Have you ever wondered how much easier travel has become, thanks to the digital innovations shaping our world? Exploring new destinations used to mean…

Tech firms serving Africa raised over $2bn in funding in 2019 reveals Partech report

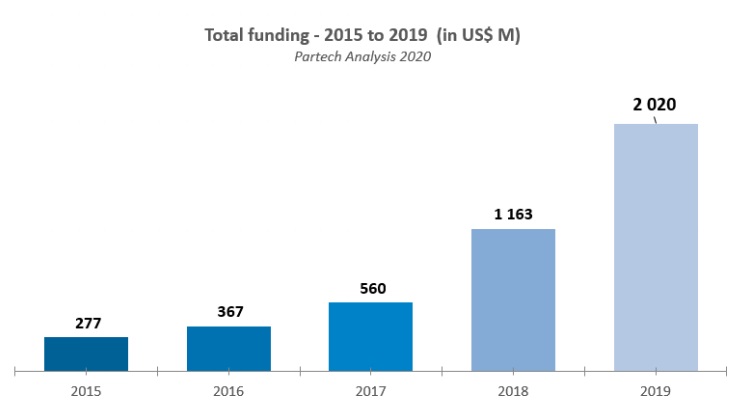

Venture capital (VC) investments in tech companies that serve the African market last year grew 74% over 2018 — to total over $2-billion, through 250 rounds, up from 164 in 2018, reveals a new report by Partech Africa.

Partech says the findings in the report (opens as a PDF) — which it launched yesterday — indicates that 2019 was another record-breaking year for investments in Africa’s tech sector.

The French venture capital (VC) firm’s report covers equity deals in tech and digital spaces, and funding rounds higher than $200 000.

Partech Africa’s new report reveals that tech companies that serve the African market last year netted over $2bn in VC investments

It includes tech firms of all sizes and ages that serve the African market (firms included in the report could be based outside Africa, as long as the continent was the firm’s primary market).

Some of the report’s key findings were:

- 250 rounds higher than $200 000 were raised by 234 tech firms, compared to 164 rounds by 146 tech firms the year before.

- 206 of the 250 transactions were in the seed and Series A investment stage.

- While the total funding grew by 74% to $2.02-billion over 2018, this was at a slower pace in 2018 when it grew by 108% to over $1.1-billion over 2017.

- 70 investors made two or more transactions in 2019, compared with 20 investors only, back in 2017. The top five most active investors each concluded seven or more deals.

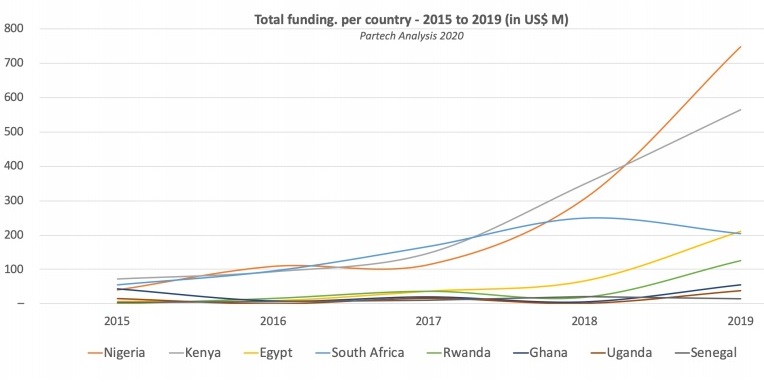

- 85% of the total funding ($1.7-billion) went to firms serving just four countries: Nigeria, Kenya, Egypt and South Africa. Nigeria attracted a record high of $747-million (38 deals) in tech VC investment (37% of all funding), but only took fourth place behind Egypt in deal count. Kenya netted $564-million in 52 deals, while Egypt received $211-million in 47 deals.

