Chinese consumer electronics company Honor is set to unveil its latest lineup of smart devices for the South African market. How about we forecast…

Nigerian fintech startup announces new focus

Lagos-based fintech, TeamApt, a company that provides digital financial solutions and payment infrastructure has announced a shift in focus from delivering financial services products to banks to delivering products for consumers and businesses.

TeamApt shifts its focus and plans to expand its offering in West and North Africa

In addition, TeamApt plans to expand its financial service offering to underserved individuals and businesses in other countries located in West and North Africa.

Tosin Eniolorunda, CEO and Co-Founder of TeamApt comments on the plans and the new focus of the innovative startup.

“We had a lot of success working with banks but we have identified some unique opportunities to empower underserved individuals and businesses with products designed to make it easier to access and manage their money more efficiently. Many synergies and opportunities have been underexplored in the journey of improving financial inclusion in Africa and other emerging markets, and we are excited by the prospects of what we can achieve. We are confident in our competence and the technical expertise to deliver products and services that will transform access to financial services across Africa”.

TeamApt

Founded in 2015, the fintech startup has worked with African banks and commercial banks in Nigeria.

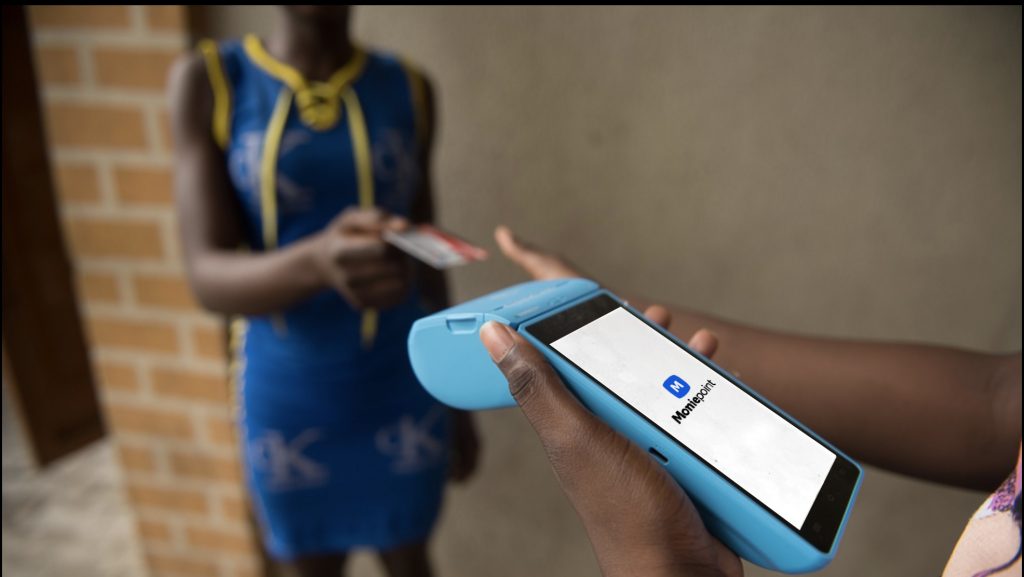

With an aim to ensure financial inclusion across the country, TeamApt is focused on creating products that make it easier for individuals and businesses to gain access to financial services. In addition, the fintech aims to grow its agent network and its existing products, Moniepoint and Monnify.

Launched in 2019, Moniepoint is a mobile money platform. The startup claims that it is the largest non-bank mobile money operator in Nigeria.

Success

The fintech startup has proved its resilience during 2020 as it claims to have a reported 150% overall QonQ growth, $3.9 billion in transaction value across its products, more than 90 million transactions processed, and 500% merchant growth.

Moniepoint’s agent network reportedly grew by 50 000, with agents in each of the 36 states of Nigeria. This critical service has increased the ratio of financial access points in the country.

Financial services for the community

Due to the scare number of banks in Nigeria, TeamApt has provided an accessible and much-needed service to the underbanked in the country.

With a reported 4.3 bank branches per 100 000 individuals, the fintech’s innovative products provide access to financial services for locals while adhering to Covid-19 social distancing regulations and eliminating the inconvenience of long queues, unreliable transactions, and poor support offered by traditional banks.

Read more: New incubation programme launches for tech startups in Nigeria

Read more: Algerian startup super app expands offering

Featured image: TeamApt (Supplied)