Artificial Intelligence is no longer a distant promise or a Silicon Valley experiment. It’s embedded in the now. South Africans are already using generative…

Want to know where to invest during a recession?

Financial markets have experienced the fastest ever crash over the past few weeks. Even during the 2000’s dotcom bust and the 2008 Great Financial Crisis, stocks didn’t fall this quickly.

In less than a month, we have seen major indices fall almost 30%, and stocks in sectors like oil and travel are down by 80%.

South Africa’s credit ratings have been slashed to junk status and the rand has depreciated by more than 25% relative to the dollar this year. We are experiencing terrifying daily declines that we haven’t seen since the 1929 stock market crash that preceded the Great Depression.

We are at a watershed moment: Covid-19 is a catalyst fast bringing the creaking financial systems around us to a halt and it’s already changing our lives in all sorts of unpredictable ways.

When it comes to the virus, we are looking at a black swan event — something that happens once a century. We don’t have good data on what the stock market did during the 1918 Spanish flu, but we do know that it led to a severe recession.

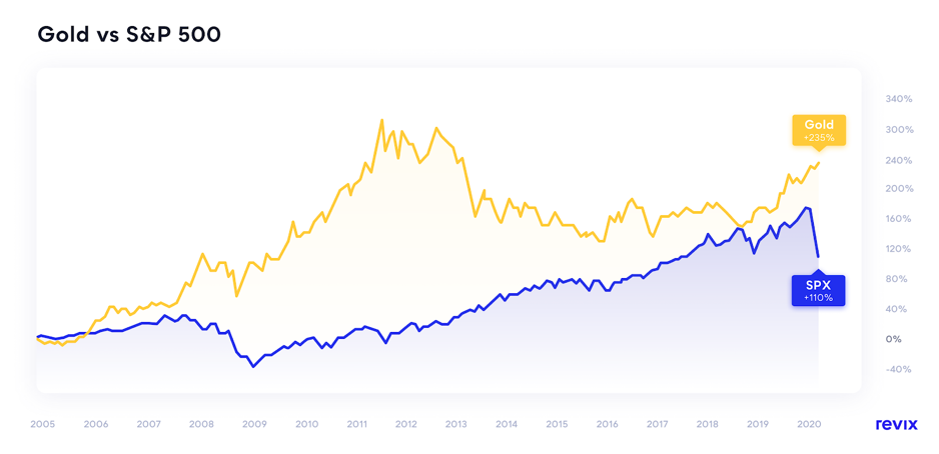

Fortunately for investors, there are investments that tend to either hold steady in a downturn or rise when markets suffer. While history can’t predict what will happen in the future, gold has historically performed well in times of crisis — and it appears to be leading the pack again.

Gold is scarce, malleable, beautiful, universally precious and it has a couple of thousand years of trading history behind it.

Although gold doesn’t generate an income, it is considered an insurance-like safe-haven investment option and it is widely recommended as part of a diversified investment portfolio. This is particularly true in times of turmoil and rapid rand depreciation, which is now down more than 25% relative to the dollar this year.

In the 2008 Great Financial Crises, when the stock market dropped by 30%, gold was up by the same amount. In 2019 its price jumped 20% as a result of geopolitical uncertainty and so far, its price is up by over 10% this year while most other asset classes are deeply in the red.

