Egypt topped the Middle East and North Africa (MENA) region last year when it came to the number of investments concluded by tech startups, a new report has found.

While this may be so, the figures revealed in a new report released earlier this week by Dubai based tech publication Magnitt, which covers the MENA region, differ widely from those of previous recent reports on the sector.

No ad to show here.

The 2019 Egypt Venture Investment Report, revealed that last year there were 142 startup investments in Egypt (up 26% over 2018), totalling $95-million (up 13%) — both a record high, it said.

Magnitt’s new report also found that startup exits reached an all-time high, with eight in 2019, including Harmonica’s acquisition by dating giant Match Group (see this story) and Fawry’s initial public offering (IPO).

According to a new report by Magnitt, Egypt in 2019 had a record 142 startup deals valued at over $95m

In terms of acquisitions, notable was Souq’s $580-million acquisition by Amazon and Careem’s $3.1-billion acquisition by Uber.

The report’s authors said the country now had more investors than ever before, with 52 institutions invested in Egypt-based startups in 2019 — with nearly two-thirds of these coming from outside the country.

What’s the true number?

Previous calculations and reports that have covered Africa’s venture capital (VC) sector put the number of deals in Egypt during 2019 at a lower figure — at between 24 deals to 83 deals, but at a higher investment total ranging between $73-million and $211-million. These include:

- In a recent report (opens as a PDF), Partech calculated that in 2019, $211-million went to Egyptian tech startups in 47 deals (see this story). The French VC fund defined startups quite broadly and included companies based outside of Africa, but with their main market in Africa.

- Tech publication Disrupt Africa in its annual Funding Report, put the figure at almost $90-million that went to 83 tech startups (see this story). It’s not clear what the publication defined as a tech startup.

- Ventureburn, which considered only those disclosed VC deals for early-stage companies (no more than seven years old) found that Egyptian startups raised $73.3-million through 24 deals (with Swvl‘s $42-million deal accounting for the majority of this) (see this story).

In addition, two other publications also include data on Egyptian deals, namely a report published by tech publication WeeTracker and an investment summary by research firm Briter Bridges .

The difference in figures could be largely down to how each researcher has opted to define tech startups and how it has collected the data (particularly as a large number of deals are not disclosed in the media).

No definition of startup

In the Magnitt report’s methodology (which Ventureburn was given sight of), the authors don’t define exactly what constitutes a tech startup.

For example, do the report’s authors consider only software firms, or are those that have developed hardware technology also included? And, is a startup by its definition limited to the age of the firm?

Furthermore the report, which Magnitt is selling for $599, doesn’t say what criteria it used to define whether a firm is Egyptian or not, other than to say that Egyptian-headquarted firms were included. This is particularly important, as a number of Egyptian firms are registered offshore.

The report however, stresses that funding raised by public companies of any kind on any stock exchange is not included in the data.

What Magnitt does note is that it collects and aggregates data on the startup ecosystem through multiple channels.

These include a quarterly followup with over 100 funding institutions requesting details on all investments which include stage, date, amount as well as other co-investors involved.

The publication also gleens investment information from public announcements such as press releases. Thirdly, institutions and startups are able to list information such as investment raised on Magnitt’s platform.

While the true number of deals and size of investment may be up for debate, what is clear is that of late money has been rushing to tech startups in Egypt.

The big question, given the onset of the coronavirus is, will the rush continue?

Read more: How Partech Africa took on the headache of counting VC money in African startups

Read more: Tech firms serving Africa raised over $2bn in funding in 2019 reveals Partech report

Read more: Why the VC sector has taken off in Egypt in 2019

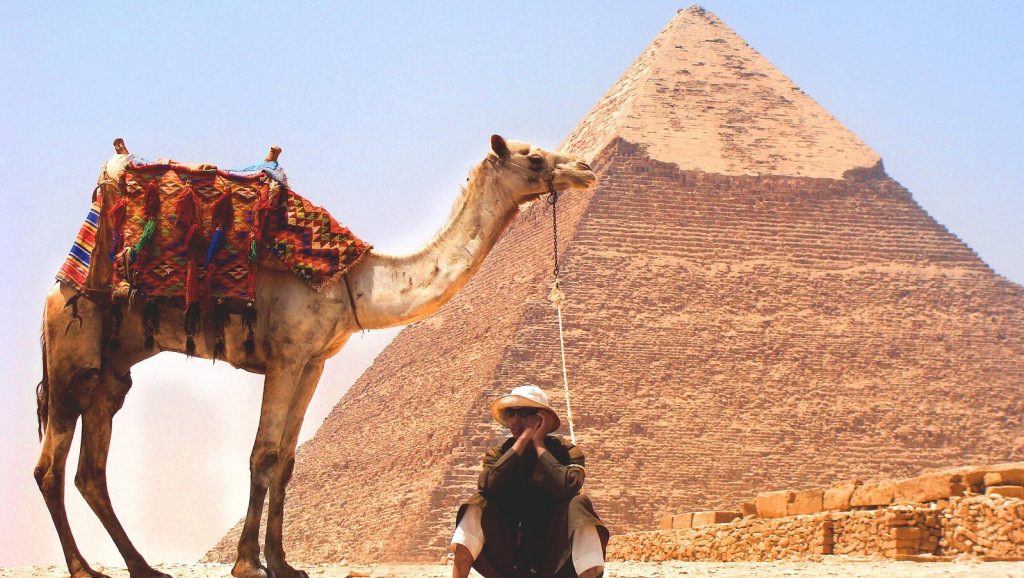

Featured image: StockSnap via Pixabay