Artificial Intelligence is no longer a distant promise or a Silicon Valley experiment. It’s embedded in the now. South Africans are already using generative…

SA had bumper VC year in 2018 with investments up 31% over 2017, reveals report

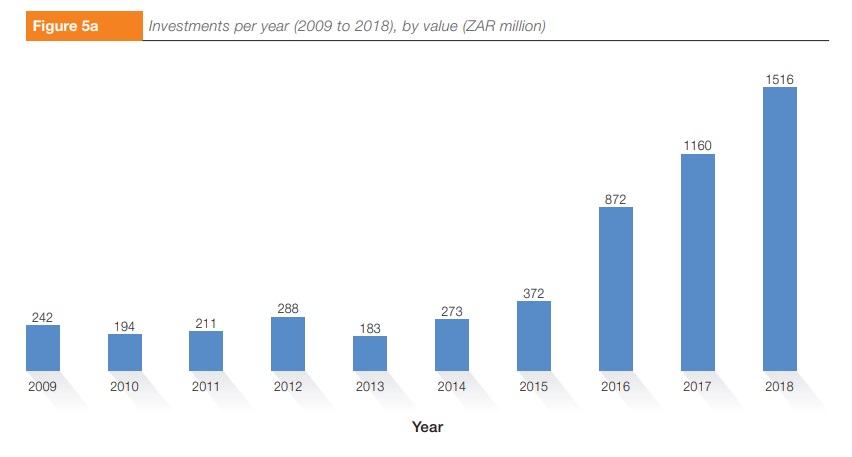

Venture capital (VC) had a bumper year in South Africa in 2018, with southern African VC funds having made investments of over R1.5-billion last year — an increase of 31% from the over R1.1-billion invested by such funds in 2017.

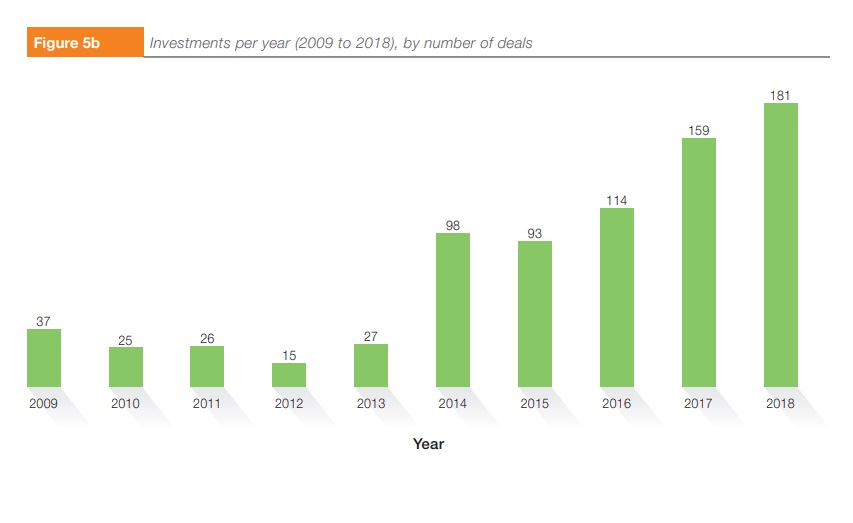

This, while the number of reported South African VC deals rose from 159 deals in 2017 to 181 last year (see below graphs — Figure 5a and 5b drawn from the report ) — the latest Southern African Venture Capital and Private Equity Association’s (Savca) Venture Capital Industry Survey has revealed.

The report which was released earlier this month, was carried out in collaboration with research partner Venture Solutions. The survey features data gathered from over 50 fund managers as well as other industry investors.

The VC sector had one of the best years in South Africa in 2018, with deal value up 31% over 2017 — reveals a new report

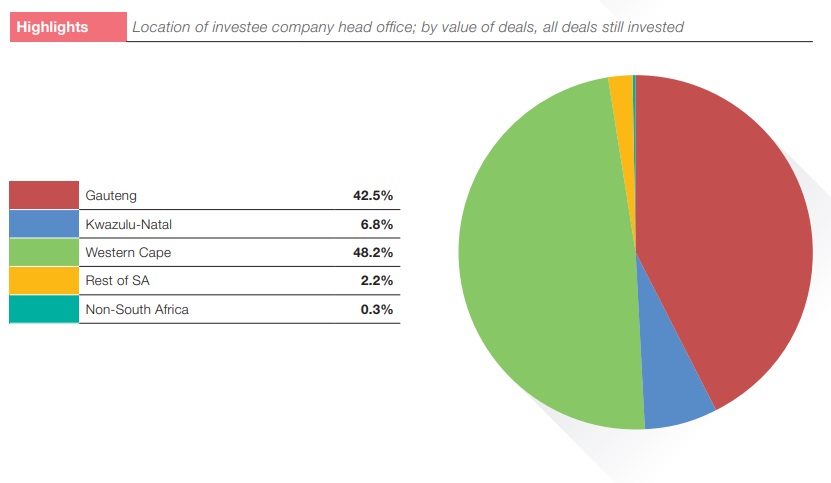

While the report also covered countries bordering South Africa — Namibia, Botswana, Lesotho, Swaziland, Mozambique and Zimbabwe — South Africa accounted for 99.7% of all deal value under management currently.

Presenting the report at an event held at law firm Bowmans’ offices in Cape Town last night, the report’s author Venture Solution’s Stephan Lamprecht said last year’s figures were evidence that the VC sector is on an “exponential upward curve”.

“The quantums that investees are raising — we haven’t seen that in recent years,” he added.

He surmised that driving the increase has been the recent uptake in the funds registered under the South African Revenue Services’s (Sars) Section 12J of the Income Tax Act (see this story).

