Both Ventureburn editor Stephen Timm and writer Daniel Mpala contributed to this piece.