- Investments in South Africa have slowed down compared to Kenya and Nigeria in terms of total funding, with $205-million, down 18% over 2018, but remains number one in terms of deal count with 66 deals (up 78%). In all, 11 tech firms raised 11 rounds equal to or higher than $5-million (see this story)

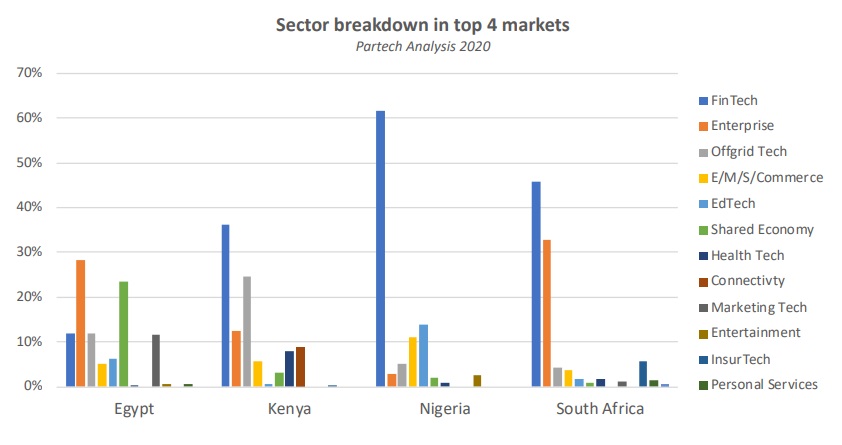

- Financial inclusion remains the main investment sector in the continent, attracting 54.5% of the total funding. Online and mobile consumer services sector increased to 29.3% of total funding (19.6% in 2018).

How much is the figure really?

Partech’s total investment figure of over $2-billion is notably larger than that of tech startup deals reported by Ventureburn in 2019, of nearly $290-million (see this story), as the French venture capital (VC) firm does not distinguish between startups (ie news firms) and more mature tech companies — tracking internet technology firms of all sizes.

In its analysis Ventureburn considered only those deals that were disclosed and that were concluded by companies founded in the last seven years and based on the African continent.

However, Partech’s authors also considered tech firms based outside of Africa, whose primary market is the continent. The company could for example be based in the UK or France, but be serving African customers.

In addition, unlike Ventureburn’s figure, Partech Africa’s figure also included disclosed and undisclosed deals.

Undisclosed deals that the VC was able to subsequently gain information on, represented 30% of the deals (75 deals) but amounted to a mere 11% of the total funding ($213-million).

Three more reports

Partech’s report is one of three released this month that aim to put a figure to how much funding went to African tech firms.

Earlier this month, London-based research firm Briter Bridges released an investment summary, saying African tech companies raised $1.27-billion in funding across 167 disclosed deals in 2019.

A subsequent report published by tech publication WeeTracker states that last year, African ventures raised a total of $1.34-billion in venture capital across 427 deals. It’s not immediately clear what methodology was used for the report.

Tech publication Disrupt Africa’s African Tech Startups Funding Report 2019, puts the amount of funding African tech startups raised at a lower $491.6-million. It says the number involves 311 companies which netted investment from disclosed deals. It is not immediately clear what the publication defined as an African tech startup.

A difference in methodology aside, one thing is certain — investment in Africa’s tech sector is rising fast.

Read more: African tech firms closed funding deals worth $1.27b in 2019 – Briter Bridges report [Updated]

Read more: Are these the 10 biggest deals by African tech startups in 2019?

Read more: Are these SA’s 11 biggest disclosed VC deals in 2019? [Updated]

Read more: African tech startups raised over $1.2bn in funding in 2018 – Partech report

Read more: African funding figures – what’s the real number? [Opinion]

Read more: Weetracker African VC report raises questions on definition of tech startups

Read more: Tech startup site Disrupt Africa mum on how it collects data for $150 reports [Updated]

Read more: AfricArena predicts funding raised by African startups in 2018 will crack $1bn

Featured image: jozuadouglas via Pixabay