The incentive allows investors who make investments in approved VCCs — that then invest in qualifying small companies — a tax deduction.

Growth in seed, startup deal value

In 2018, 41% of all deals by value were in startup capital.

The total number of deals invested through seed or startup deals amounted to 60% of all deal value — up from 57% in 2017 and 49% in 2016.

Despite the growth in early-stage deals by share of deal value, Lamprecht said South Africa still needs to improve the system that taps into talent and that more must be done to get industry to invest in the startup sector, beyond just enterprise development deals.

Gauteng firms get biggest share

When it comes to the location of investees, Gauteng businesses last year received the largest share of VC money (R658-million), up 38% from 2017. This, while the Western Cape saw an increase in 2018 of 14% in VC investments. amounting to R433-million.

The report also noted that KwaZulu-Natal backed VC businesses saw a significant increase in activity in comparison to 2017, with R71-million invested in 2018.

By number of deals, Gauteng has shown significant growth. In 2014 just 19 deals were conducted in the province, climbing to 41 in 2017 and 73 last year.

In comparison, the number of deals in the Western Cape has been more stable — 41 in 2014, 45 in 2017 and 61 last year (see below graph — Figure 7b).

Low number of exits

Concerning however, noted the report is that overall exit activity remains low. Just 11 exits took place last year, compared to 15 in 2017. Most exits are by trade sales.

Of the 11 last year, six were reported as profitable, compared to nine in 2017 (see below, Figure 9).

Lamprecht attributed the low number of exits to evidence of South Africa’s nascent VC industry. He pointed out in the report that a range of opportunities and early stage investment challenges need to be addressed in order for the industry to continue to grow and mature.

VC has R5.3bn under management

So, that was 2018, but how much capital have VC fund managers in the Southern Africa currently deployed?

The report puts this figure at the end of 2018, at over R5.3-billion, invested in 665 active deals.

Most of these funds are being deployed in the Western Cape (48.2% of active deal value), followed closely by Gauteng (42.5%). By number of transactions the Western Cape accounts for 52.6% and Gauteng 34.6% (see below graph).

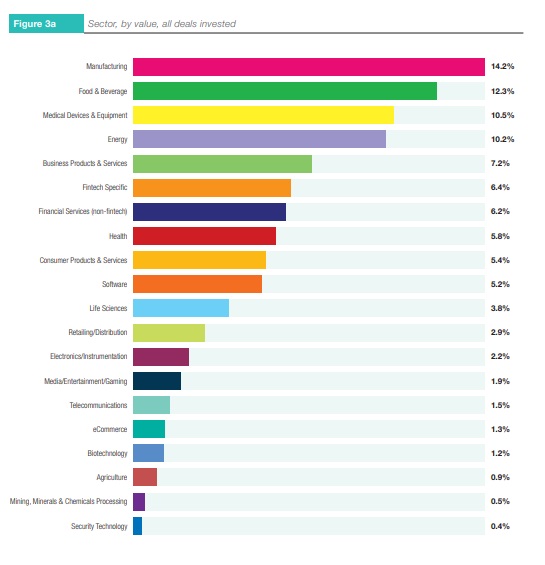

Manufacturing comprised 14.2% of the value of all deals invested at 31 December 2018 with the food and beverages sector and medical devices and equipment sector accounting for 12.3% and 10.5% respectively (see below graph — Figure 3a).

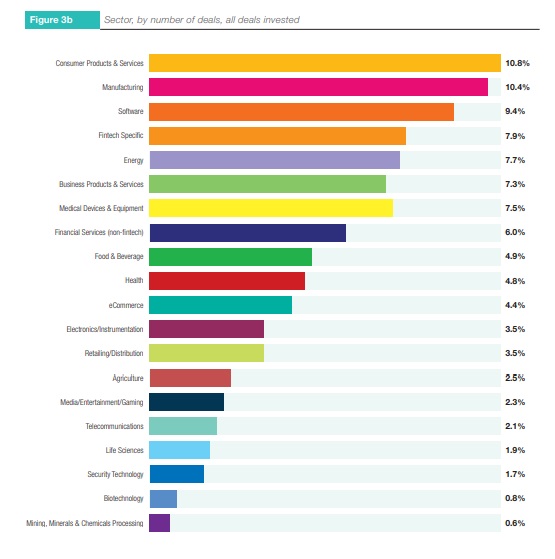

Software amounts to only 5.2% of deals if taken by value (and 9.4% by deal number — see below graph — Figure 3b), and consumer products and services to 5.4% (10.8% by number), but combined these make up one in five transactions under management currently.

The report also noted that deals in energy type businesses amount to the fourth largest share in active deals if taken by value. Lamprecht pointed out that the growth in this sector had been stimulated by the 12J tax incentive, with investors having invested in solar PVR units among others.

For example, the number of deals jumped to 24 in 2018, from less than four in 2017. Software was also up significantly, from eight to 17.

In all, consumer products and services account for the largest share of active deals by number (10.8%), followed closely by manufacturing (10.4%) and software (9.4%).

The latter mirrors the global trend for investing in deals involving software, including many transactions classified as Consumer Products & Services where the business activity involves software, noted the report.

South Africa’s economy might be mired in political and economic uncertaintly, but the VC sector is growing in leaps and bounds.

Says Lamprecht: “We haven’t seen anything that will decimate the sector, despite the current economic and political challenges”. The question is, will it keep booming?

Read more: Is spike in energy deals evidence that Section 12J funds are driving VC boom in SA?

Read more: Southern African VC sector invested over R1bn in 2017 reveals Savca report

Read more: Here are eight facts you should know about venture capital in South Africa