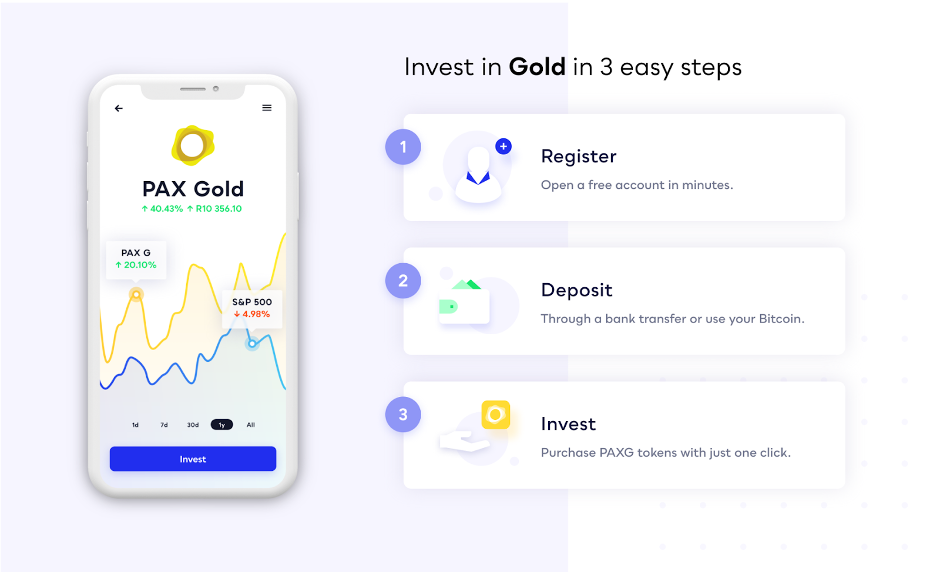

Since 2008, we’ve witnessed the incredible rise of fintech. With the launch of digital investment platforms like Revix, you can now invest in tokenised gold, or PAX Gold — a gold-backed token which tracks the real-time market price of gold and a fast, effortless way to invest in physical gold.

Revix, backed by JSE listed Sabvest, launched PAX Gold last Friday in response to an increasingly urgent customer demand for new stable investment options to protect their wealth in the current uncertain climate.

Sean Sanders, CEO and founder of Revix, comments: “Our world is changing, and our investments should too. We built Revix to provide a ladder of opportunity for wealth creation and in times like these, wealth preservation. People are looking for the best way to protect their portfolio and diversify, so we’ve responded by making it possible to invest in safe-haven assets like gold for as little as R500.”

What is tokenised gold?

In plain English, tokenised gold is when a gold bar stored in a secure vault is legally converted into digital tokens that can be transferred, stored, and recorded on a blockchain. This makes it easier to own or trade and doesn’t carry the burdens of storage fees, insurance or custodianship.

What is PAX Gold?

PAX Gold, with the ticker PAXG, is an asset-backed token where one token represents one fine troy ounce of a London Good Delivery gold bar, stored in professional vaults in London.

Anyone who owns PAX Gold owns the underlying gold which is held under the custody of Paxos Trust Company.

This means the value of PAX Gold also tracks with the real-time market price of gold. PAX Gold can be purchased using rands or other cryptocurrencies like Bitcoin.

The gold-backed PAXG token is the only fully regulated gold token that you can redeem for LBMA accredited Good Delivery gold bullion bars.

Unlike traditional gold, which is only available to settle trades during banking business hours, PAX Gold can be traded anywhere, anytime.

Investors also benefit through the ease of purchase as they don’t have to worry about the custodianship and safety of their holdings, as all gold is kept safe in secure, accredited precious metal vaults in London, as well as being registered on the blockchain.

Leading the pack

As Warren Buffett noted in a 2008 Berkshire Hathaway shareholder meeting, “the market might go up, the market might go down, the economy might fluctuate, but there will always be intelligent things to do”.

So, while the financial markets have experienced the fastest ever crash over the past few weeks, there are assets that can perform, even during a recession. You just need to know which ones.

Your world is changing, your investments should too. It’s time to invest in gold.

About Revix

Revix is an intelligent investment platform that allows anyone to create a diversified portfolio or “Bundle” of assets in just a few clicks.

Revix was built to provide a ladder of opportunity for wealth creation and in times like these, wealth preservation. PAX Gold was launched so that anyone, anywhere can invest in safe-haven assets like gold for as little as R500.

Revix will guarantee your PAX Gold investment this Easter

Give a golden egg this Easter!

If you sign up to Revix and refer a friend, Revix will guarantee both of your PAX gold investments – that’s 10 days of risk-free investing where the worst you can do is break even. You’ll both keep all your PAX Gold profits and Revix will cover any downside.

For more information, head to www.revix.com.

Company Office is a subscription-based press office service.