Chinese consumer electronics company Honor is set to unveil its latest lineup of smart devices for the South African market. How about we forecast…

ABAN, research firm Briter Bridges partner to map Africa’s investment landscape

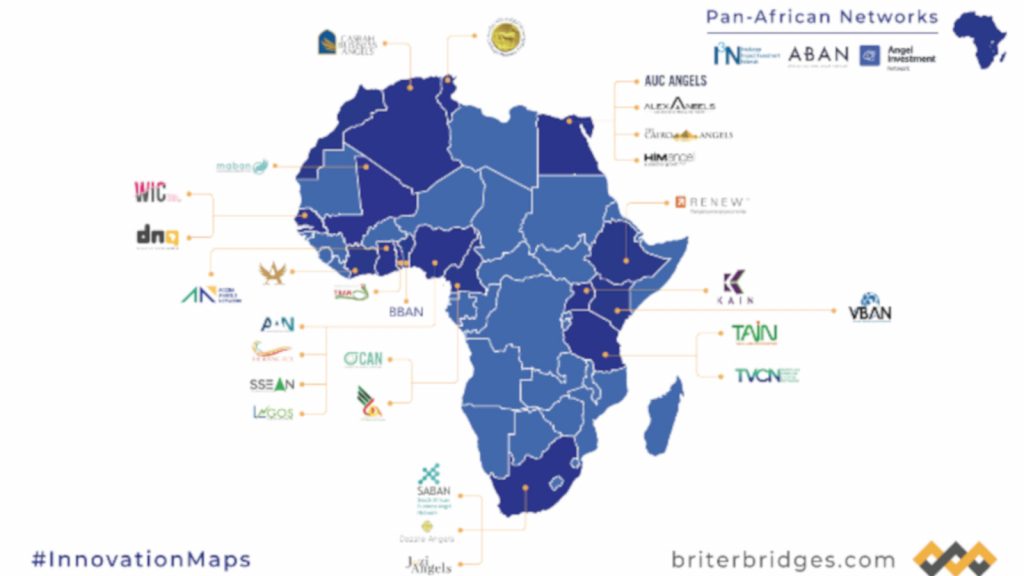

The African Business Angel Network (ABAN) has partnered with Briter Bridges, a London-based think-tank and data driven research firm, to map Africa’s investment landscape.

Briter Bridges said in a statement last Thursday (22 August) that the initiative will focus on funding dedicated to tech startups.

Briter Bridges founder Dario Giuliani explained in a post on LinkedIn that in mapping the investment landscape, the two organisations will not only focus on venture funds, but also on the work of angel investors, angel investment networks and impact investors on the continent.

The findings of the mapping exercise will be presented at the Africa Early Stage Investment Summit

“Our collaboration comes as part of a commitment to dramatically increase the amount and the quality of the available data across Africa’s technology ecosystems and other under-served markets,” said Giuliani.

The findings of the mapping exercise will be presented at the Africa Early Stage Investment Summit which takes place on 13 and 15 November in Cape Town.

The research firm pointed out that mapping exercises are valuable tools when it comes to outlining the state of development of a specific industry or market.

The firm has released a series of over 50 visual maps that provide extensive snapshots of technology ecosystems in Africa, the Middle East and North Africa and South Asia.

Briter Bridges is looking to build a publicly accessible library of data and maps which the firm hopes will cut down the cost associated with preliminary market research.

“Throughout Briter Bridges’ research work, partnerships and crowdsourcing have proven an effective approach to gathering information scattered across the different ecosystem players, and the only real way to decentralise the research while maintaining granularity,” the firm said in its statement.

It added that the partnership with ABAN will give it far-reaching access to angel investors and angel investment networks on the continent and beyond.

This, the firm said, will help it to extend the research beyond the conventional venture capital space.

“It will also constitute a first step towards increasing the dialogue with angel investors and it will do so by putting forward more informative sets of data,” said Briter Bridges.

Investors, as well as those that represent organisations that invest in the continent, can register to list on Briter Bridges database here.

Read more: Screenshot of main African angels networks (Briter Bridges)