LG’s 100-Inch QNED evo AI TV Redefines Big-Screen Viewing in South Africa In a bold leap forward for home entertainment, LG Electronics South Africa…

Safaricom’s financials show how much stake it owns in the new M-Pesa venture

This article is brought to you as part of a new partnership between two of Africa's foremost news and information platforms for African tech startups, Ventureburn and Techpoint Africa.

In 2007, M-Pesa was launched as a product by UK telecommunications company, Vodafone and its subsidiary, Safaricom, the largest telco operator in Kenya.

Since then, it has become one of the largest mobile-based financial services in Africa as over 40-million users and 400 000 agents use the service across seven African countries.

Safaricom is one of the largest mobile-based financial services in Africa

In 2008, South African telecoms operator, Vodacom, launched M-Pesa in Tanzania. It also launched in South Africa and Lesotho in 2010 and 2013, although the telco stopped operations in the former in 2016.

To keep operating M-Pesa in their respective markets, Vodafone consolidated its position in the two telcos. It has a 60% stake in Vodacom and a five percent stake in Safaricom.

Also, both Vodacom and Safaricom had to pay five percent and two percent of their M-Pesa annual revenue to the UK telco operator.

Last year, the African telcos began talks to acquire the whole M-Pesa brand from Vodafone. The pair planned to do this via a joint venture and in the process, would acquire the intellectual property rights of M-Pesa.

By the end of March 2020, the deal was complete. At the time, it was unclear what stake each had in the new joint venture and if there was a larger shareholder.

Safaricom’s recent financials for the fiscal year 2020 (1 April 2019 – 31 March 2020) seems to answer these questions.

According to the financials, the registration name given to the joint venture was M-PESA Global Services Limited and was registered in Kenya. Regarding the stake, both Safaricom and Vodacom own 50% a piece in the new M-Pesa joint venture.

During the buyout of M-Pesa from Vodafone, details surrounding the cost of acquisition was unclear. Reuters, in 2019, reported that the deal was worth about $13-million (1.39-billion Kenyan Shilling).

However, from Safaricom’s and Vodacom’s financials, we get a different picture.

afaricom stated that the acquisition costs the company 1.073-billion Kenyan Shilling ($10-million). The deal cost Vodacom the same amount, thus, pegging the total acquisition cost at 2.146-billion Kenyan Shilling (~$20,071,628m).

Despite the fact that Vodacom possesses a 35% stake in Safaricom, this ownership structure gives both parties equal participation in the M-Pesa brand as stated in the financials.

“Decisions by the joint venture to declare and/or pay any dividends or make any capital distribution to shareholders must have the prior written consent of the existing shareholders.”

M-Pesa is pivotal to the growth of both telcos

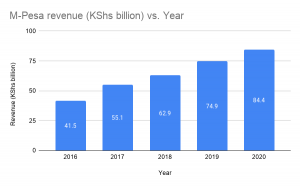

In the fiscal year 2020 (FY20), M-Pesa revenue grew 12.6% from 74.99-billion Kenyan Shilling ($701.5-million) to 84.44-billion Kenyan Shilling ($790-million). According to the Kenyan telco, a 10% increase in active monthly customers to 24.91-million was influential to the revenue increase.

Also, Safaricom’s total revenue for the same fiscal year stands at 262.6-billion Kenyan Shilling ($2.45-billion), meaning M-Pesa accounted for about 32.2% of the company’s revenue.

It was a similar case for Vodacom. According to the South African telco’s financials, M-Pesa’s revenue grew by 22.7% for FY20.

“We currently have 40 million customers transacting on M-Pesa across all our operations, generating total revenue of R16.2-billion,” a statement from the financials read.

Vodacom’s M-Pesa customers also increased by 9.2% to 14.7-million, representing 38.2% of the telco’s customer base.

M-Pesa is now accepted in over 173,000 outlets in Kenya and 167 countries worldwide, according to Safaricom. Through M-Pesa Global, customers can send money and make purchases beyond the Kenyan borders.

Safaricom adds that the product has been able to achieve this by partnering with PayPal, Western Union, and AliExpress. With this expansion to international markets, Safaricom says customers within the M-Pesa ecosystem now process more than $14-billion in monthly transactions.

The original version of this article appeared on Techpoint Africa on 10 July. See it here.

Featured image: Vodacom website (Supplied)