LG’s 100-Inch QNED evo AI TV Redefines Big-Screen Viewing in South Africa In a bold leap forward for home entertainment, LG Electronics South Africa…

African tech firms closed funding deals worth $1.27b in 2019 – Briter Bridges report [Updated]

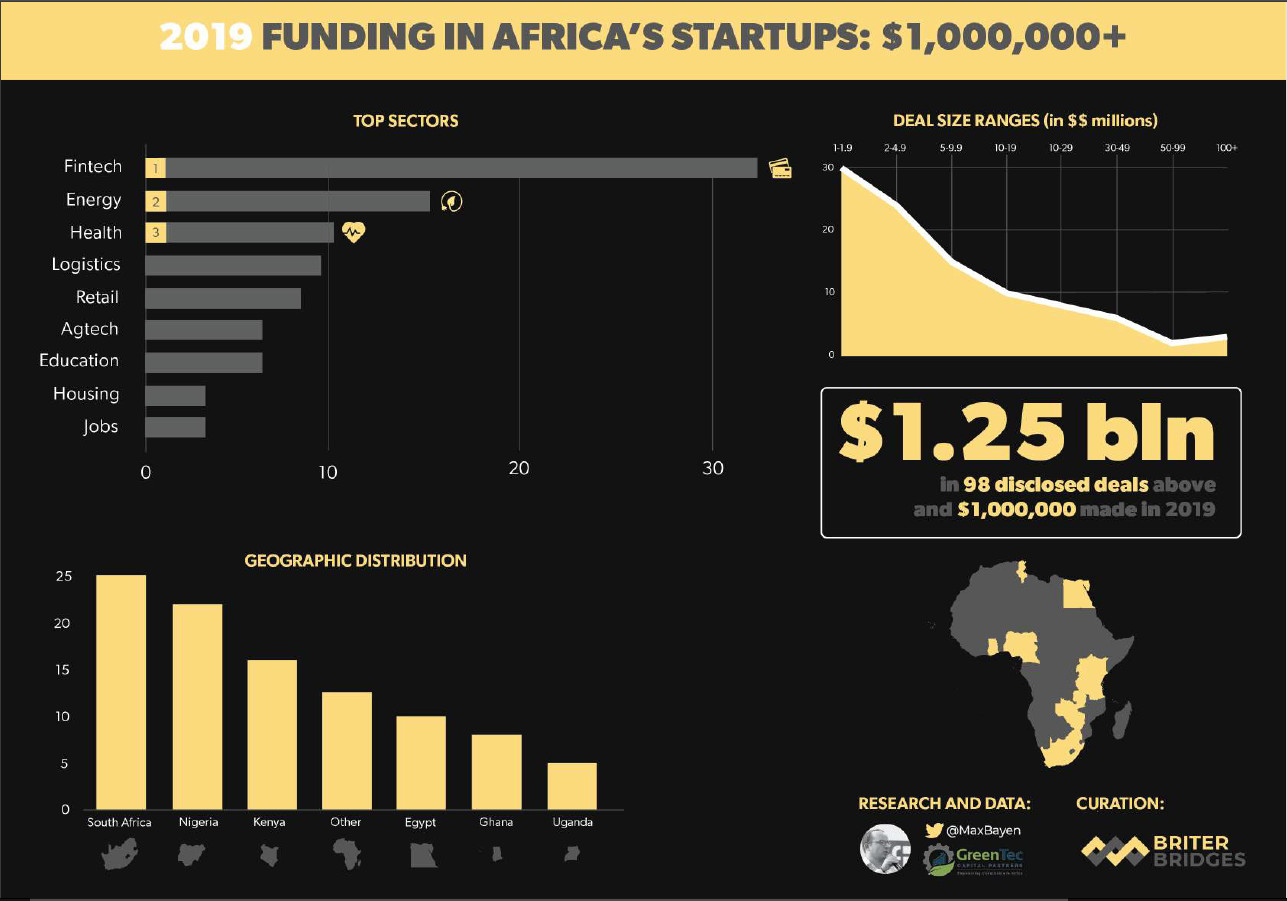

African tech companies raised $1.27-billion in funding across 167 disclosed deals in 2019, an investment summary by London-based research firm Briter Bridges has found.

The report (available for free to download here) is based on research and data collected by GreenTec Capital Partners senior company builder Maxime Bayen and includes deals that were disclosed in 2019, up to 30 December.

Briter Bridges said the report integrates Bayen’s list of companies that raised over $1-million with the research firm’s own list of deals below $1-million.

The report looks at variables such as type of technology used, product built and market addressed.

The research firm also explained that the report, which also includes two maps on Africa’s investor landscape, refers to disclosed deals and not what startups in Africa raised in 2019.

African tech firms raised $1.27-billion across 167 disclosed deals — Briter Bridges 2019 Africa investment summary

At least 98 of the 167 deals were worth $1-million or more last year, states the investment summary which was published earlier this month.

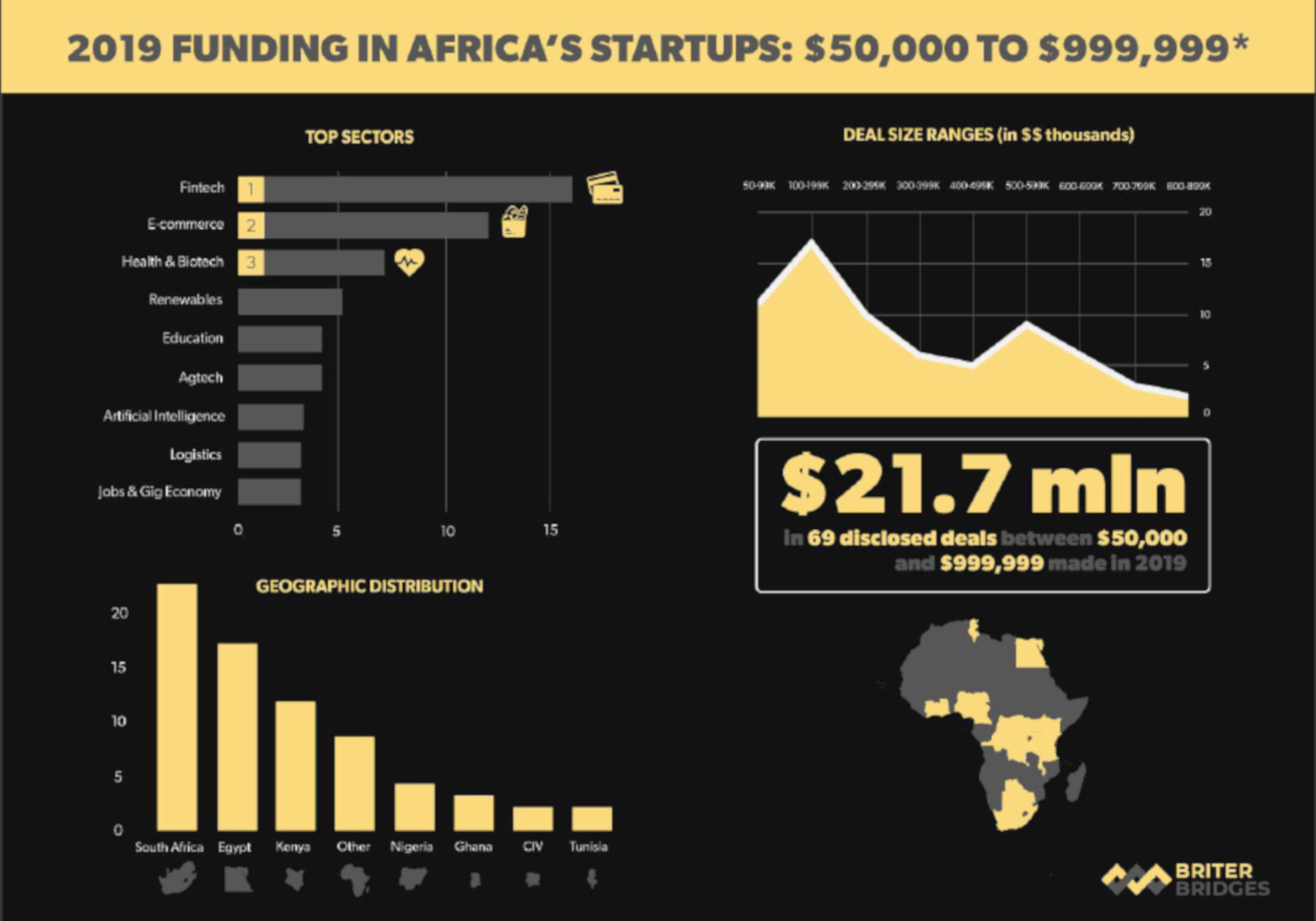

The report also found that African companies closed 69 funding deals worth between $50 000 and $999 999. These transactions total $21.7-million.

It is likely this figure could be higher as some startups have not opted to disclose their deals.

Briter Bridges last Friday (10 January) called on those with information on deals that aren’t part of the summary to add this information to the research firm’s platform.

https://twitter.com/Briter_bridges/status/1215507856398671872

Biggest deals in fintech, energy and health

The summary found that among the big ticket deals — those of at least $1-million and above — the majority of the funding was raised by startups operating in the fintech (over 30 transactions), energy (about 15 deals) and health (10 transactions) verticals.

This while the top investment destinations were South Africa, Nigeria and Kenya, respectively.

Fintech vertical dominates deals under $1-million

Looking at verticals, a similar trend is apparent among smaller ticket deals of between $50 000 to $999 999 with the fintech vertical coming out tops with more than 15 deals.

The next biggest sector among smaller ticket deals of between $50 000 and $999 999 is e-commerce with over 10 disclosed transactions.

A subsequent report published by tech publication WeeTracker states that last year, African ventures raised a total of $1.34-billion in venture capital across 427 deals. It’s not immediately clear what methodology was used for the report.

Tech publication Disrupt Africa’s African Tech Startups Funding Report 2019, released yesterday (20 January), puts the amount of funding African tech startups raised at a lower $491.6-million. It says the number involves 311 companies which netted investment from disclosed deals.

It is not immediately clear what the publication defined as a African tech startup. This is not made clear on the landing page for the report. While this may be contained in the report itself, the report is only visible to those that pay the $300 to purchase it.

Among tech startups under seven years-old which are based on the continent that disclosed their deals, Ventureburn tracked a total of 88 transactions in 2019 which amounted to about $290-million (see this story).

Read more: Are these the 10 biggest deals by African tech startups in 2019?

Read more: Are these SA’s 11 biggest disclosed VC deals in 2019? [Updated]

Read more: Infographic: The 120 tech companies that operate in Africa’s logistics sector

Read more: ABAN, research firm Briter Bridges partner to map Africa’s investment landscape

UPDATE (21 January 2020): The article has been updated to include figures from tech publication Disrupt Africa’s African Tech Startups Funding Report which states that 311 African tech companies raised $491.6-million in disclosed deals last year.

Featured image: Vladimir Solomyani via Unsplash